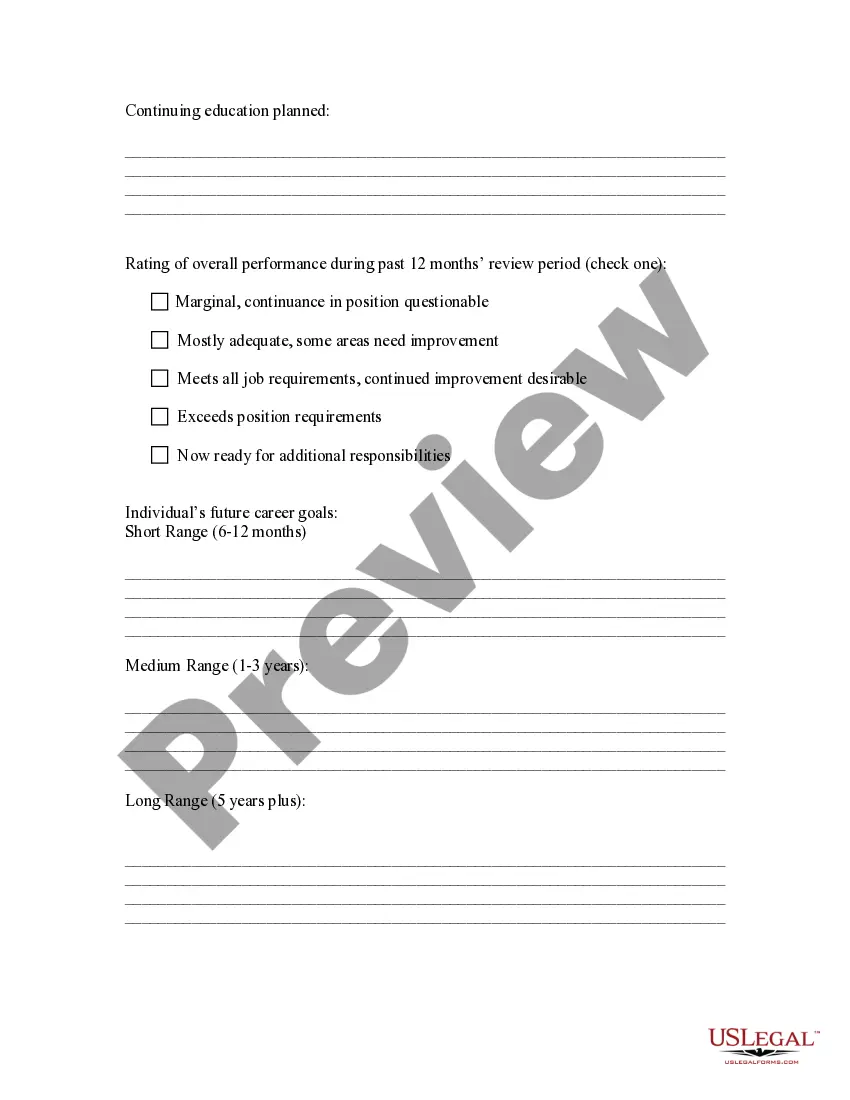

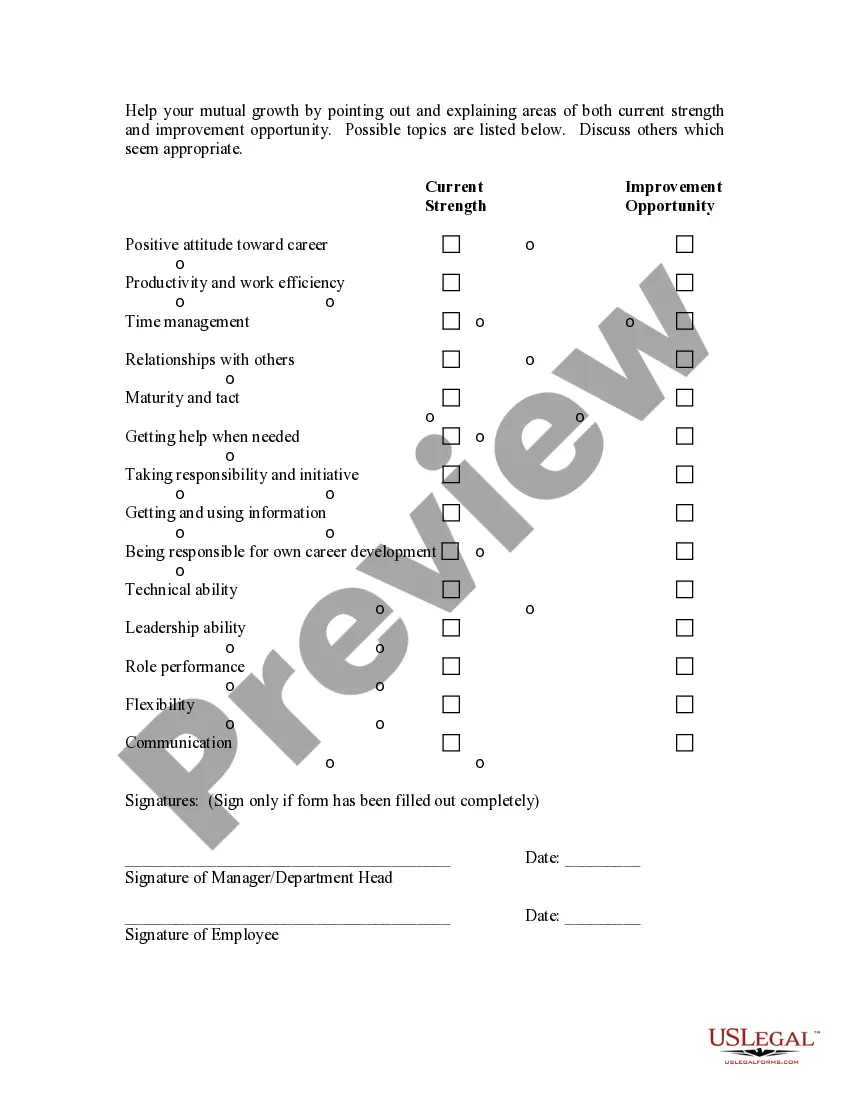

Virgin Islands Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees

Description

How to fill out Model Performance Evaluation - Appraisal Form For Hourly, Exempt, Nonexempt, And Managerial Employees?

You can devote hours on the web searching for the appropriate legal format that meets the state and federal requirements you require.

US Legal Forms provides a vast collection of legal documents that are vetted by experts.

It is easy to download or print the Virgin Islands Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees from my service.

First, make sure you have selected the correct format for the area/city that you choose. Check the form description to ensure you have selected the right document. If available, utilize the Preview button to view the format as well. If you wish to find another version of the form, use the Search field to find the format that meets your needs and requirements. Once you have identified the format you want, click on Get now to continue. Choose the pricing plan you desire, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Retrieve the format in the file and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the Virgin Islands Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees. Access and print a vast array of document templates through the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Get button.

- After that, you can complete, modify, print, or sign the Virgin Islands Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees.

- Each legal format you obtain is yours permanently.

- To get another copy of any downloaded form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Executive, administrative, professional and outside sales employees: (as defined in Department of Labor regulations) and who are paid on a salary basis are exempt from both the minimum wage and overtime provisions of the FLSA.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

The learned professional exemption is restricted to professions where specialized academic training is a standard prerequisite for entrance into the profession. The best evidence of meeting this requirement is having the appropriate academic degree.

Key Takeaways. An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

In addition, to be classified as exempt after July 1, 2017, a teacher in a private elementary or secondary school must be paid the greater of the following: The lowest salary paid by any California school district to an employee with a teaching credential, or.

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.

Employees who are exempt from the FLSA's minimum wage and overtime laws include: executive, administrative, and professional employees and some computer workers; outside salespeople such as those who do sales away from the employer's place of business, like a door-to-door salesperson.

Under Section 2, Subdivision (b) of the AB-5 Text, the following is included in the ABC Test Exemption: (3) An individual who holds an active license from the State of California and is practicing one of the following recognized professions: lawyer, architect, engineer, private investigator, or accountant.

An exempt employee is someone whose job is not subject to one or more sets of wage and hour laws. In most cases, there are three simple requirements to determine whether a worker is an exempt employee under California law: Minimum Salary.