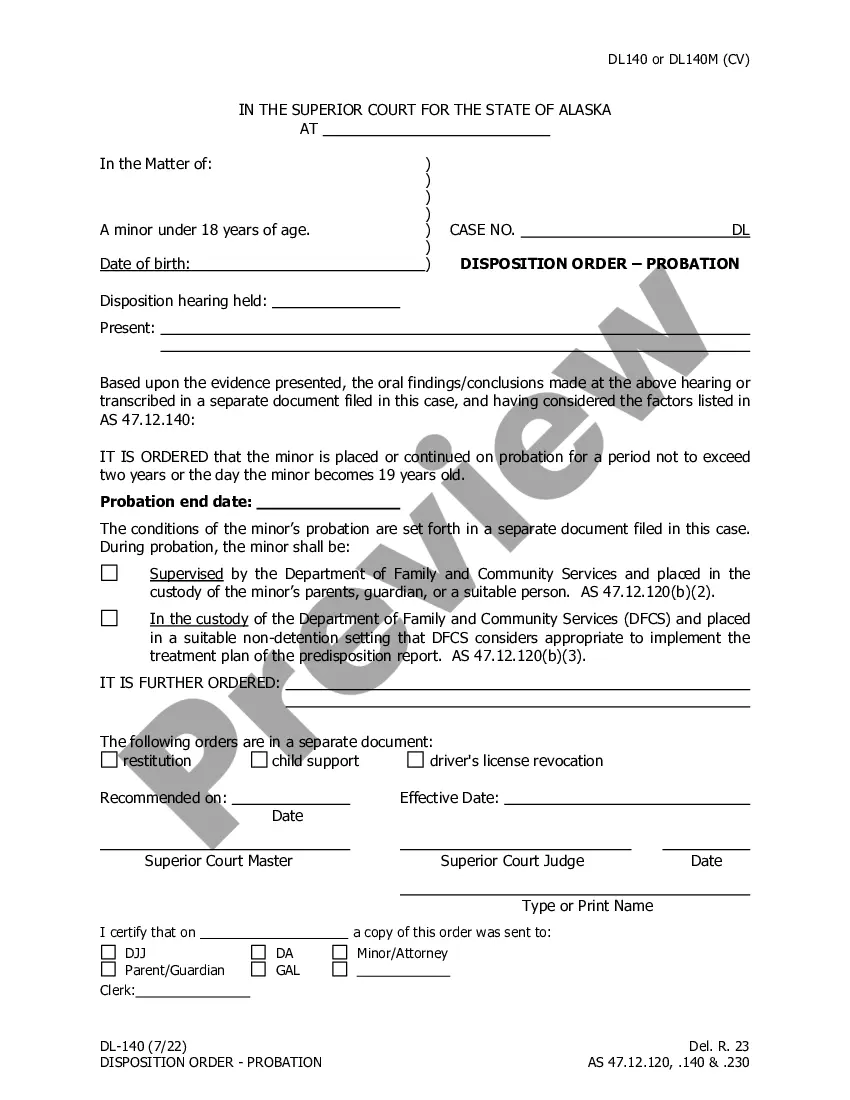

Virgin Islands Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

US Legal Forms - one of the largest collections of authorized varieties in the USA - provides a broad selection of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most current versions of forms like the Virgin Islands Acknowledgment Form for Consultants or Self-Employed Independent Contractors within minutes.

If the form does not suit your requirements, utilize the Search area at the top of the screen to find the one that does.

Should you be satisfied with the form, confirm your selection by clicking the Acquire now button. Then, select your preferred pricing plan and provide your details to register for an account.

- If you have an existing subscription, Log In and download the Virgin Islands Acknowledgment Form for Consultants or Self-Employed Independent Contractors from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some basic steps to help you get started.

- Ensure you have selected the correct form for your state/region. Click the Preview button to review the form's content.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

To prove that you are self-employed, compile documents such as contracts, invoices, and the Virgin Islands Acknowledgment Form for Consultants or Self-Employed Independent Contractors. Having a diverse set of documents strengthens your position if questioned. Regularly updating your business records also enhances your credibility as a self-employed professional.

You must file Form 1040-SS if you meet all three requirements below. 1. You, or your spouse if filing a joint return, had net earnings from self-employment (from other than church employee income) of $400 or more (or you had church employee income of $108.28 or moresee Church Employees, later).

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

About Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

Taxpayers complete Form 8862 and attach it to their tax return if: Their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC) or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Legal methods you can use to avoid paying taxes include things such as tax-advantaged accounts (401(k)s and IRAs), as well as claiming 1099 deductions and tax credits. Being a freelancer or an independent contractor comes with various 1099 benefits, such as the freedom to set your own hours and be your own boss.

Since these forms are virtually identical in function, the main reason to use Form 1040-SR is if you're filling out your tax return by hand rather than online. Form 1040-SR has larger type and larger boxes to write numbers in, making it slightly easier for seniors to read and fill out.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.