Virgin Islands Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment

Description

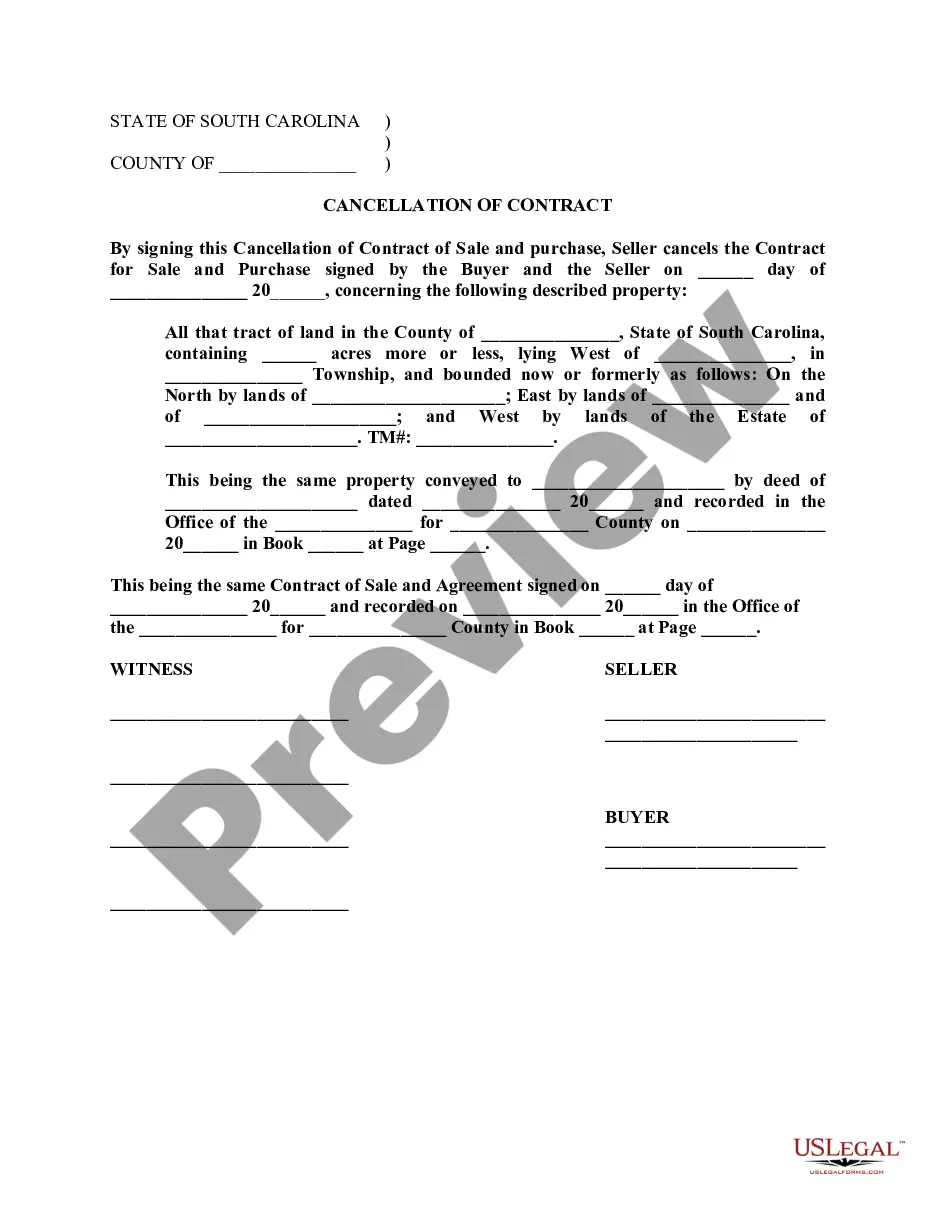

How to fill out Proposed Amendment To The Certificate Of Incorporation To Authorize Up To 10,000,000 Shares Of Preferred Stock With Amendment?

Finding the right lawful file web template might be a have a problem. Needless to say, there are a lot of layouts available online, but how do you obtain the lawful type you require? Use the US Legal Forms internet site. The support offers 1000s of layouts, like the Virgin Islands Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment, which you can use for organization and private requires. Each of the types are checked by pros and fulfill state and federal specifications.

In case you are presently listed, log in in your account and click the Down load switch to have the Virgin Islands Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment. Make use of your account to look with the lawful types you might have purchased earlier. Go to the My Forms tab of your respective account and get another backup in the file you require.

In case you are a new consumer of US Legal Forms, listed here are basic recommendations for you to comply with:

- Initial, make certain you have selected the appropriate type for the metropolis/region. You may look over the form using the Review switch and read the form outline to guarantee it will be the right one for you.

- If the type does not fulfill your requirements, take advantage of the Seach area to find the appropriate type.

- Once you are positive that the form is proper, select the Purchase now switch to have the type.

- Pick the rates prepare you need and type in the necessary information and facts. Design your account and purchase your order using your PayPal account or Visa or Mastercard.

- Opt for the file format and down load the lawful file web template in your device.

- Full, revise and printing and signal the attained Virgin Islands Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment.

US Legal Forms is the most significant catalogue of lawful types in which you can find a variety of file layouts. Use the company to down load skillfully-produced papers that comply with express specifications.

Form popularity

FAQ

What information do Articles of Incorporation contain? Name or number of your business. ... Full Address of the corporation's registered office. ... Names and addresses for directors/incorporators for the Articles of Incorporation. ... Directors Citizenship Status. ... Share Structure and Provisions.

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.