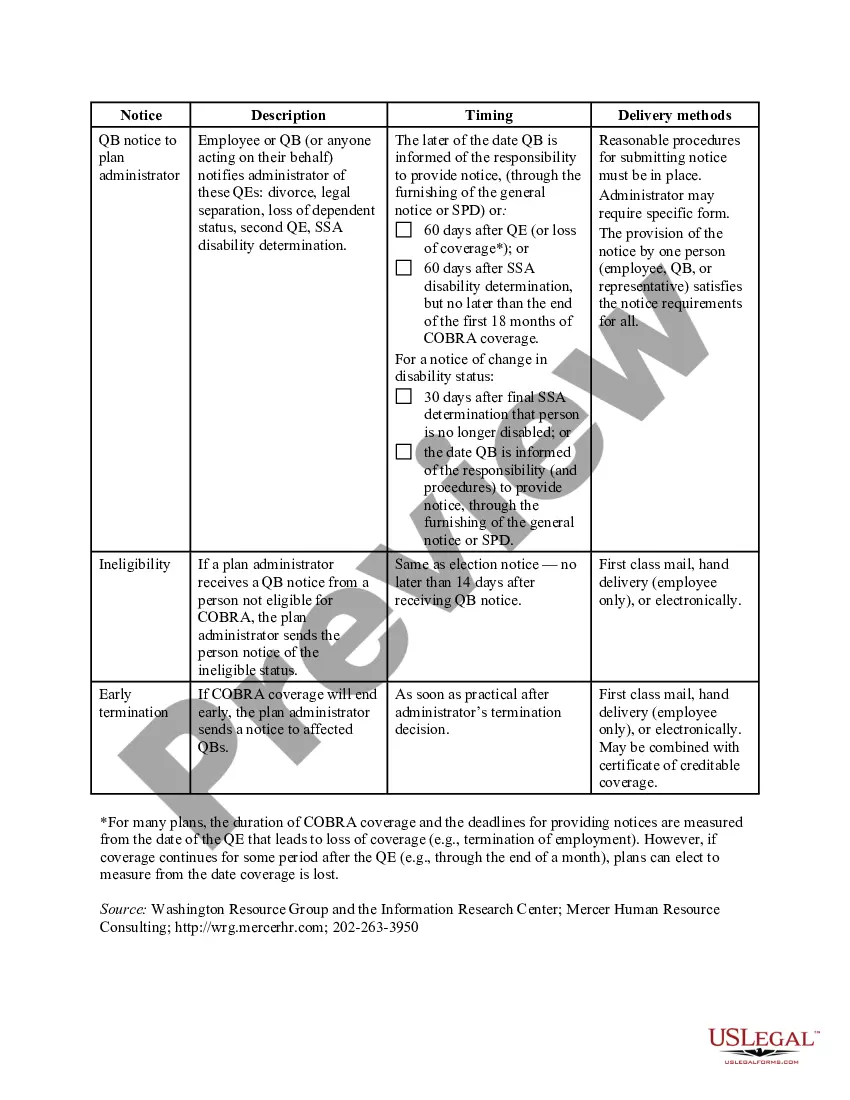

Virgin Islands COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

You can spend numerous hours online trying to locate the legal document format that meets the state and federal criteria you require.

US Legal Forms offers thousands of legal templates that are evaluated by professionals.

You can acquire or create the Virgin Islands COBRA Notice Timing Delivery Chart from our service.

Read the form summary to confirm that you have chosen the right document. If available, utilize the Preview button to review the document format as well.

- If you have an account with US Legal Forms, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Virgin Islands COBRA Notice Timing Delivery Chart.

- Each legal document format you acquire belongs to you indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the region/city of your choice.

Form popularity

FAQ

To be eligible for COBRA coverage, you must have been enrolled in your employer's health plan when you worked and the health plan must continue to be in effect for active employees.

Yes, an employer can pay all or part of a former or current employee's COBRA premiums.

Request a Refund for Amounts Paid in COBRA Premiums Exceeding Federal Employment Tax Liability: The employer may claim the Credit through an employment tax refund on the applicable employment tax return, generally Form 941, Employer's Quarterly Federal Tax Return.

Conclusion. Anyone eligible for COBRA insurance benefits has 2 months following the date of the end of their coverage, or the day they receive a COBRA notification, to enroll in a COBRA coverage plan.

Employers who provide ARPA COBRA subsidies can claim a tax credit against their Medicare tax obligations. The ARPA tax credit is fully refundable, which means that employers can receive a payment from the IRS if their credit exceeds their Medicare obligations in a calendar quarter.

If you have Original Medicare, you have coverage anywhere in the U.S. and its territories. This includes all 50 states, the District of Columbia, Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands.

Employers pay 100% of the assistance eligible individual's COBRA premiums during the Subsidy Period and will be reimbursed through payroll tax credits.

Yes. The ICHRA is subject to COBRA, but the individual major medical plans and Medicare coverage obtained by employees are not subject to COBRA. However, COBRA does not apply if an employee loses their individual major medical coverage or Medicare coverage during the year (for example, due to non-premium payment).

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,

The Consolidated Omnibus Budget Reconciliation Act of 1985, commonly known as COBRA, requires group health plans with 20 or more employees to offer continued health coverage for employees and their dependents for 18 months after the employee leaves or resigns from the organization.