The Virgin Islands Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees is a specialized retirement plan designed to provide key employees with additional financial security and benefits during their retirement years. This agreement is specifically tailored for individuals who hold significant positions within the company and play a crucial role in driving its success. (Additional types of the Virgin Islands Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees:) 1. Executive Deferred Compensation Agreement: This type of agreement specifically caters to top-level executives who hold critical leadership roles within the organization, such as CEOs, CFOs, and Presidents. 2. Senior Management Deferred Compensation Agreement: This category includes key employees in senior management positions, such as Vice Presidents and Directors, who contribute significantly to the bank's overall performance and growth. 3. Sales and Marketing Deferred Compensation Agreement: This type of agreement is designed for key employees who work in sales and marketing departments and possess valuable skills and expertise in driving customer acquisition and revenue generation. 4. Technical Experts Deferred Compensation Agreement: This category focuses on rewarding key employees who have specialized technical knowledge and skills that are critical to the bank's operations, innovation, and technological advancements. 5. Compliance and Risk Management Deferred Compensation Agreement: This agreement targets key employees who handle compliance and risk management responsibilities within the bank, ensuring adherence to regulations and minimizing potential risks. The Virgin Islands Deferred Compensation Agreement offers various benefits to eligible employees, including tax advantages and potential for long-term wealth accumulation. Key employees can voluntarily defer a portion of their salary or bonuses, which is then placed into a tax-deferred account. The accumulated funds grow and are invested according to the employee's preferences and risk appetite. One significant advantage of this agreement is the potential for a higher retirement income since the funds are invested and grow on a tax-deferred basis. This allows key employees to build a more substantial nest egg for their retirement years. Additionally, the agreement may provide for employer contributions and matching contributions, further enhancing the retirement savings. Another noteworthy feature is the flexibility in distribution options. The agreement typically allows key employees to choose between various payout methods, including a lump sum payment, staggered distributions, or installments over a specific period. This flexibility enables employees to tailor their distribution strategy according to their individual financial needs and objectives. It's crucial to note that the Virgin Islands Deferred Compensation Agreement is subject to certain rules and regulations outlined by the Internal Revenue Service (IRS) and other relevant authorities. Hence, First Florida Bank, Inc. ensures full compliance with these requirements to ensure the retirement plan's tax-advantaged status and the overall legality of the agreement. In conclusion, the Virgin Islands Deferred Compensation Agreement is a specialized retirement plan tailored for key employees within First Florida Bank, Inc. It offers tax advantages, potential for wealth accumulation, and various distribution options. Different types of agreements exist, catering to executives, senior management, sales/marketing, technical experts, compliance, and risk management employees.

Virgin Islands Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees

Description

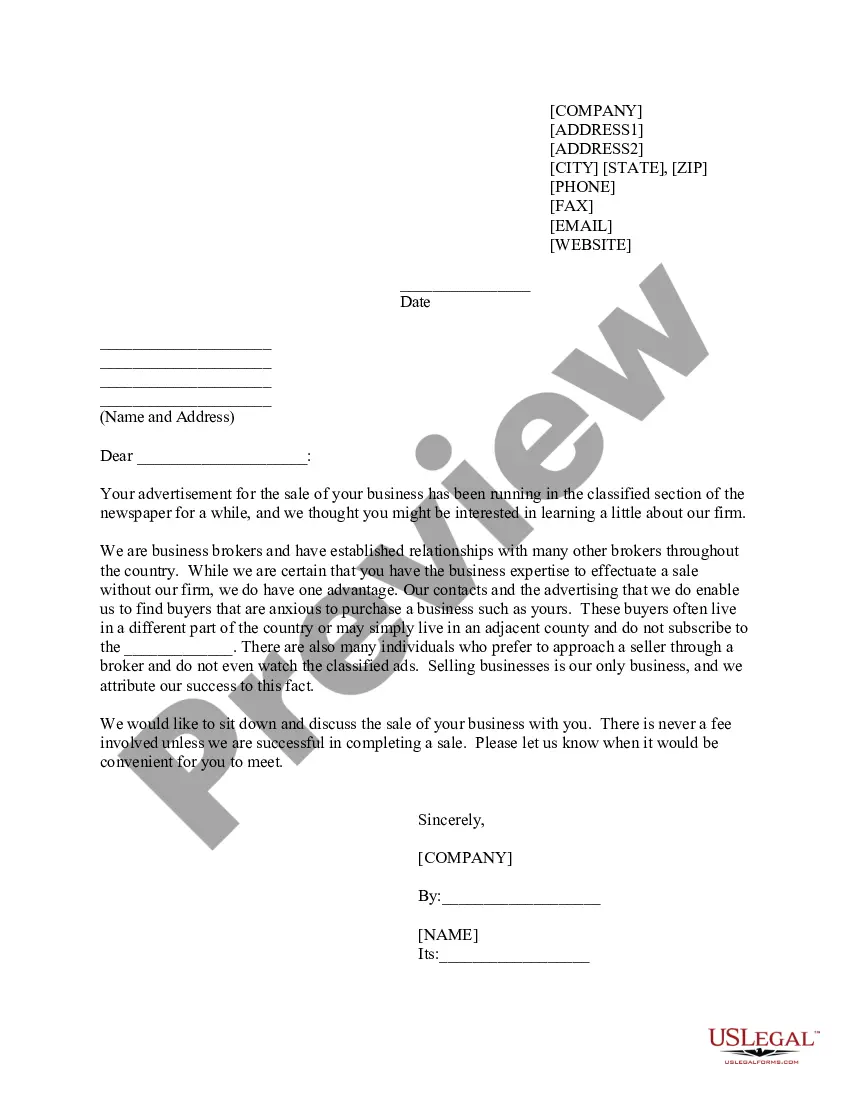

How to fill out Virgin Islands Deferred Compensation Agreement By First Florida Bank, Inc. For Key Employees?

Finding the right legal document format could be a battle. Needless to say, there are a lot of themes available on the Internet, but how can you obtain the legal develop you need? Make use of the US Legal Forms website. The assistance delivers a large number of themes, like the Virgin Islands Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees, which can be used for organization and private requirements. Each of the varieties are checked out by experts and meet federal and state specifications.

In case you are previously authorized, log in for your accounts and click on the Obtain key to find the Virgin Islands Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees. Use your accounts to search throughout the legal varieties you may have acquired in the past. Proceed to the My Forms tab of your respective accounts and acquire yet another version from the document you need.

In case you are a brand new user of US Legal Forms, here are basic guidelines for you to follow:

- Initially, make sure you have chosen the proper develop for your personal metropolis/region. You are able to look over the shape making use of the Preview key and look at the shape outline to make certain it is the right one for you.

- When the develop does not meet your preferences, use the Seach discipline to discover the right develop.

- Once you are certain the shape would work, click the Acquire now key to find the develop.

- Pick the rates program you want and enter in the required information. Build your accounts and purchase your order utilizing your PayPal accounts or credit card.

- Select the document format and download the legal document format for your gadget.

- Complete, change and printing and sign the obtained Virgin Islands Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees.

US Legal Forms is definitely the largest catalogue of legal varieties where you can discover various document themes. Make use of the company to download professionally-manufactured paperwork that follow state specifications.