Virgin Islands Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans

Description

How to fill out Proposals To Approve Employees' Stock Deferral Plan And Directors' Stock Deferral Plan With Copy Of Plans?

Are you presently in the position in which you need paperwork for sometimes enterprise or specific uses nearly every day? There are tons of authorized papers templates accessible on the Internet, but getting ones you can depend on is not effortless. US Legal Forms delivers 1000s of develop templates, much like the Virgin Islands Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans, that are published to satisfy state and federal specifications.

If you are presently informed about US Legal Forms website and have a merchant account, simply log in. After that, you may obtain the Virgin Islands Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans format.

Should you not have an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is for the appropriate city/area.

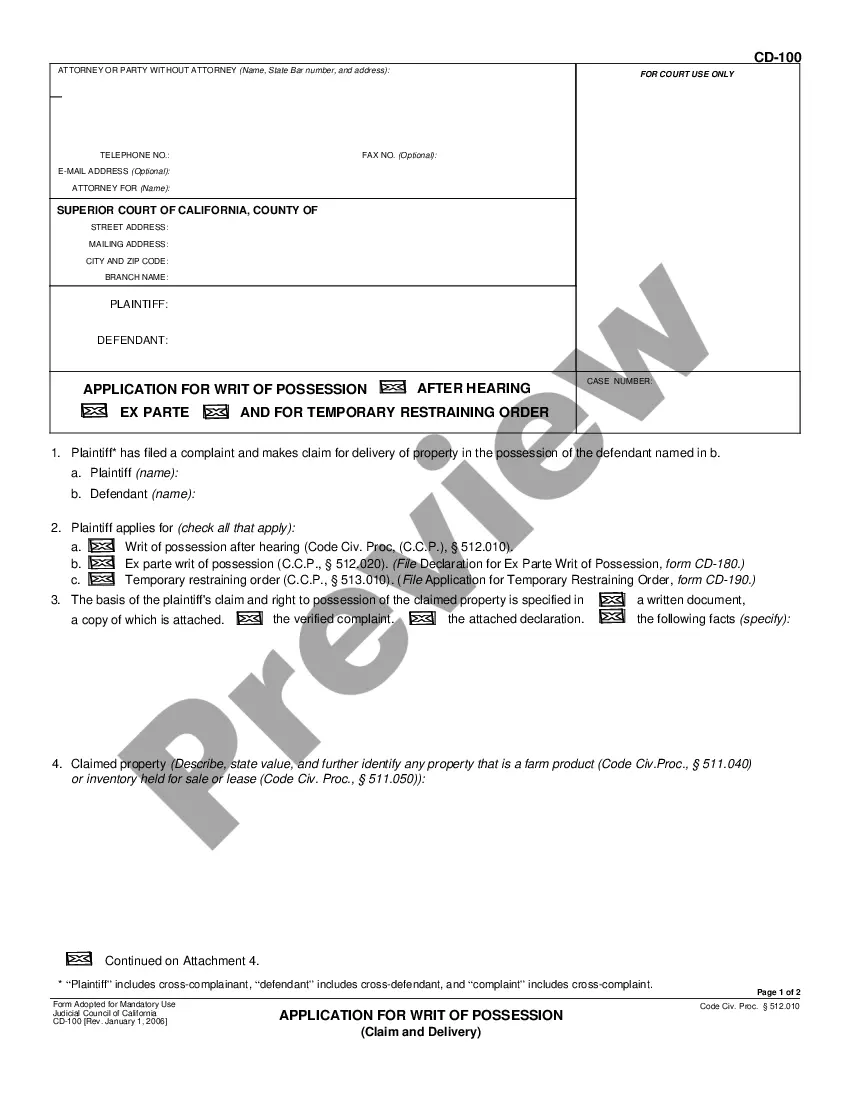

- Make use of the Preview switch to analyze the shape.

- Browse the information to actually have chosen the proper develop.

- If the develop is not what you`re trying to find, take advantage of the Search field to find the develop that meets your needs and specifications.

- Whenever you find the appropriate develop, click on Purchase now.

- Opt for the prices plan you want, submit the necessary info to generate your account, and purchase an order using your PayPal or charge card.

- Decide on a convenient file format and obtain your backup.

Discover all the papers templates you might have purchased in the My Forms menus. You can get a more backup of Virgin Islands Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans whenever, if possible. Just go through the needed develop to obtain or print out the papers format.

Use US Legal Forms, probably the most comprehensive variety of authorized forms, to save lots of time and stay away from errors. The support delivers expertly made authorized papers templates which you can use for an array of uses. Make a merchant account on US Legal Forms and commence generating your lifestyle a little easier.