Virgin Islands Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc. The Virgin Islands Approval of Employee Stock Purchase Plan is a significant step towards providing employees of The American Annuity Group, Inc. with a unique opportunity to become shareholders in the company. This plan allows eligible employees to purchase company stock at a discounted price through voluntary payroll deductions. It not only serves as a means to attract and retain talented individuals but also fosters a sense of ownership and motivation among the workforce. The Virgin Islands Approval signifies the legal authorization granted by the government of the U.S. Virgin Islands for The American Annuity Group, Inc. to introduce this employee stock purchase plan. This approval ensures compliance with the local regulatory requirements specific to the Virgin Islands jurisdiction. The American Annuity Group, Inc. offers different types of employee stock purchase plans within the Virgin Islands Approval: 1. Standard Employee Stock Purchase Plan: — This plan allows employees to purchase company stock at a discounted price, typically at a rate lower than its current market value. — Employees can contribute a portion of their after-tax income to the plan through regular payroll deductions. — Stock purchases are usually made at designated intervals, known as offering periods. 2. Tax-Advantaged or Qualified Employee Stock Purchase Plan: — This plan provides additional tax benefits to employees. — Contributions towards purchasing company stock are deducted from pre-tax income, resulting in potential tax savings for participants. — The plan must comply with specific regulations and may have certain limitations or restrictions. The Virgin Islands Approval ensures that The American Annuity Group, Inc. has met all the necessary legal requirements, including obtaining proper licenses and permits, to offer these employee stock purchase plans within the jurisdiction. This approval is crucial for maintaining the integrity and transparency of the stock purchase process and protects the interests of both the company and its employees. Employees who participate in the Virgin Islands-approved employee stock purchase plans gain several advantages. These may include: 1. Ownership Stake: — By purchasing company stock, employees become partial owners of The American Annuity Group, Inc., aligning their interests with the long-term success and profitability of the company. 2. Potential Financial Gain: — A discount on the stock price allows employees to potentially earn instant gains if the stock's market value appreciates after the purchase. — Stock ownership provides the opportunity to earn dividends if the company distributes them to its shareholders. 3. Employee Engagement and Motivation: — Participating in the stock purchase plan enhances the sense of commitment, loyalty, and motivation among employees. — Employees feel more connected to the company's success, fostering a positive work environment and encouraging higher productivity. Overall, by obtaining Virgin Islands Approval for their employee stock purchase plan, The American Annuity Group, Inc. demonstrates its commitment to providing attractive benefits, fostering employee loyalty, and promoting a sense of ownership among its workforce in the U.S. Virgin Islands.

