Virgin Islands Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

It is possible to devote time on-line trying to find the authorized record template that meets the state and federal specifications you require. US Legal Forms supplies 1000s of authorized kinds which are examined by experts. It is possible to download or print the Virgin Islands Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. from your assistance.

If you already possess a US Legal Forms bank account, you can log in and then click the Download option. Next, you can comprehensive, modify, print, or indicator the Virgin Islands Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.. Every single authorized record template you purchase is yours permanently. To obtain an additional version of any obtained form, proceed to the My Forms tab and then click the related option.

If you are using the US Legal Forms site initially, follow the basic recommendations under:

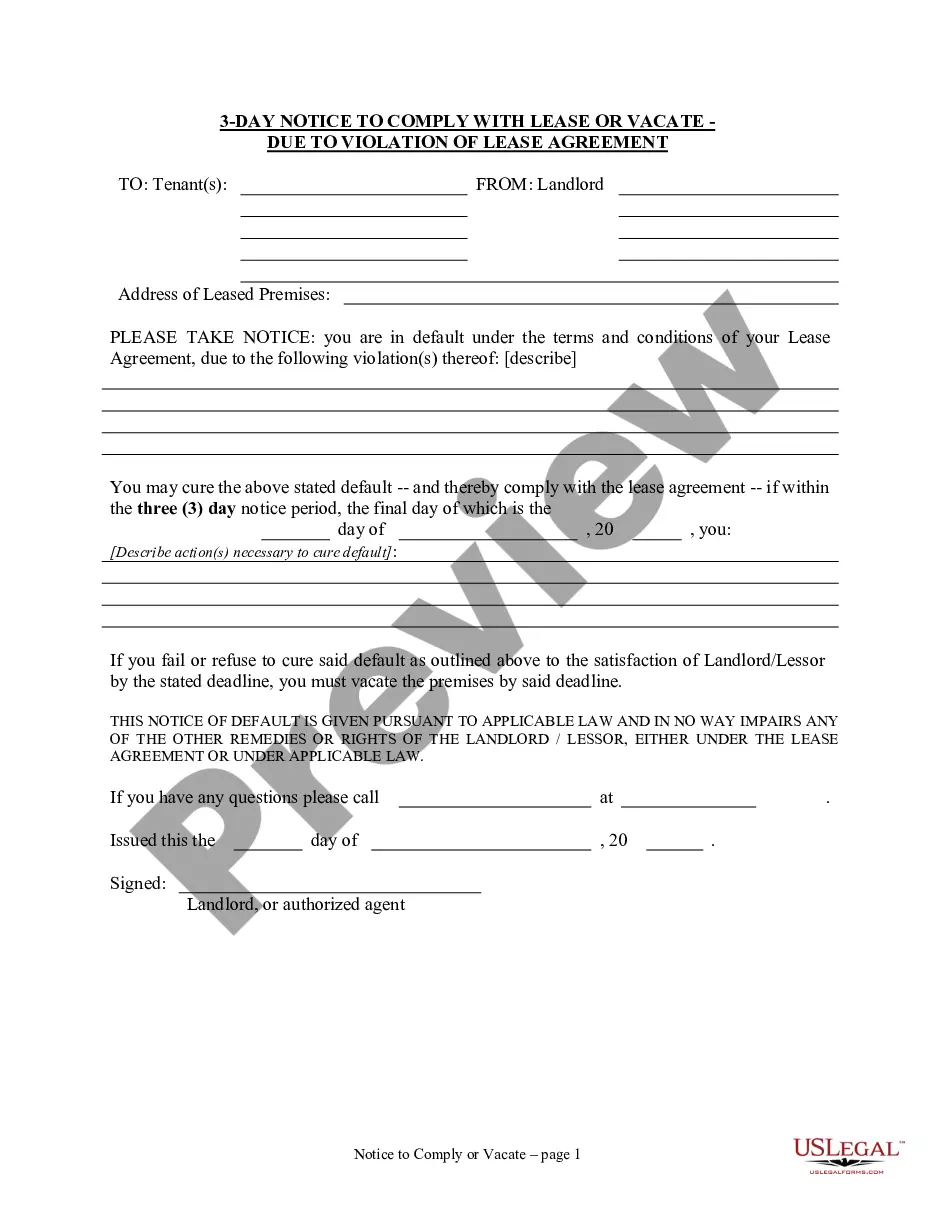

- Initial, make certain you have selected the correct record template for the area/metropolis of your choosing. Browse the form outline to ensure you have picked out the right form. If readily available, make use of the Preview option to appear through the record template at the same time.

- If you would like find an additional model in the form, make use of the Search industry to discover the template that suits you and specifications.

- When you have identified the template you desire, click on Get now to proceed.

- Find the costs strategy you desire, key in your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your bank card or PayPal bank account to cover the authorized form.

- Find the file format in the record and download it to your product.

- Make changes to your record if possible. It is possible to comprehensive, modify and indicator and print Virgin Islands Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc..

Download and print 1000s of record layouts making use of the US Legal Forms web site, that provides the greatest selection of authorized kinds. Use expert and state-particular layouts to deal with your small business or person demands.

Form popularity

FAQ

A mortgage servicing disclosure provides information from the lender about whether or not the servicing of the loan may be transferred, sold, or assigned to some other person or entity during the life of the loan.

The Pooling and Servicing Agreement can be a stand-alone document or it can be part of another paper, usually called the ?Prospectus.? If the securitization is public, these documents must be filed with the Securities and Exchange Commission (SEC), and will be available to the public at .sec.gov.

All of the mortgage records you can legally gain access to will be stored with the county where the property is located. Fortunately, most counties now have a digital version of their records for easy viewing. In any case, you'll want to locate the county's clerk's office or public records website.

The transferor and transferee servicers may provide a single notice, in which case the notice shall be provided not less than 15 days before the effective date of the transfer of the servicing of the mortgage loan.

A servicer shall retain records that document actions taken with respect to a borrower's mortgage loan account until one year after the date a mortgage loan is discharged or servicing of a mortgage loan is transferred by the servicer to a transferee servicer.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.