This due diligence form entails policies and procedures for the identification, retention, storage, protection and disposal of company records. This Records Retention Policy is intended to ensure that the company's records management policies adhere to customer, legal and business requirements and are conducted in a cost-efficient manner.

Virgin Islands Records Retention Policy

Description

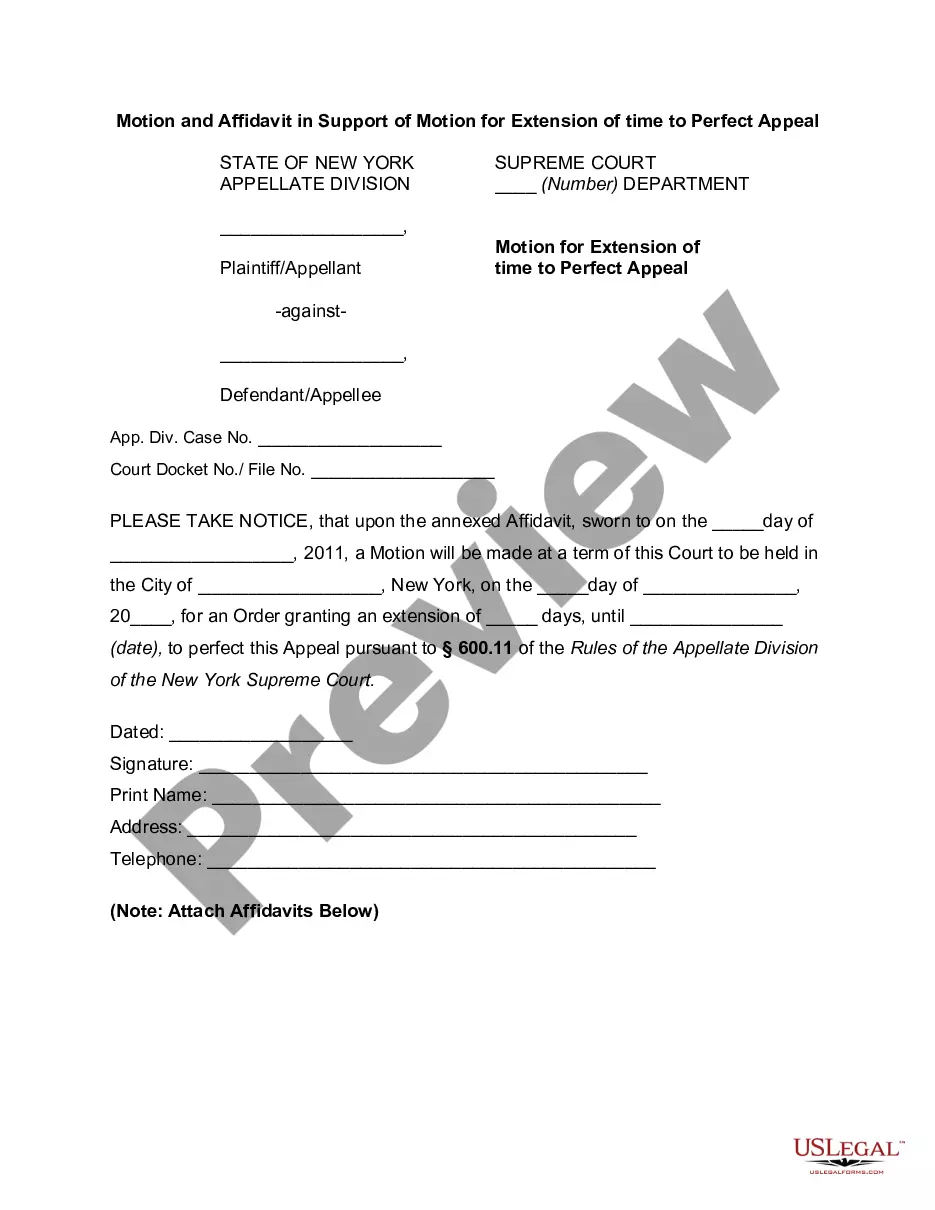

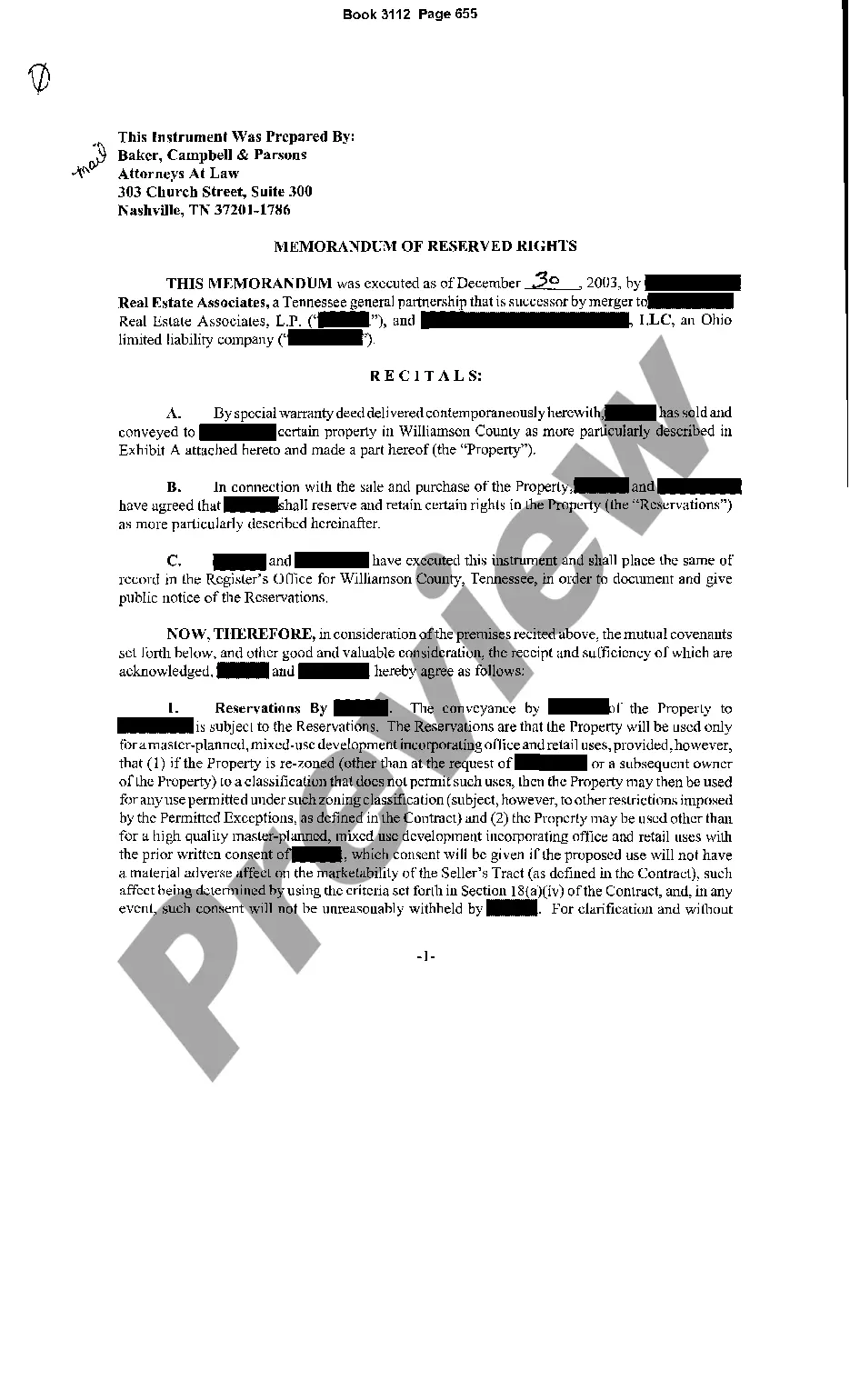

How to fill out Virgin Islands Records Retention Policy?

Are you currently in a situation that you need to have documents for either enterprise or individual uses just about every working day? There are plenty of legitimate document themes accessible on the Internet, but locating kinds you can depend on isn`t simple. US Legal Forms provides 1000s of form themes, just like the Virgin Islands Records Retention Policy, which can be created to fulfill federal and state requirements.

When you are currently familiar with US Legal Forms web site and also have an account, merely log in. Next, you can down load the Virgin Islands Records Retention Policy web template.

Unless you come with an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and ensure it is for your right town/region.

- Utilize the Review switch to check the form.

- Read the explanation to ensure that you have selected the right form.

- In case the form isn`t what you`re searching for, take advantage of the Search field to obtain the form that meets your needs and requirements.

- Whenever you find the right form, click on Buy now.

- Opt for the prices strategy you want, complete the necessary info to make your money, and pay for your order with your PayPal or credit card.

- Decide on a convenient data file format and down load your backup.

Get all of the document themes you may have purchased in the My Forms menu. You can obtain a additional backup of Virgin Islands Records Retention Policy anytime, if possible. Just go through the necessary form to down load or produce the document web template.

Use US Legal Forms, the most considerable collection of legitimate forms, to conserve some time and prevent blunders. The services provides professionally produced legitimate document themes which you can use for a range of uses. Produce an account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

