Virgin Islands Approval of Stock Option Plan

Description

How to fill out Approval Of Stock Option Plan?

US Legal Forms - one of the most significant libraries of authorized kinds in the USA - gives an array of authorized record themes you are able to acquire or printing. Making use of the site, you may get thousands of kinds for organization and specific functions, categorized by categories, says, or key phrases.You can get the newest types of kinds such as the Virgin Islands Approval of Stock Option Plan within minutes.

If you already possess a subscription, log in and acquire Virgin Islands Approval of Stock Option Plan from your US Legal Forms library. The Down load key will show up on every type you see. You have access to all previously delivered electronically kinds in the My Forms tab of the account.

In order to use US Legal Forms the first time, allow me to share basic directions to help you get started:

- Be sure to have chosen the right type for the metropolis/area. Click the Review key to examine the form`s content material. Read the type outline to ensure that you have selected the proper type.

- In case the type doesn`t suit your requirements, make use of the Look for discipline towards the top of the monitor to obtain the the one that does.

- When you are pleased with the form, confirm your choice by clicking the Purchase now key. Then, select the costs prepare you prefer and offer your accreditations to sign up to have an account.

- Method the deal. Use your credit card or PayPal account to finish the deal.

- Select the formatting and acquire the form on your own product.

- Make changes. Complete, revise and printing and indicator the delivered electronically Virgin Islands Approval of Stock Option Plan.

Every single format you included with your bank account lacks an expiration particular date and it is the one you have forever. So, if you want to acquire or printing one more copy, just visit the My Forms area and click in the type you want.

Gain access to the Virgin Islands Approval of Stock Option Plan with US Legal Forms, the most comprehensive library of authorized record themes. Use thousands of specialist and condition-certain themes that meet up with your company or specific demands and requirements.

Form popularity

FAQ

There are two main ways to allocate options to your team: As a percentage of the salary - companies offer options to their team based on their salary, seniority, and type of role. As a percentage of the company - in this case, key people might get allocated a fixed % of the company's total equity.

If you are an employee of a private company, part of your compensation may be paid in stock, restricted stock units, stock options, or other company securities.

There are a few outcomes for stock options when a company goes private. Stock options holders could receive a cash payment for cancelled shares or have their shares substituted to a successor entity.

Many private companies offer equity compensation in the form of employee stock options. For employers, offering this benefit is one way to attract and retain talent.

