Virgin Islands Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc

Description

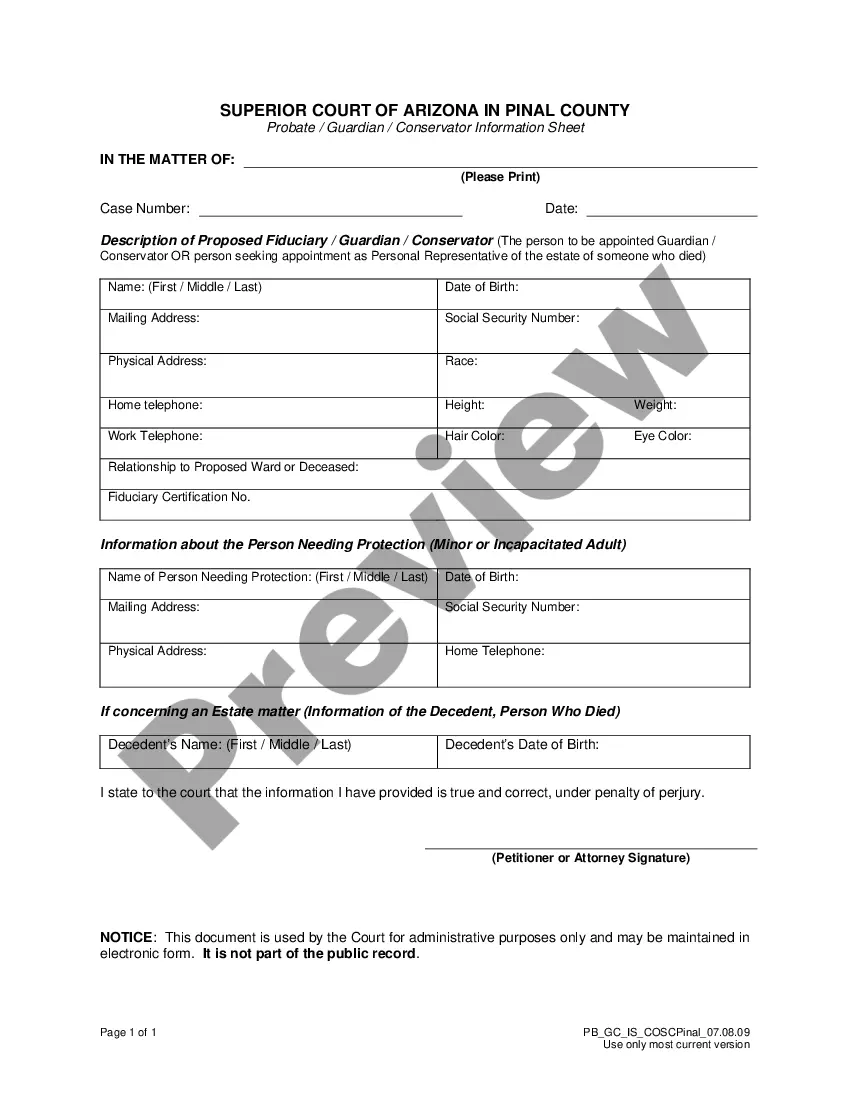

How to fill out Administration Agreement Between Neuberger And Berman Advisers Management Trust And Neuberger And Berman Management Inc?

US Legal Forms - one of many most significant libraries of legitimate varieties in the States - gives a wide array of legitimate papers themes you may obtain or produce. Making use of the website, you may get a huge number of varieties for company and specific uses, sorted by groups, claims, or keywords and phrases.You will discover the most up-to-date variations of varieties such as the Virgin Islands Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc within minutes.

If you have a monthly subscription, log in and obtain Virgin Islands Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc from your US Legal Forms library. The Obtain button will appear on every single develop you see. You have access to all previously saved varieties within the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, listed below are simple instructions to help you started:

- Be sure you have picked the proper develop for the metropolis/state. Select the Review button to review the form`s articles. Look at the develop description to ensure that you have selected the right develop.

- When the develop doesn`t suit your requirements, take advantage of the Research industry near the top of the display to get the the one that does.

- In case you are happy with the shape, affirm your decision by simply clicking the Acquire now button. Then, opt for the prices program you prefer and supply your references to register for an profile.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal profile to perform the deal.

- Pick the format and obtain the shape in your system.

- Make changes. Load, revise and produce and indication the saved Virgin Islands Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc.

Each web template you included in your account does not have an expiry time which is your own property permanently. So, if you wish to obtain or produce another copy, just go to the My Forms section and click on in the develop you require.

Gain access to the Virgin Islands Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc with US Legal Forms, by far the most considerable library of legitimate papers themes. Use a huge number of specialist and status-certain themes that satisfy your business or specific requires and requirements.

Form popularity

FAQ

Neuberger Berman Trust Company N.A. offers comprehensive fiduciary and investment services for individuals and institutions.

The Neuberger Berman Tactical Macro UCITS fund aims to achieve positive returns regardless of the market environment through identifying market pricing imbalances across a range of asset classes, markets and regions in a risk-managed framework.

Neuberger Berman Investment Funds II PLC is a qualifying investor alternative investment fund available to professional investors only. KIDs/KIIDs are not produced for this fund.

Since 1939, Neuberger Berman has been a leader in the asset management business servicing the investment needs of institutional and individual investors. Neuberger Berman is an independent, employee majority-controlled global asset management firm.

With offices in 25 countries, Neuberger Berman's diverse team has over 2,400 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more).

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.

Neuberger Berman actively manages over $120bn2 of assets across its private equity platform and has been a private markets investor for more than 30 years. We believe our position within the private equity ecosystem provides differentiated access to investment opportunities as well as enhanced information.

Neuberger Berman is a private, independent, employee-owned investment manager?a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.