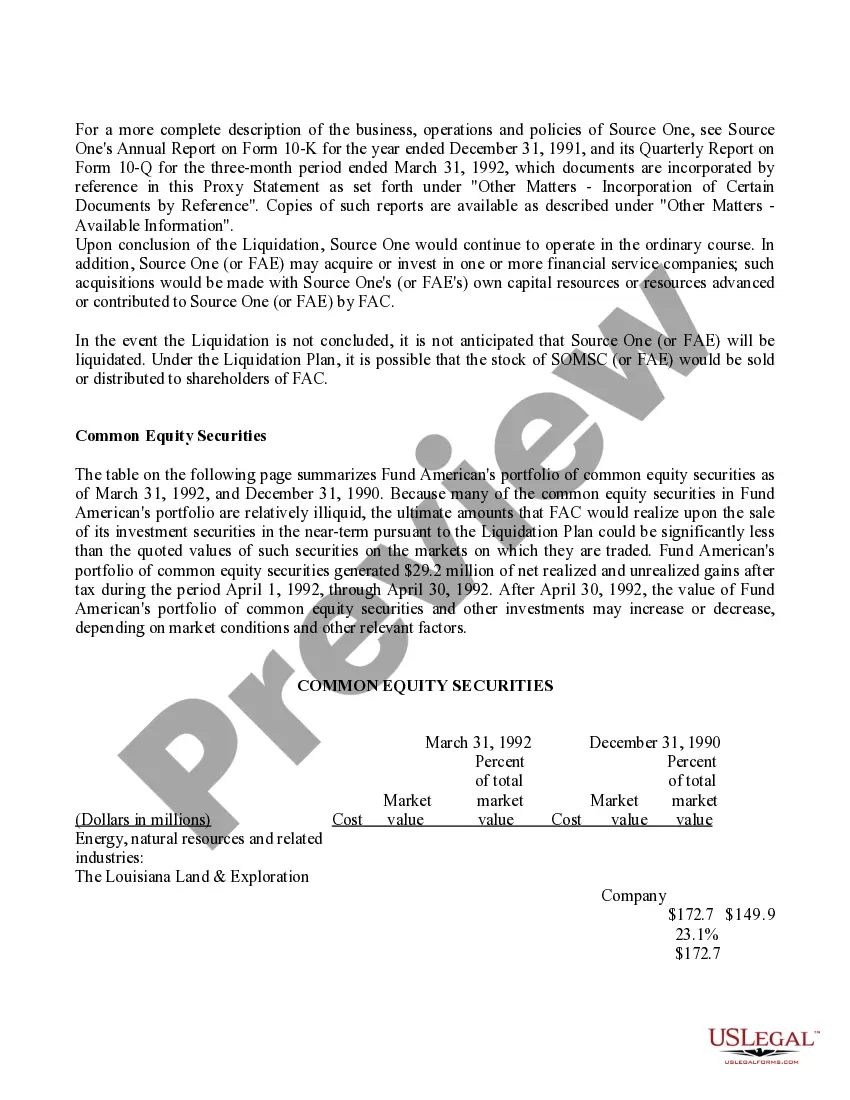

Virgin Islands Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Proposal - Conclusion Of The Liquidation With Exhibit?

Are you currently inside a situation in which you will need documents for both enterprise or specific purposes just about every day time? There are plenty of authorized record layouts available online, but locating types you can rely on isn`t effortless. US Legal Forms gives a huge number of develop layouts, just like the Virgin Islands Proposal - Conclusion of the Liquidation with exhibit, which are written to meet state and federal requirements.

When you are previously informed about US Legal Forms web site and possess your account, basically log in. After that, it is possible to down load the Virgin Islands Proposal - Conclusion of the Liquidation with exhibit format.

Unless you come with an profile and would like to start using US Legal Forms, adopt these measures:

- Discover the develop you need and ensure it is for the right city/region.

- Make use of the Preview key to analyze the shape.

- Browse the outline to ensure that you have chosen the proper develop.

- When the develop isn`t what you are seeking, use the Look for discipline to obtain the develop that fits your needs and requirements.

- If you obtain the right develop, click on Get now.

- Choose the costs prepare you would like, complete the desired information and facts to produce your account, and pay for your order with your PayPal or charge card.

- Pick a convenient document file format and down load your backup.

Discover all the record layouts you might have bought in the My Forms menus. You may get a more backup of Virgin Islands Proposal - Conclusion of the Liquidation with exhibit any time, if necessary. Just select the needed develop to down load or print the record format.

Use US Legal Forms, one of the most comprehensive variety of authorized kinds, to conserve time and steer clear of errors. The services gives professionally manufactured authorized record layouts that can be used for an array of purposes. Produce your account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

Directors who are owed money by their companies risk losing their unpaid debts along with all the other creditors if the company goes into insolvent Liquidation. With the exception of any preferential element to their claims as creditors, Directors rank as unsecured creditors.

Liquidation Disadvantages Generally speaking the name, brand and goodwill of the business will be lost. Given that the company is liquidated, the appointed liquidator will have an obligation to report to the Insolvency Service on the conduct of any directors of the company for the last three years.

Liquidation is the process of selling off assets to repay creditors and dissolve a business. An example of liquidation would be a company selling off its inventory, property, and other assets in order to pay its creditors and close its doors.

Disadvantages to Liquidation Any employees will lose their jobs and so will the directors. Shareholders may have to repay illegal dividends (not paid out of profit). Overdrawn directors loan accounts will have to repaid. Suppliers and creditors will lose money.

The quick answer. The effects of liquidation on a business means that it will stop trading and the powers of the director's will cease. The directors are replaced by a Liquidator whose job it is to realise the assets of the business for the benefit of all the creditors. All of the employees are automatically dismissed.

Liquidation is a process in which the company is brought to an end. Also, the assets and property of the company are redistributed to the creditors and owners. Liquidation is also referred to as winding-up or dissolution, although dissolution technically refers to the last stage of liquidation.

Conclusion. In conclusion, liquidation is a legal process that is initiated when a company is unable to pay its debts. The assets of the company are sold off to pay off its creditors. The process of liquidation is usually carried out by a liquidator who is appointed by the court.

The principle effects of liquidation are that the limited company stops trading immediately, and the directors role ends. A liqudator will close down the company, make employees redundant and sell off assets for the benefit for corporate creditors.