When tackling data retention, you need to address four related records retention issues: access, cost, risks and productivity. If you take a methodical look at each of these issues, you'll soon realize why keeping everything forever isn't a smart business decision.

How long the records must be kept? 200bFive years: counting from the date of submission of a return until the last day of the period. 200bA person required to submit a return but has not complied. 200bFive years: After the end of the five years period, indefinitely until the return is submitted.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

With few exceptions, records in the physical possession of a federal agency are subject to the Freedom of Information Act. Agencies do not, however, have to retain indefinitely all records which are created by or submitted to them. Under the Federal Records Act, 44 U.S.C.

RETENTION SCHEDULE DEVELOPMENT: DEFINING ACTIVE (ACT) Key Points. 2022 In the ACTIVE PERIOD of a record's lifecycle, the record is used by the agency regularly. 2022 ACT is used on the retention schedule to define the variable portion of a record's retention period that corresponds to this active period.

Records Retention Guideline #4: Keep everyday paperwork for 3 yearsMonthly financial statements.Credit card statements.Utility records.Employment applications (for businesses)Medical bills (in case of insurance disputes)

Records retention is a practice by which organizations maintain confidential records for set lengths of time, and then employ a system of actions to either redirect, store or dispose of them.

You must keep the following records for 7 years:minutes of board and committee meetings.written communications with shareholders, including emails.resolutions.certificates issued by directors.copies of all financial statements.a record of the assets and liabilities of the company.

You need to keep most records for five years, starting from when you prepared or obtained the records, or completed the transactions (or acts they relate to), whichever is the later. You need to be able to show the ATO your records if they ask for them.