Virgin Islands private placement financing refers to the process of raising capital from private investors in the Virgin Islands, which is a group of islands located in the Caribbean Sea. Private placement financing allows companies and organizations to access funds without going through the public securities market. Private placement financing in the Virgin Islands is regulated by the British Virgin Islands Financial Services Commission (FSC) and offers various advantages such as flexibility, confidentiality, and limited regulatory requirements. This financing method is commonly used by startups, small and medium-sized enterprises (SMEs), and even larger corporations to fund their expansion, research and development, acquisitions, or other business activities. There are several types of the Virgin Islands private placement financing: 1. Equity Private Placement: Companies can raise funds by issuing shares or equity ownership stakes to private investors. This approach allows investors to become shareholders of the company and potentially benefit from any future profits or capital appreciation. 2. Debt Private Placement: This type of financing involves raising capital through the issuance of debt securities such as bonds or promissory notes. Companies can borrow funds from private investors who receive regular interest payments and the principal amount at maturity. 3. Convertible Private Placement: In this financing method, companies issue convertible securities that can be later converted into equity shares of the company. This allows private investors to participate in future growth opportunities while initially investing in debt-like securities. 4. Real Estate Private Placement: Specific to the Virgin Islands, this type of private placement financing focuses on investment opportunities in the local real estate market. Private investors can contribute to real estate development projects, property acquisitions, or property management ventures. 5. Infrastructure Private Placement: This financing option involves raising funds for infrastructure projects in the Virgin Islands, such as transportation, utilities, or telecommunication initiatives. Private investors can invest in these projects and expect returns from the generated revenues. 6. Renewable Energy Private Placement: The Virgin Islands' commitment towards sustainable energy creates opportunities for private investors to participate in renewable energy projects. Private placement financing can support the development and operation of wind, solar, or hydroelectric power generation facilities. Understanding the different types of the Virgin Islands private placement financing allows companies and investors to tailor their investment strategies according to their specific requirements, risk appetite, and project objectives. It is advisable to consult with legal and financial professionals to ensure compliance with local regulations and to maximize the benefits of private placement financing in the Virgin Islands.

Virgin Islands Private Placement Financing

Description

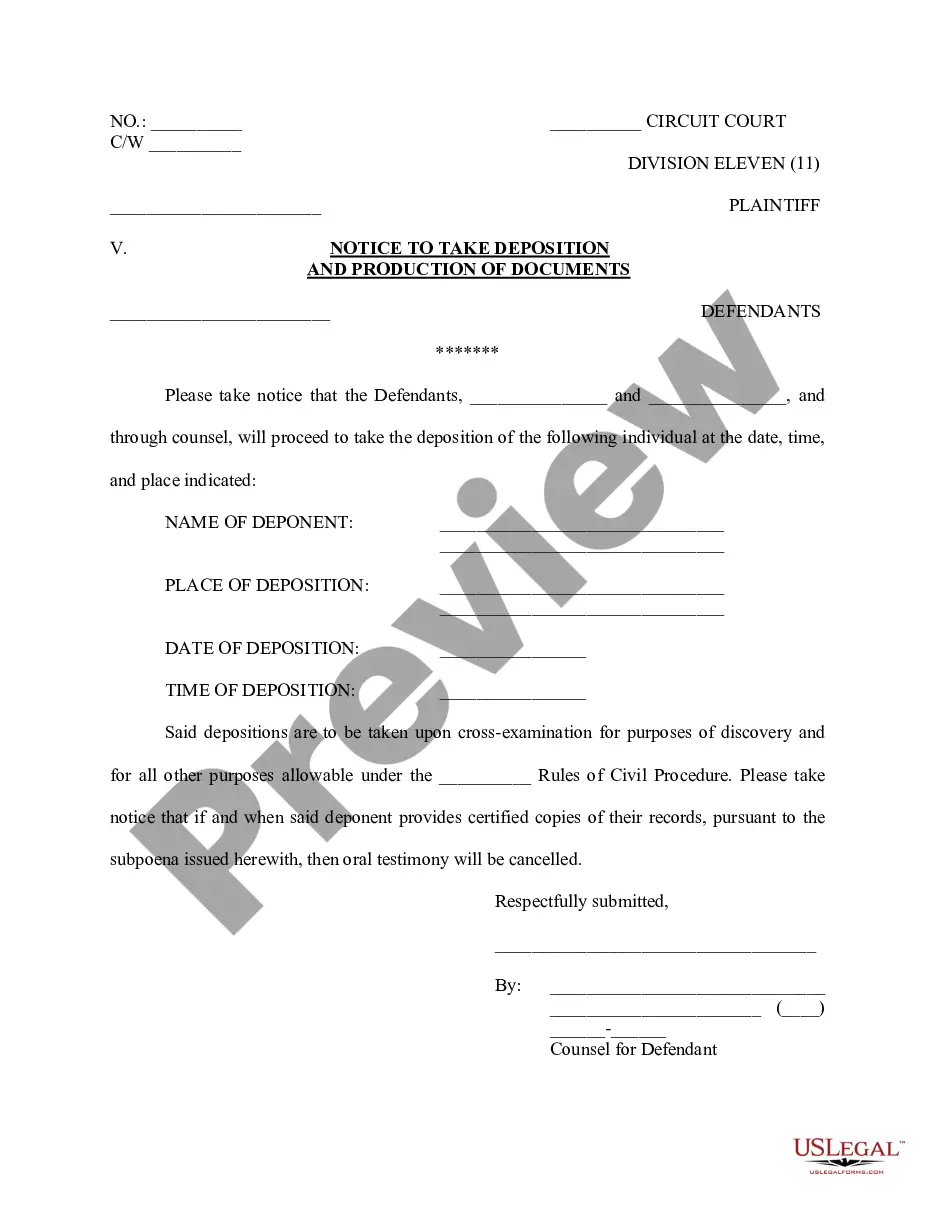

How to fill out Virgin Islands Private Placement Financing?

It is possible to devote hrs on the web attempting to find the legitimate file design that meets the state and federal requirements you require. US Legal Forms supplies a huge number of legitimate kinds that happen to be evaluated by professionals. You can easily download or produce the Virgin Islands Private Placement Financing from my assistance.

If you already have a US Legal Forms account, it is possible to log in and then click the Acquire button. Afterward, it is possible to complete, modify, produce, or signal the Virgin Islands Private Placement Financing. Every single legitimate file design you acquire is yours permanently. To obtain one more backup of any purchased form, visit the My Forms tab and then click the related button.

Should you use the US Legal Forms site the very first time, adhere to the straightforward instructions listed below:

- Initially, ensure that you have chosen the right file design for that state/city of your choosing. Read the form explanation to ensure you have picked out the right form. If offered, use the Review button to search throughout the file design too.

- If you want to locate one more model of your form, use the Lookup field to obtain the design that meets your needs and requirements.

- When you have identified the design you desire, just click Acquire now to move forward.

- Pick the prices plan you desire, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You can use your bank card or PayPal account to cover the legitimate form.

- Pick the format of your file and download it to your device.

- Make alterations to your file if needed. It is possible to complete, modify and signal and produce Virgin Islands Private Placement Financing.

Acquire and produce a huge number of file templates utilizing the US Legal Forms Internet site, which provides the largest assortment of legitimate kinds. Use specialist and status-particular templates to deal with your company or person needs.