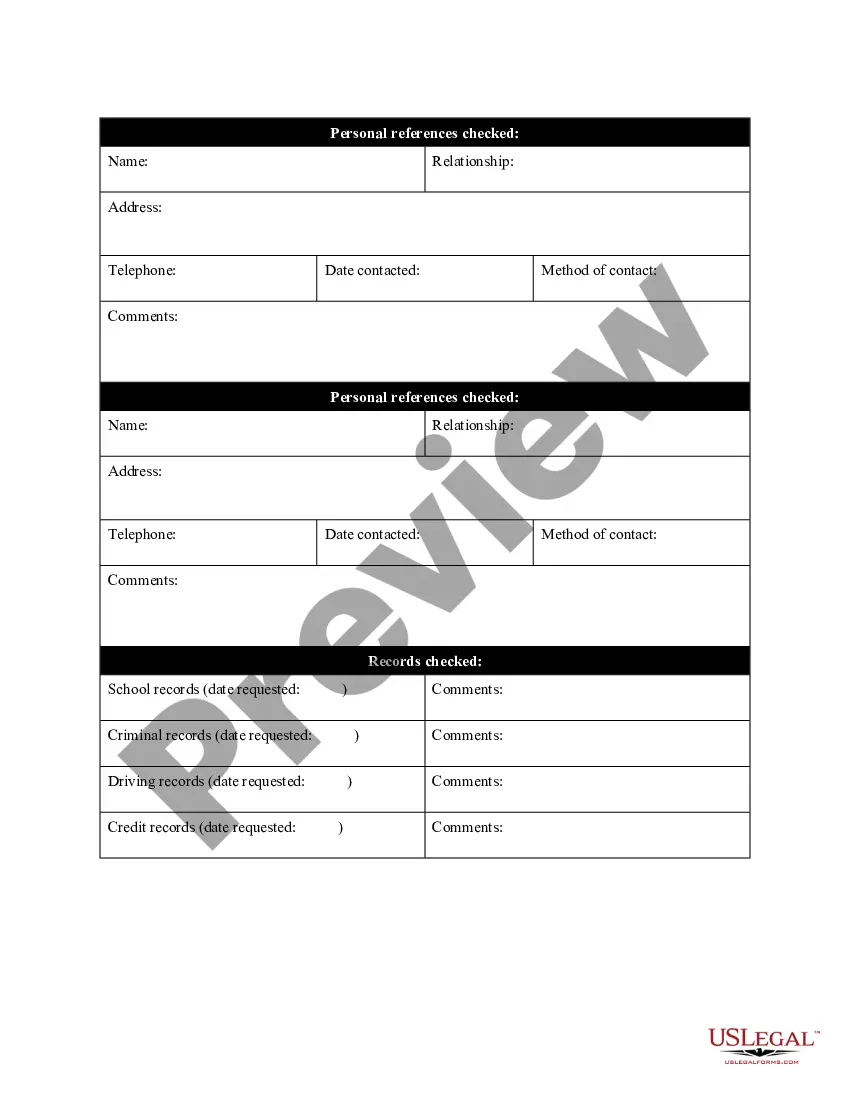

The Virgin Islands Reference Check Control Form is a standardized document used to conduct background checks and verify the authenticity of references provided by individuals. It is an essential tool used by employers, educational institutions, and other organizations to ensure the accuracy and reliability of information provided by applicants or potential candidates. The Virgin Islands Reference Check Control Form is designed to systematically gather important details about an applicant's references, including their contact information, relationship with the applicant, and how long they have known each other. This form enables the user to record crucial information about the individuals being referenced, such as their job titles, companies, and the dates of employment. The purpose is to obtain a comprehensive overview of the references to evaluate the applicant's qualifications, skills, and character. Multiple types of Virgin Islands Reference Check Control Forms may exist based on the specific needs of different organizations or sectors. Variations of this form may include slight modifications or additions to tailor it to the employer's industry or the educational institution's requirements. These forms could also be specific to different types of applicants, such as job applicants, scholarship applicants, or student exchange program applicants. Some common variations of the Virgin Islands Reference Check Control Form include: 1. Job Applicant Reference Check Control Form: This form is utilized by employers during the hiring process to verify an applicant's professional background and past employment history. 2. Educational Reference Check Control Form: This form is commonly used by educational institutions, such as universities or colleges, to verify an applicant's academic qualifications, achievements, and character references. 3. Scholarship Applicant Reference Check Control Form: Organizations or foundations offering scholarships often require reference checks to assess an applicant's eligibility. This form helps evaluate the suitability of the candidate based on their academic achievements, extracurricular activities, and personal characteristics. 4. Volunteer Reference Check Control Form: Non-profit organizations and community service agencies may use this form to ensure the suitability of potential volunteers by verifying their character, reliability, and previous volunteer experiences. Regardless of the specific type, the Virgin Islands Reference Check Control Form is an effective tool to gather accurate, comprehensive, and reliable information about an applicant's references. It helps organizations make informed decisions when evaluating candidates and plays a vital role in maintaining transparency and integrity throughout various selection processes.

The Virgin Islands Reference Check Control Form is a standardized document used to conduct background checks and verify the authenticity of references provided by individuals. It is an essential tool used by employers, educational institutions, and other organizations to ensure the accuracy and reliability of information provided by applicants or potential candidates. The Virgin Islands Reference Check Control Form is designed to systematically gather important details about an applicant's references, including their contact information, relationship with the applicant, and how long they have known each other. This form enables the user to record crucial information about the individuals being referenced, such as their job titles, companies, and the dates of employment. The purpose is to obtain a comprehensive overview of the references to evaluate the applicant's qualifications, skills, and character. Multiple types of Virgin Islands Reference Check Control Forms may exist based on the specific needs of different organizations or sectors. Variations of this form may include slight modifications or additions to tailor it to the employer's industry or the educational institution's requirements. These forms could also be specific to different types of applicants, such as job applicants, scholarship applicants, or student exchange program applicants. Some common variations of the Virgin Islands Reference Check Control Form include: 1. Job Applicant Reference Check Control Form: This form is utilized by employers during the hiring process to verify an applicant's professional background and past employment history. 2. Educational Reference Check Control Form: This form is commonly used by educational institutions, such as universities or colleges, to verify an applicant's academic qualifications, achievements, and character references. 3. Scholarship Applicant Reference Check Control Form: Organizations or foundations offering scholarships often require reference checks to assess an applicant's eligibility. This form helps evaluate the suitability of the candidate based on their academic achievements, extracurricular activities, and personal characteristics. 4. Volunteer Reference Check Control Form: Non-profit organizations and community service agencies may use this form to ensure the suitability of potential volunteers by verifying their character, reliability, and previous volunteer experiences. Regardless of the specific type, the Virgin Islands Reference Check Control Form is an effective tool to gather accurate, comprehensive, and reliable information about an applicant's references. It helps organizations make informed decisions when evaluating candidates and plays a vital role in maintaining transparency and integrity throughout various selection processes.