Virgin Islands Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd.

Description

How to fill out Form Of Security Agreement Between Everest And Jennings International, Ltd., Everest And Jennings, Inc., And BIL, Ltd.?

US Legal Forms - one of many biggest libraries of lawful kinds in America - provides a variety of lawful document themes you can download or produce. Making use of the internet site, you will get 1000s of kinds for enterprise and individual reasons, sorted by classes, suggests, or key phrases.You will find the most up-to-date versions of kinds just like the Virgin Islands Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. in seconds.

If you already have a registration, log in and download Virgin Islands Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. from your US Legal Forms catalogue. The Obtain switch can look on each form you view. You gain access to all previously downloaded kinds in the My Forms tab of your profile.

If you would like use US Legal Forms the very first time, listed here are straightforward recommendations to get you began:

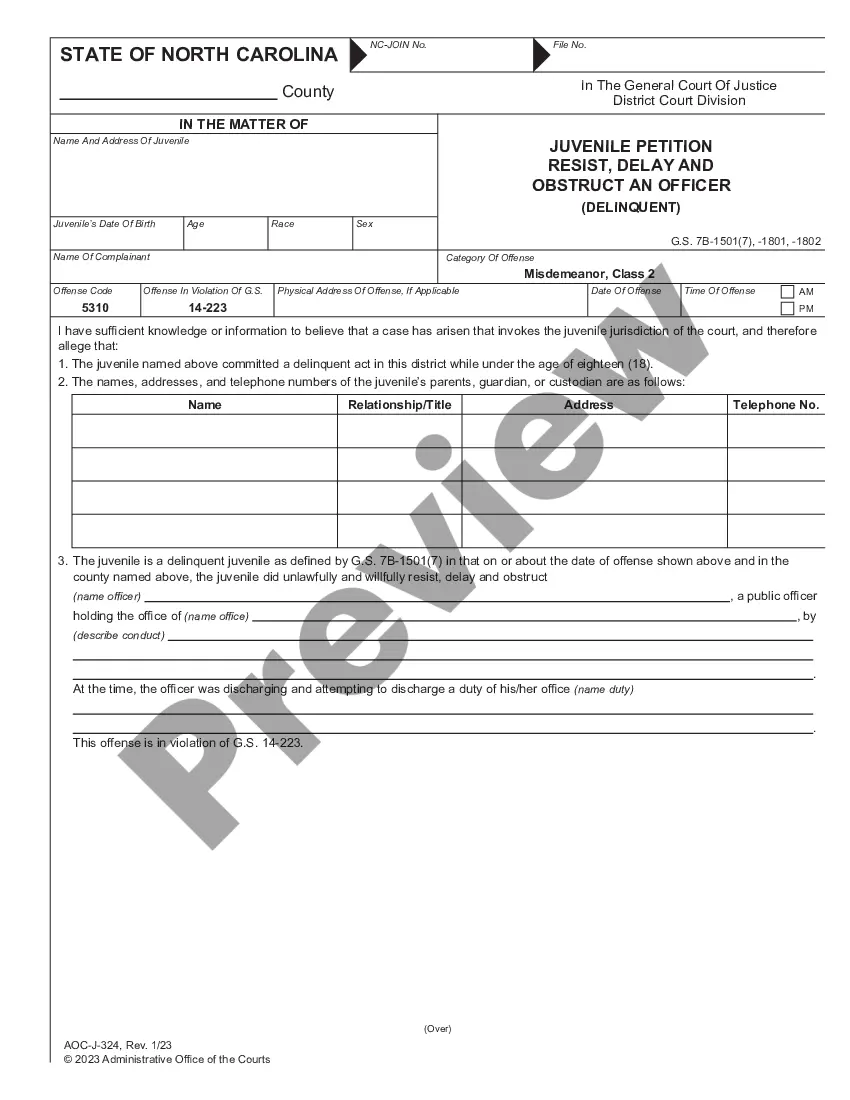

- Be sure you have selected the proper form for your metropolis/area. Select the Preview switch to analyze the form`s information. Read the form explanation to actually have chosen the proper form.

- In the event the form does not suit your needs, utilize the Look for area at the top of the screen to obtain the one that does.

- When you are satisfied with the form, confirm your selection by visiting the Acquire now switch. Then, select the rates strategy you favor and supply your accreditations to sign up to have an profile.

- Method the deal. Use your bank card or PayPal profile to accomplish the deal.

- Find the formatting and download the form on your own product.

- Make modifications. Fill out, change and produce and signal the downloaded Virgin Islands Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd..

Every web template you put into your bank account lacks an expiry particular date and it is your own property for a long time. So, in order to download or produce yet another version, just visit the My Forms section and then click about the form you will need.

Gain access to the Virgin Islands Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. with US Legal Forms, by far the most substantial catalogue of lawful document themes. Use 1000s of professional and condition-particular themes that meet your business or individual requirements and needs.