Virgin Islands Guardianship Current Assets

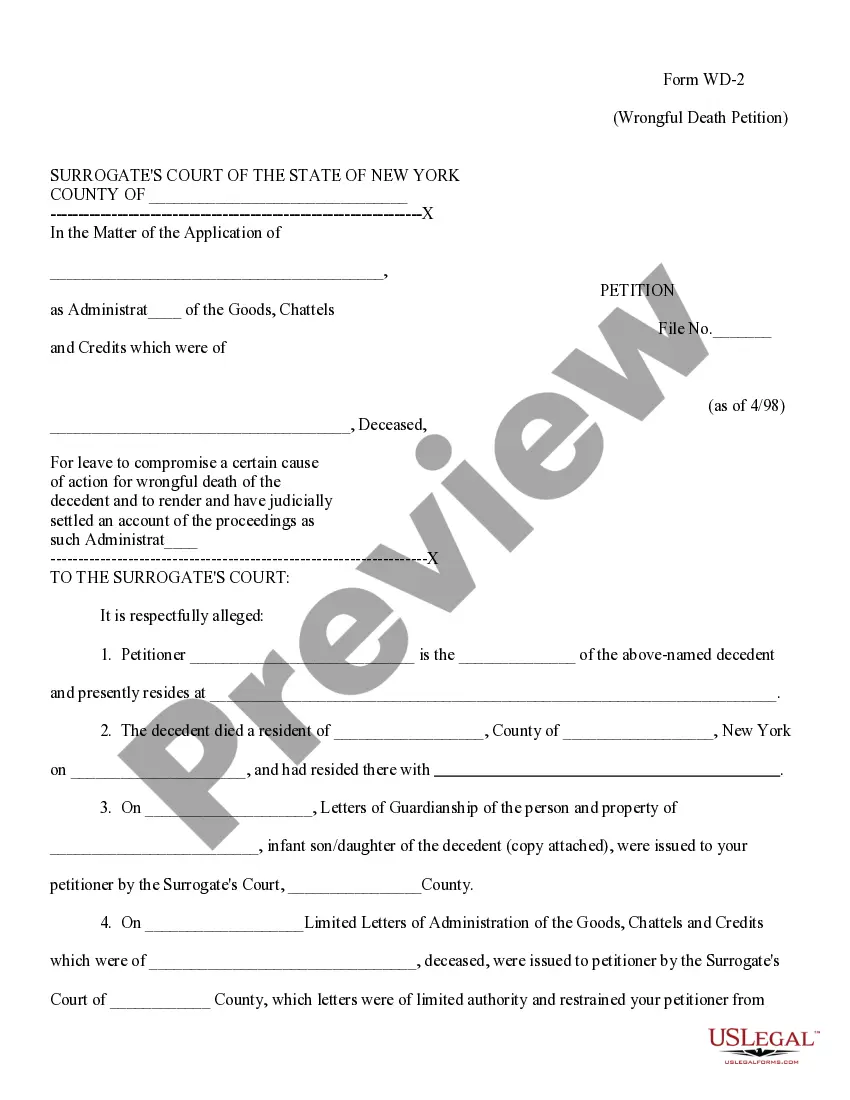

Description

How to fill out Guardianship Current Assets?

Choosing the best legitimate papers template might be a have difficulties. Needless to say, there are tons of web templates accessible on the Internet, but how would you get the legitimate kind you want? Use the US Legal Forms internet site. The support offers 1000s of web templates, for example the Virgin Islands Guardianship Current Assets, that you can use for enterprise and private demands. Each of the varieties are inspected by specialists and fulfill state and federal needs.

If you are presently signed up, log in to the account and click on the Download switch to obtain the Virgin Islands Guardianship Current Assets. Utilize your account to check with the legitimate varieties you possess purchased in the past. Visit the My Forms tab of your account and obtain another copy of your papers you want.

If you are a brand new customer of US Legal Forms, listed here are easy directions that you can stick to:

- Very first, ensure you have selected the correct kind for your personal town/county. You may look over the form making use of the Preview switch and read the form explanation to make sure this is basically the right one for you.

- In case the kind does not fulfill your needs, utilize the Seach discipline to discover the correct kind.

- When you are certain that the form is acceptable, click the Buy now switch to obtain the kind.

- Pick the rates prepare you want and enter the required info. Make your account and purchase the order using your PayPal account or Visa or Mastercard.

- Choose the file structure and down load the legitimate papers template to the device.

- Comprehensive, change and produce and signal the acquired Virgin Islands Guardianship Current Assets.

US Legal Forms may be the greatest library of legitimate varieties that you can see numerous papers web templates. Use the company to down load professionally-produced documents that stick to express needs.

Form popularity

FAQ

A durable power of attorney contains a ?durability clause,? which is a provision permitting your designated attorney-in-fact to act on your behalf in the event you are unable to handle your affairs. A general power of attorney permits your attorney-in-fact to act on your behalf in all of your personal affairs.

The U.S. Virgin Islands are part of the Third Circuit Court of Appeals. The jurisdiction has one federal district court, the U.S. Federal District Court of the Virgin Islands.

U.S. Virgin Islands The United States Virgin Islands are an unincorporated territory of the United States, meaning that only certain parts of the U.S. Constitution apply to its residents. Individuals born in the U.S. Virgin Islands are considered citizens of the United States.

The organization of the Government of the Virgin Islands rests upon the Revised Organic Act of 1954 in which the United States Congress declared the U.S. Virgin Islands to be an unincorporated territory of the United States.

To transfer guardianship from another state to North Carolina, you must first request a provisional order of transfer from the other state. Once you have received that order, you can petition North Carolina to accept the transfer of guardianship using this form.

Courts in the Virgin Islands have always held that adverse possession means that the adverse claimant asserts ownership, an interest that is hostile to the title of the true owners.

The U.S. Virgin Islands do not have their own constitution. The main governing document of the U.S. Virgin Islands is the Revised Organic Act of the Virgin Islands, which was passed by the U.S. Congress in 1954.

Currently, the U.S. Territory is governed by the "Revised Organic Act of the Virgin Islands," a federal law approved by Congress in 1954.