Virgin Islands Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

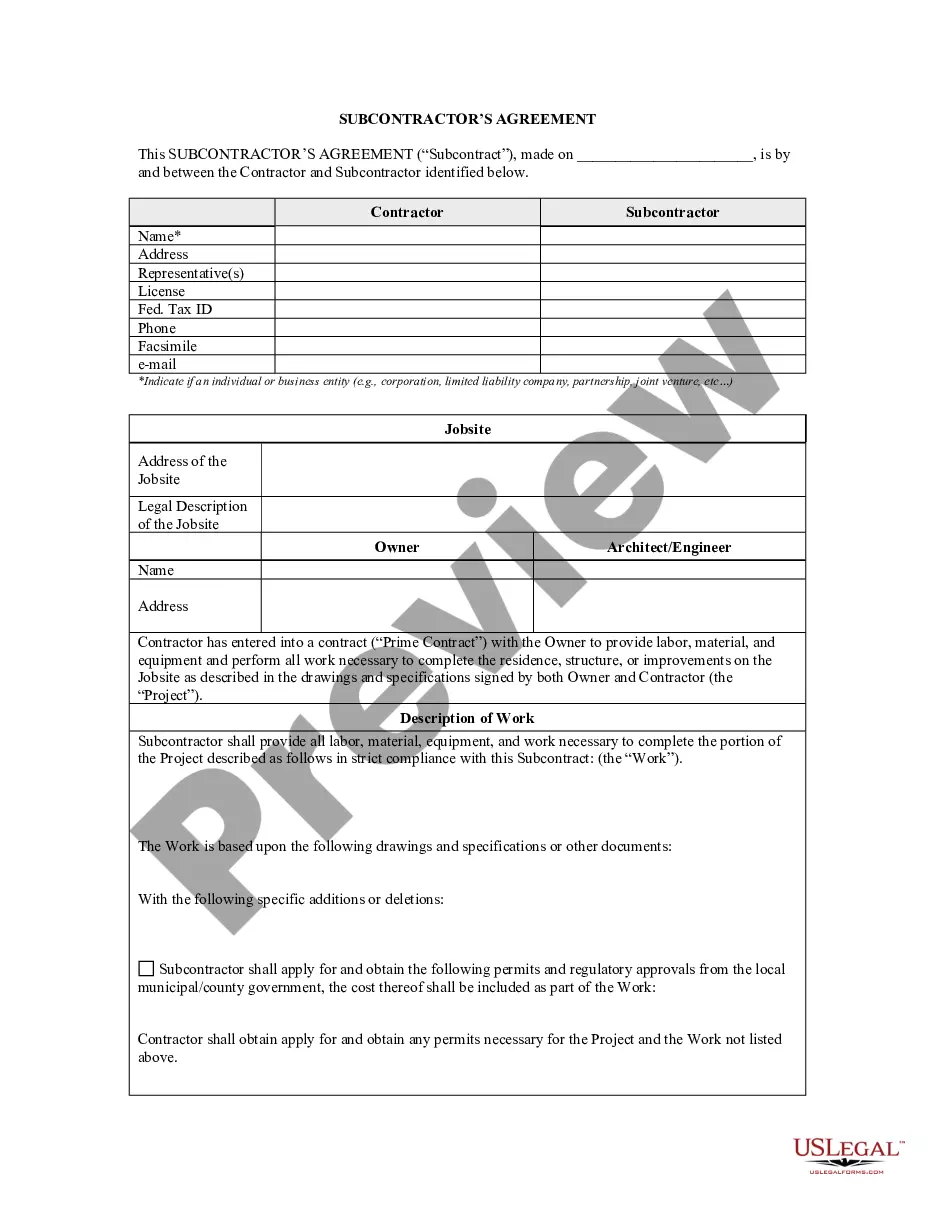

How to fill out Virgin Islands Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

If you have to complete, download, or print authorized document web templates, use US Legal Forms, the biggest collection of authorized forms, that can be found on the web. Take advantage of the site`s easy and handy research to obtain the files you need. Numerous web templates for business and personal uses are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the Virgin Islands Approval of employee stock purchase plan for The American Annuity Group, Inc. within a few clicks.

If you are currently a US Legal Forms consumer, log in to your bank account and click the Download key to have the Virgin Islands Approval of employee stock purchase plan for The American Annuity Group, Inc.. You may also gain access to forms you previously delivered electronically within the My Forms tab of your bank account.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your correct area/nation.

- Step 2. Use the Preview solution to look over the form`s information. Do not forget about to read through the information.

- Step 3. If you are unhappy with all the form, utilize the Research area at the top of the monitor to discover other versions of the authorized form format.

- Step 4. Upon having found the shape you need, select the Buy now key. Select the rates plan you choose and add your qualifications to register for an bank account.

- Step 5. Procedure the transaction. You should use your bank card or PayPal bank account to accomplish the transaction.

- Step 6. Pick the file format of the authorized form and download it on your own device.

- Step 7. Full, modify and print or signal the Virgin Islands Approval of employee stock purchase plan for The American Annuity Group, Inc..

Each authorized document format you purchase is the one you have for a long time. You have acces to every form you delivered electronically in your acccount. Click on the My Forms portion and select a form to print or download yet again.

Be competitive and download, and print the Virgin Islands Approval of employee stock purchase plan for The American Annuity Group, Inc. with US Legal Forms. There are thousands of professional and state-distinct forms you can utilize to your business or personal requirements.