Virgin Islands Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees

Description

How to fill out Voting Trust Agreement Which Provides That The Shareholder Has Issued Certificates In The Care Of The Depositary In The Name Of The Voting Trustees?

Choosing the right legal document template can be quite a have a problem. Needless to say, there are a variety of web templates accessible on the Internet, but how would you obtain the legal develop you require? Make use of the US Legal Forms web site. The service gives a huge number of web templates, like the Virgin Islands Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees, which you can use for company and private requires. Every one of the kinds are checked out by experts and meet federal and state requirements.

Should you be previously authorized, log in to the bank account and then click the Down load key to find the Virgin Islands Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees. Utilize your bank account to search from the legal kinds you possess purchased earlier. Proceed to the My Forms tab of the bank account and have one more duplicate of the document you require.

Should you be a new user of US Legal Forms, listed below are basic instructions so that you can follow:

- Initially, be sure you have selected the correct develop for the area/region. You are able to check out the form making use of the Preview key and study the form outline to make sure it will be the best for you.

- When the develop is not going to meet your preferences, take advantage of the Seach field to obtain the correct develop.

- Once you are positive that the form is suitable, click on the Purchase now key to find the develop.

- Pick the prices plan you would like and type in the required information and facts. Build your bank account and buy an order utilizing your PayPal bank account or credit card.

- Choose the document formatting and acquire the legal document template to the product.

- Complete, change and print out and signal the attained Virgin Islands Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees.

US Legal Forms is the largest library of legal kinds in which you can see numerous document web templates. Make use of the company to acquire appropriately-created files that follow status requirements.

