The Virgin Islands Trust Agreement of Ameriquest Mortgage Securities, Inc. is a legally binding contract that governs the creation and management of mortgage-backed securities (MBS) in the Virgin Islands territory. This agreement is specific to the operations and investments made by Ameriquest Mortgage Securities, Inc. within the Virgin Islands. Ameriquest Mortgage Securities, Inc. is an American mortgage company that operates on a national level, but has specific agreements and trusts in place for different regions and territories. The Virgin Islands Trust Agreement is tailored for the Virgin Islands market, ensuring compliance with local regulations and guidelines. This trust agreement is designed to facilitate the process of securitizing mortgage loans originated by Ameriquest Mortgage Securities, Inc. within the Virgin Islands jurisdiction. It outlines the rights, responsibilities, and obligations of various parties involved, including the trust issuer (Ameriquest Mortgage Securities, Inc.), the trustee, the service, and the investors. The Virgin Islands Trust Agreement of Ameriquest Mortgage Securities, Inc. typically includes provisions related to the identification, selection, and transfer of mortgage loans into the trust. It outlines the procedures for the distribution of principal and interest payments to the certificate holders (investors) based on the performance of the underlying mortgage loans. Furthermore, the agreement outlines the responsibilities of the trustee, who is responsible for enforcing the terms of the agreement and protecting the interests of the investors. It also covers the mechanisms for handling loan defaults, foreclosure proceedings, and potential conflicts of interest. There may be different types of Virgin Islands Trust Agreements offered by Ameriquest Mortgage Securities, Inc., which could vary based on the specific mortgage loan portfolios, risk profiles, and investment strategies. Each type would have its own unique terms, conditions, and characteristics tailored to meet the demands and preferences of different investors. In summary, the Virgin Islands Trust Agreement of Ameriquest Mortgage Securities, Inc. represents a legally binding contract governing the operations and management of mortgage-backed securities in the Virgin Islands. It is a specific agreement designed to ensure compliance with local regulations and guidelines, while facilitating the securitization and distribution of mortgage loans originated by Ameriquest Mortgage Securities, Inc. in the Virgin Islands territory.

Virgin Islands Trust Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Virgin Islands Trust Agreement Of Ameriquest Mortgage Securities, Inc.?

If you wish to full, obtain, or produce legal record web templates, use US Legal Forms, the largest assortment of legal kinds, which can be found on the Internet. Utilize the site`s simple and easy handy research to get the paperwork you require. Different web templates for enterprise and individual uses are categorized by groups and says, or key phrases. Use US Legal Forms to get the Virgin Islands Trust Agreement of Ameriquest Mortgage Securities, Inc. with a few click throughs.

In case you are currently a US Legal Forms customer, log in to the profile and then click the Down load key to obtain the Virgin Islands Trust Agreement of Ameriquest Mortgage Securities, Inc.. You can even access kinds you previously delivered electronically in the My Forms tab of the profile.

If you are using US Legal Forms the very first time, refer to the instructions below:

