Virgin Islands Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Discovering the right legal record design can be quite a have a problem. Needless to say, there are a variety of layouts available online, but how will you find the legal kind you need? Use the US Legal Forms web site. The services offers a large number of layouts, like the Virgin Islands Proposal to approve material terms of stock appreciation right plan, which you can use for business and private requires. Every one of the varieties are checked by specialists and meet federal and state demands.

If you are previously authorized, log in to your account and click on the Download option to get the Virgin Islands Proposal to approve material terms of stock appreciation right plan. Use your account to check with the legal varieties you may have acquired previously. Visit the My Forms tab of your account and obtain one more version of your record you need.

If you are a brand new user of US Legal Forms, here are simple recommendations that you should stick to:

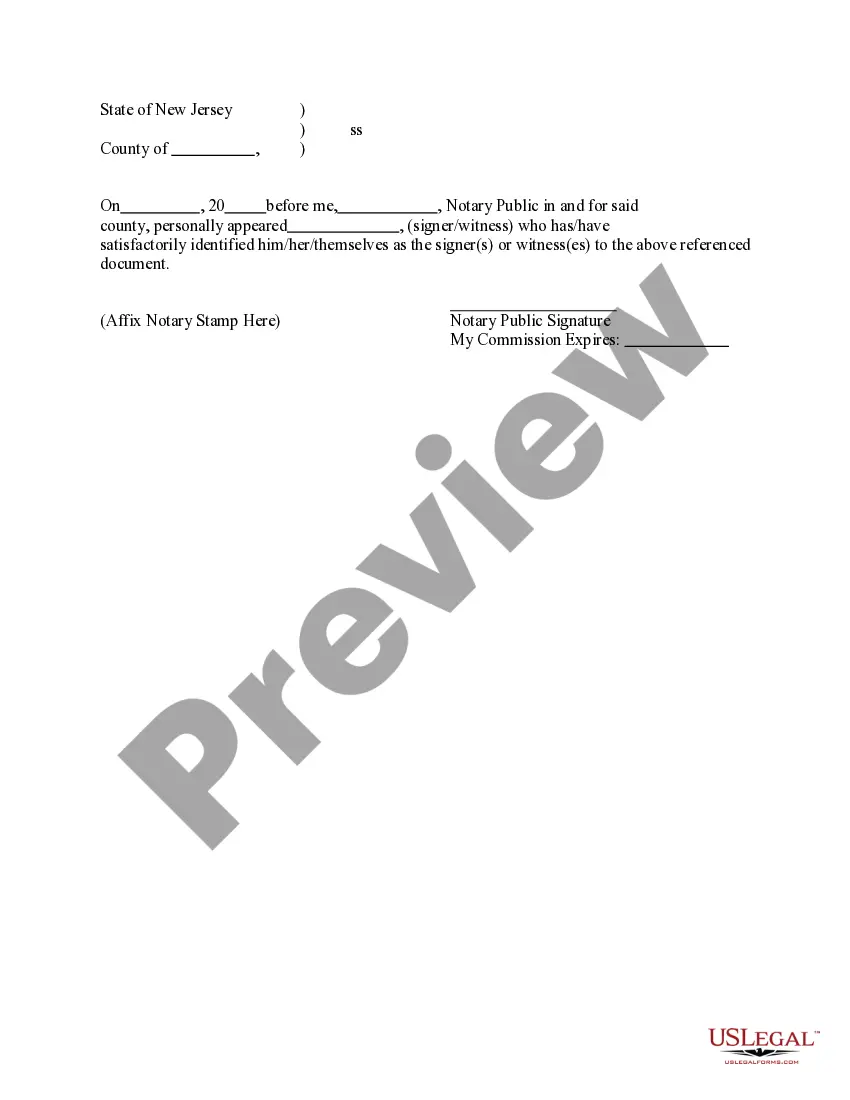

- Very first, be sure you have selected the proper kind for your personal city/region. You can look over the form making use of the Review option and look at the form outline to guarantee this is the right one for you.

- In case the kind will not meet your preferences, take advantage of the Seach area to get the right kind.

- Once you are certain that the form is proper, click on the Acquire now option to get the kind.

- Opt for the pricing strategy you want and enter the necessary details. Design your account and purchase your order making use of your PayPal account or Visa or Mastercard.

- Select the file formatting and obtain the legal record design to your gadget.

- Full, change and produce and sign the attained Virgin Islands Proposal to approve material terms of stock appreciation right plan.

US Legal Forms will be the most significant library of legal varieties in which you will find various record layouts. Use the company to obtain appropriately-produced papers that stick to status demands.

Form popularity

FAQ

Take the selling price and subtract the initial purchase price. The result is the gain or loss. Take the gain or loss from the investment and divide it by the original amount or purchase price of the investment. Finally, multiply the result by 100 to arrive at the percentage change in the investment.

Stock appreciation rights are similar to stock options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a stock appreciation right vests, an employee can exercise it at any time prior to its expiration.

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

Intrinsic value is the difference between the fair value of the shares and the price that is to be paid for the shares by the counterparty.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

How do I value it? For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.