Virgin Islands Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics

Description

How to fill out Eligible Director Nonqualified Stock Option Agreement Of Wyle Electronics?

Choosing the best legal document format might be a battle. Obviously, there are plenty of layouts accessible on the Internet, but how do you discover the legal type you require? Take advantage of the US Legal Forms website. The assistance delivers 1000s of layouts, such as the Virgin Islands Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics, which can be used for enterprise and personal needs. All of the types are checked by pros and meet federal and state specifications.

When you are currently listed, log in in your accounts and then click the Download button to have the Virgin Islands Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics. Make use of your accounts to check through the legal types you possess acquired formerly. Proceed to the My Forms tab of your respective accounts and have another backup in the document you require.

When you are a whole new customer of US Legal Forms, listed here are easy instructions that you should comply with:

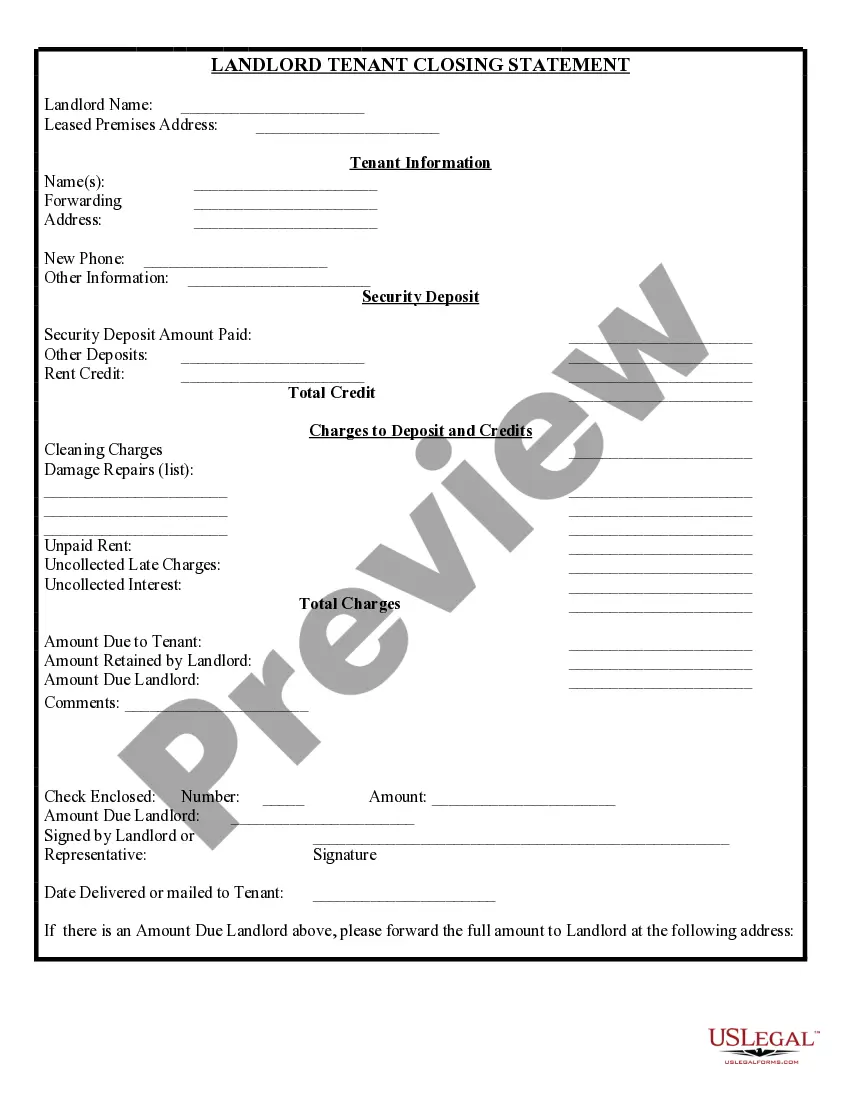

- Initial, ensure you have chosen the proper type to your town/state. You are able to look through the form making use of the Review button and read the form explanation to make sure it will be the best for you.

- In the event the type fails to meet your requirements, make use of the Seach field to get the correct type.

- When you are positive that the form would work, click the Buy now button to have the type.

- Opt for the costs plan you want and type in the needed information and facts. Create your accounts and buy the order using your PayPal accounts or credit card.

- Choose the submit format and download the legal document format in your device.

- Comprehensive, modify and print out and indication the received Virgin Islands Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics.

US Legal Forms will be the largest catalogue of legal types for which you can see different document layouts. Take advantage of the service to download skillfully-produced papers that comply with express specifications.