Form popularity

FAQ

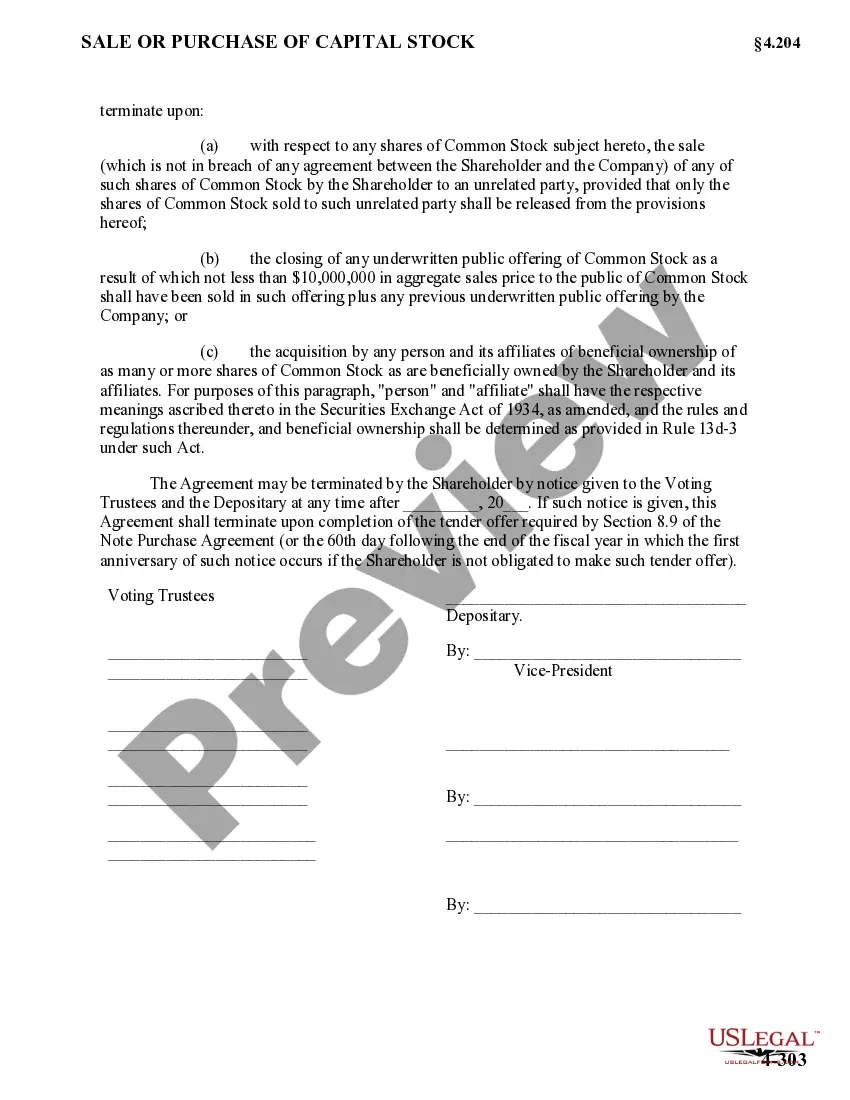

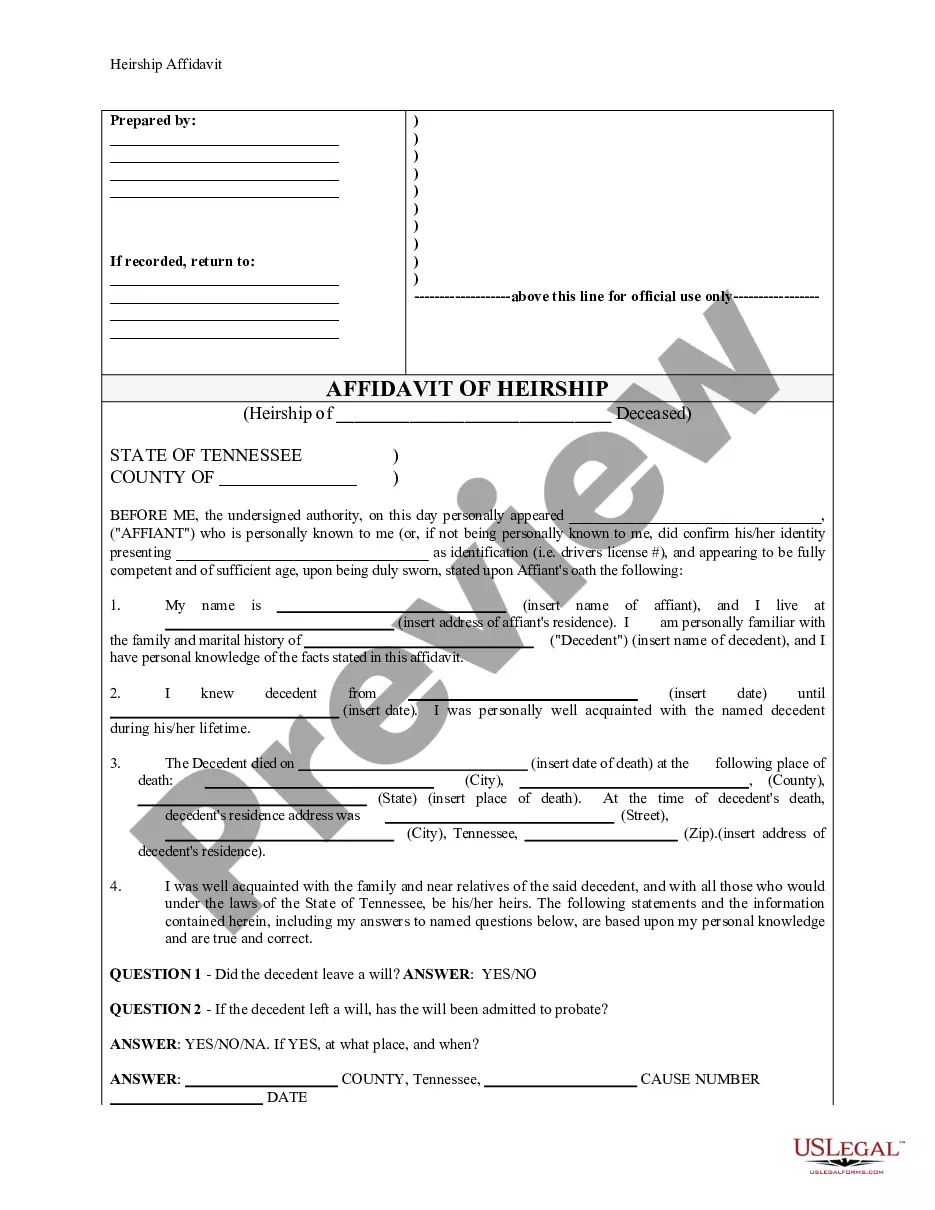

A voting trust is an arrangement whereby the shares in a company of one or more shareholders and the voting rights attached thereto are legally transferred to a trustee, usually for a specified period of time (the "trust period").

For a proxy vote, it is a temporary arrangement for a one-time issue; whereas, for a voting trust, it gives the trustees increased power to make decisions on behalf of all shareholders to control the company, which differs from proxy voting in terms of how much power is allocated.

While the proxy may be a temporary or one-time arrangement, often created for a specific vote, the voting trust is usually more permanent, intended to give a bloc of voters increased power as a group?or indeed, control of the company, which is not necessarily the case with proxy voting.

A voting trust certificate is a document used to give temporary voting control over a corporation to one or several individuals. It is issued to a shareholder and represents the normal rights of any other stockholder, such as receiving quarterly dividends in exchange for their common shares.

A voting agreement is an agreement between shareholders to vote their shares in a specific way. Instead of delegating voting authority to a third party as is the case in a voting trust, in a voting agreement, each shareholder pledges to abide by the agreement.

A voting trust is a contract between shareholders in which their shares and voting rights are temporarily transferred to a trustee. A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights.

A voting trust is a contract between shareholders in which their shares and voting rights are temporarily transferred to a trustee. A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights.

A voting trust agreement also goes under the name, pooling agreement. Two or more shareholders transfer their shares to a trustee under a voting arrangement. The trustee will then vote for those shares as a group following the agreement's terms or the majority's will.