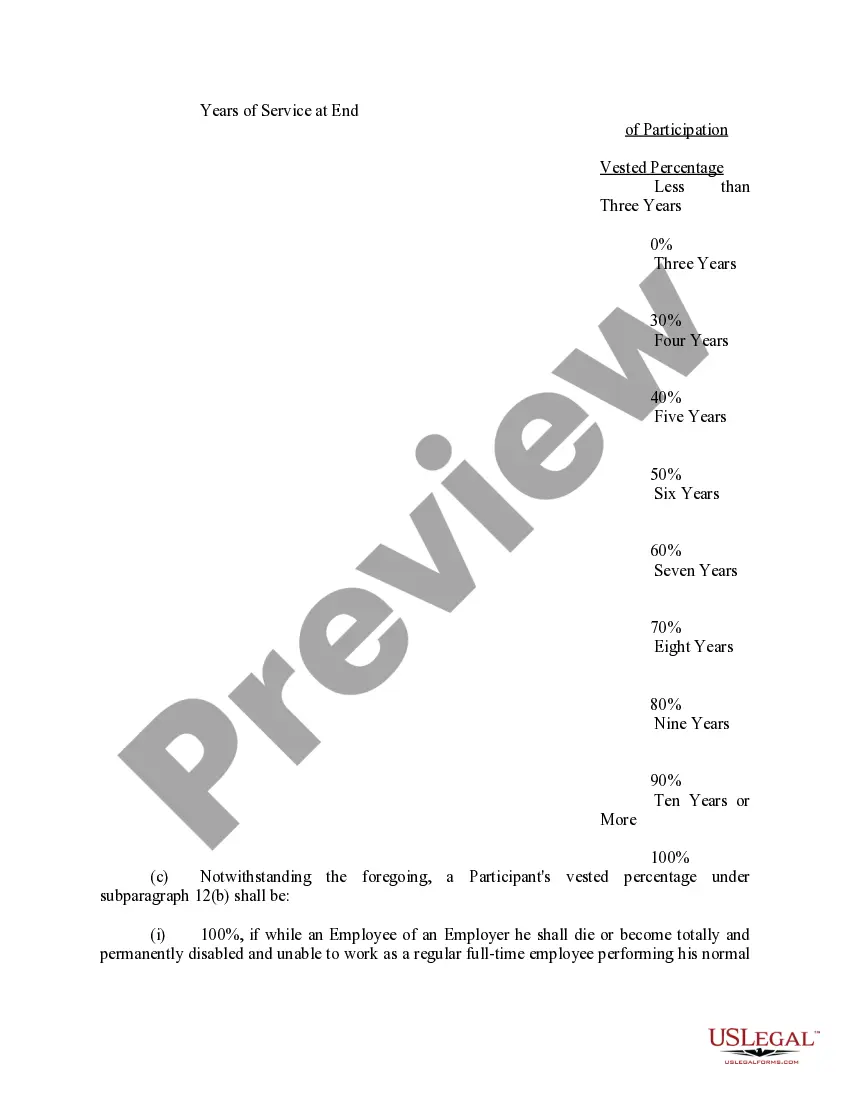

Virgin Islands Executive Stock Incentive Plan of Octo Limited

Description

How to fill out Executive Stock Incentive Plan Of Octo Limited?

Are you presently in the position in which you need to have paperwork for either company or specific functions nearly every day? There are plenty of legitimate papers layouts available on the net, but discovering types you can rely on isn`t effortless. US Legal Forms offers a huge number of kind layouts, just like the Virgin Islands Executive Stock Incentive Plan of Octo Limited, which can be written to fulfill state and federal specifications.

When you are presently informed about US Legal Forms site and also have your account, merely log in. After that, you may download the Virgin Islands Executive Stock Incentive Plan of Octo Limited format.

Unless you have an accounts and wish to begin using US Legal Forms, adopt these measures:

- Find the kind you need and make sure it is for your correct city/area.

- Use the Review switch to check the form.

- Browse the description to ensure that you have selected the right kind.

- If the kind isn`t what you`re seeking, make use of the Search field to discover the kind that fits your needs and specifications.

- Once you get the correct kind, simply click Get now.

- Choose the rates prepare you need, complete the necessary details to create your account, and buy your order making use of your PayPal or credit card.

- Pick a hassle-free document file format and download your backup.

Locate all of the papers layouts you have purchased in the My Forms food selection. You can aquire a extra backup of Virgin Islands Executive Stock Incentive Plan of Octo Limited any time, if required. Just click the necessary kind to download or produce the papers format.

Use US Legal Forms, by far the most comprehensive selection of legitimate types, to save time as well as avoid mistakes. The services offers expertly made legitimate papers layouts which can be used for an array of functions. Generate your account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

The benefit of incentive stock options Over time, you can make a significant amount of money on your shares. You not only owe a portion of the business, but you also benefit from the company's growth. Companies offering ISOs can also increase employee motivation .

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Employee stock options can be a lucrative part of an individual's overall compensation package, although not every company offers them. Workers can buy shares at a pre-determined price at a future date, regardless of the price of the stock when the options are exercised.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.