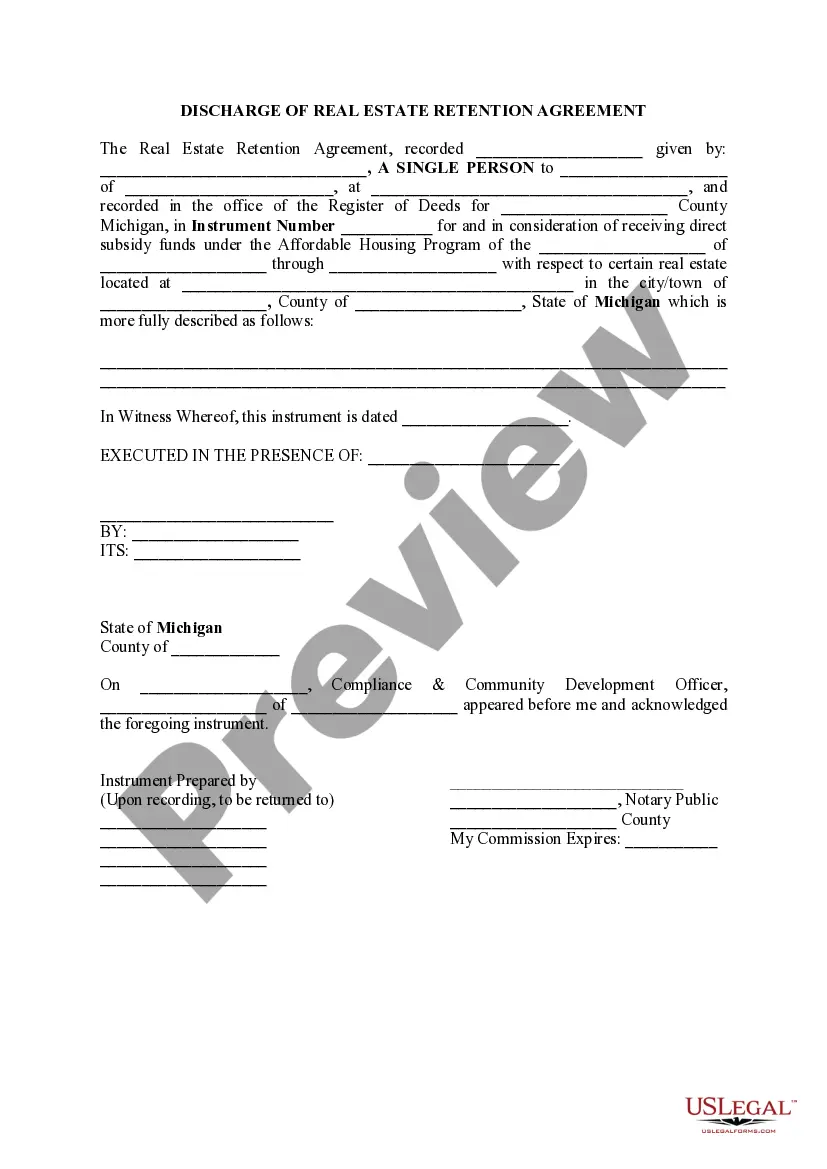

- Step 1. Ensure you have selected the form for your right town/land.

- Step 2. Make use of the Preview method to look over the form`s content. Do not forget to learn the outline.

- Step 3. In case you are unhappy with all the develop, utilize the Research field near the top of the display to discover other models of the legal develop format.

- Step 4. When you have found the form you require, click on the Buy now key. Choose the costs strategy you choose and put your credentials to register on an profile.

- Step 5. Procedure the transaction. You can utilize your credit card or PayPal profile to perform the transaction.

- Step 6. Find the formatting of the legal develop and obtain it in your device.

- Step 7. Total, change and produce or signal the Virgin Islands Trust Agreement of Ameriquest Mortgage Securities, Inc..

Each and every legal record format you get is your own eternally. You may have acces to each develop you delivered electronically with your acccount. Click the My Forms area and decide on a develop to produce or obtain once again.

Compete and obtain, and produce the Virgin Islands Trust Agreement of Ameriquest Mortgage Securities, Inc. with US Legal Forms. There are millions of skilled and state-particular kinds you may use to your enterprise or individual requirements.

Form popularity

FAQ

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

To create an MBS, the bank will bundle your loan with hundreds or thousands of other mortgages. These loans are then sold to an investment bank as a single bond. The investment bank then sections off the loans by their quality and sells them to other investors.

?(Hidden)? Eligibility Requirements Issuers must be approved FHA mortgagees in good standing. ... Issuers must possess demonstrated experience and management capacity in the underwriting, origination, and servicing of mortgage loans. ... Issuers must have fidelity bond and a "mortgagee errors and omissions" policy in effect.

Mortgages are sold to institutions such as an investment bank or government institution, which then package it into an MBS that can be sold to individual investors. A mortgage contained in an MBS must have originated from an authorized financial institution.

Most mortgage-backed securities are issued by the Government National Mortgage Association (Ginnie Mae), a U.S. government agency, or the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), U.S. government-sponsored enterprises.

To create an MBS, the bank will bundle your loan with hundreds or thousands of other mortgages. These loans are then sold to an investment bank as a single bond. The investment bank then sections off the loans by their quality and sells them to other investors.