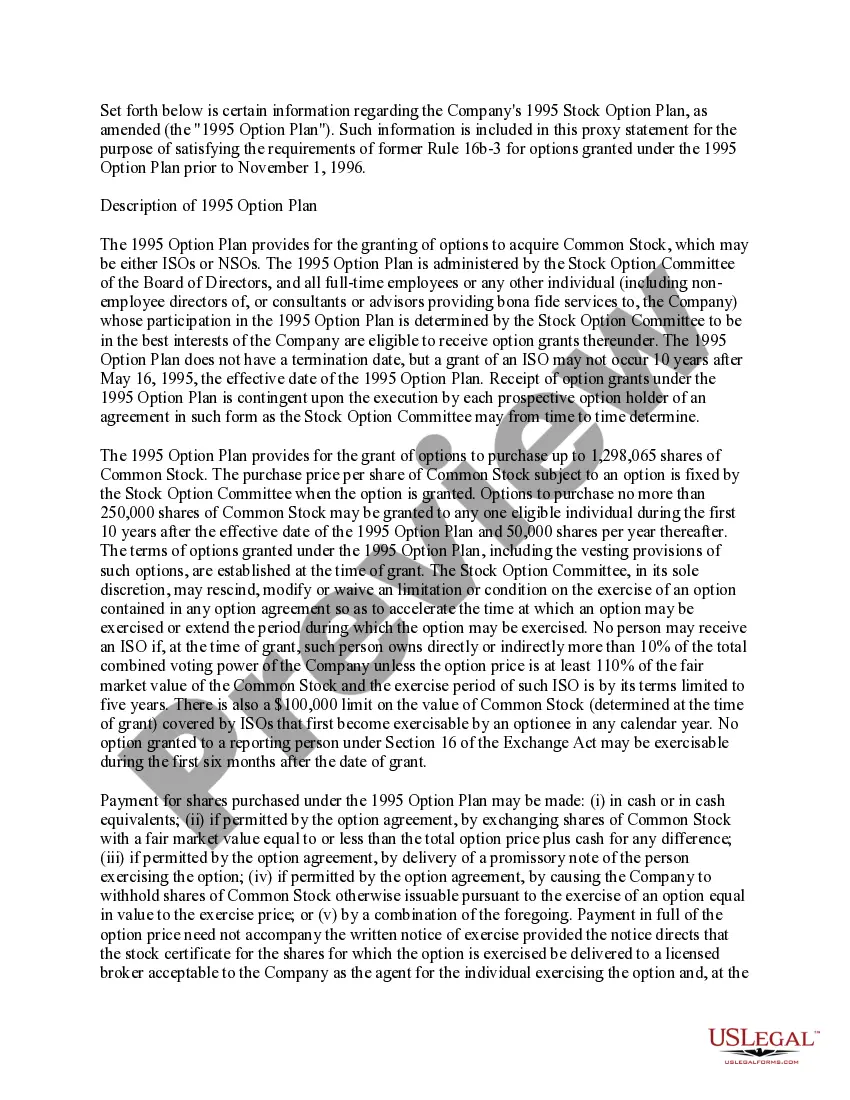

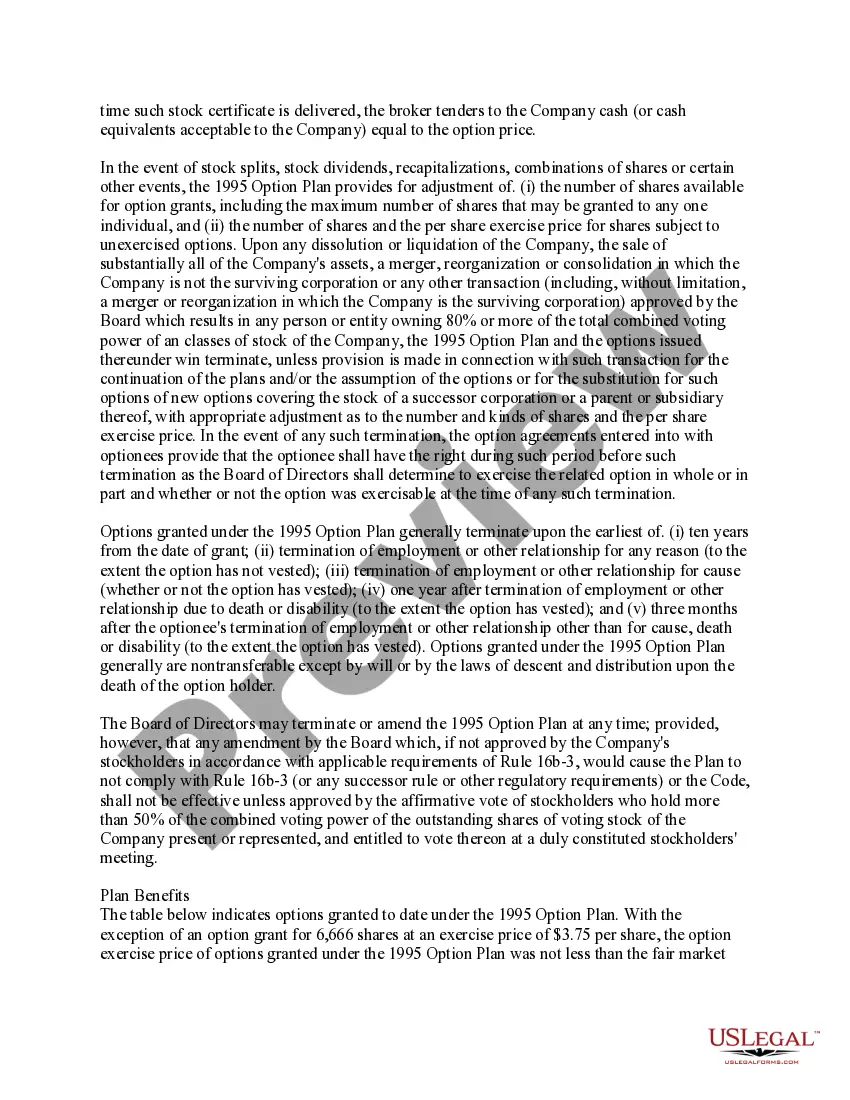

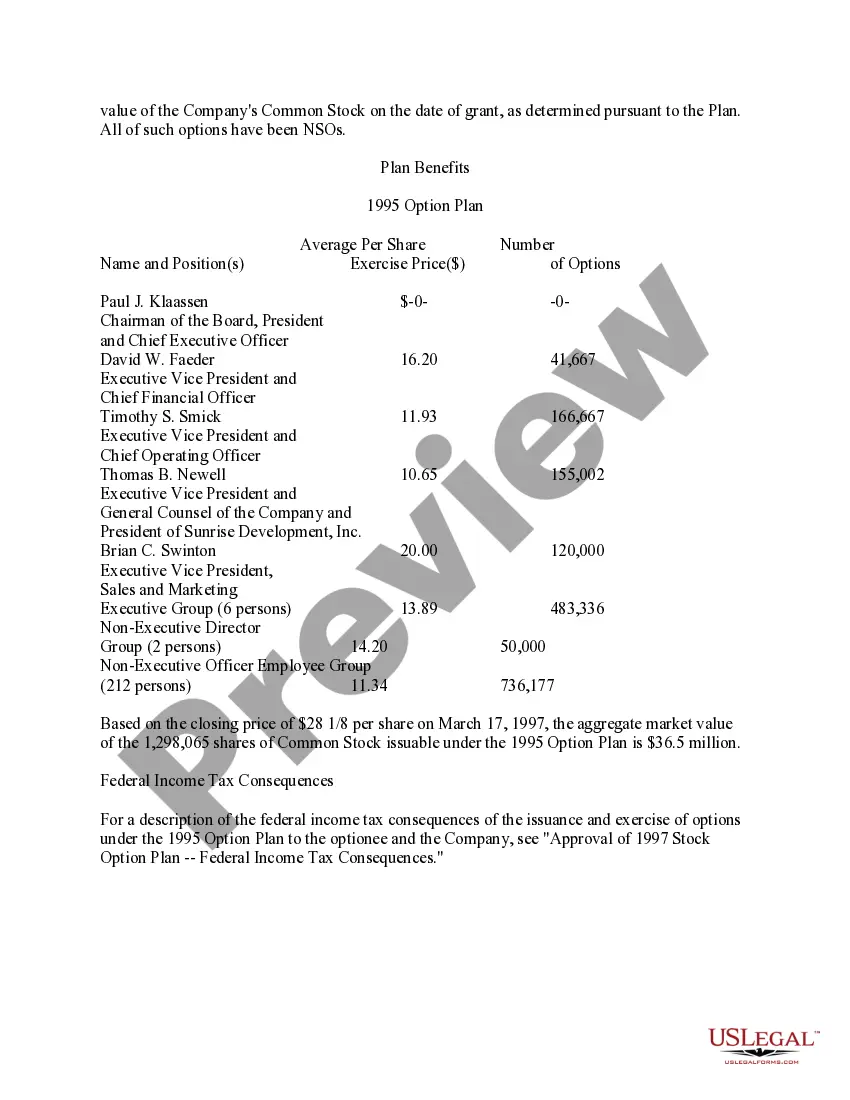

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

What is a stock option grant? Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

The Bottom Line. Unless you're an accredited investor, you can't directly buy shares of stock in a private company. However, you can invest in funds that track this part of the market and can buy shares of private equity firms that do invest in private companies.