Virgin Islands Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc.

Description

How to fill out Underwriting Agreement Of ABFS Mortgage Loan Trust 1999-4 And Prudential Securities, Inc.?

Have you been in the position in which you need paperwork for sometimes organization or specific uses almost every time? There are tons of authorized document web templates accessible on the Internet, but finding kinds you can rely isn`t straightforward. US Legal Forms provides thousands of type web templates, like the Virgin Islands Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc., that happen to be written to fulfill state and federal demands.

When you are already acquainted with US Legal Forms website and have your account, merely log in. Next, it is possible to obtain the Virgin Islands Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. web template.

If you do not provide an accounts and wish to start using US Legal Forms, adopt these measures:

- Get the type you want and make sure it is for your appropriate town/area.

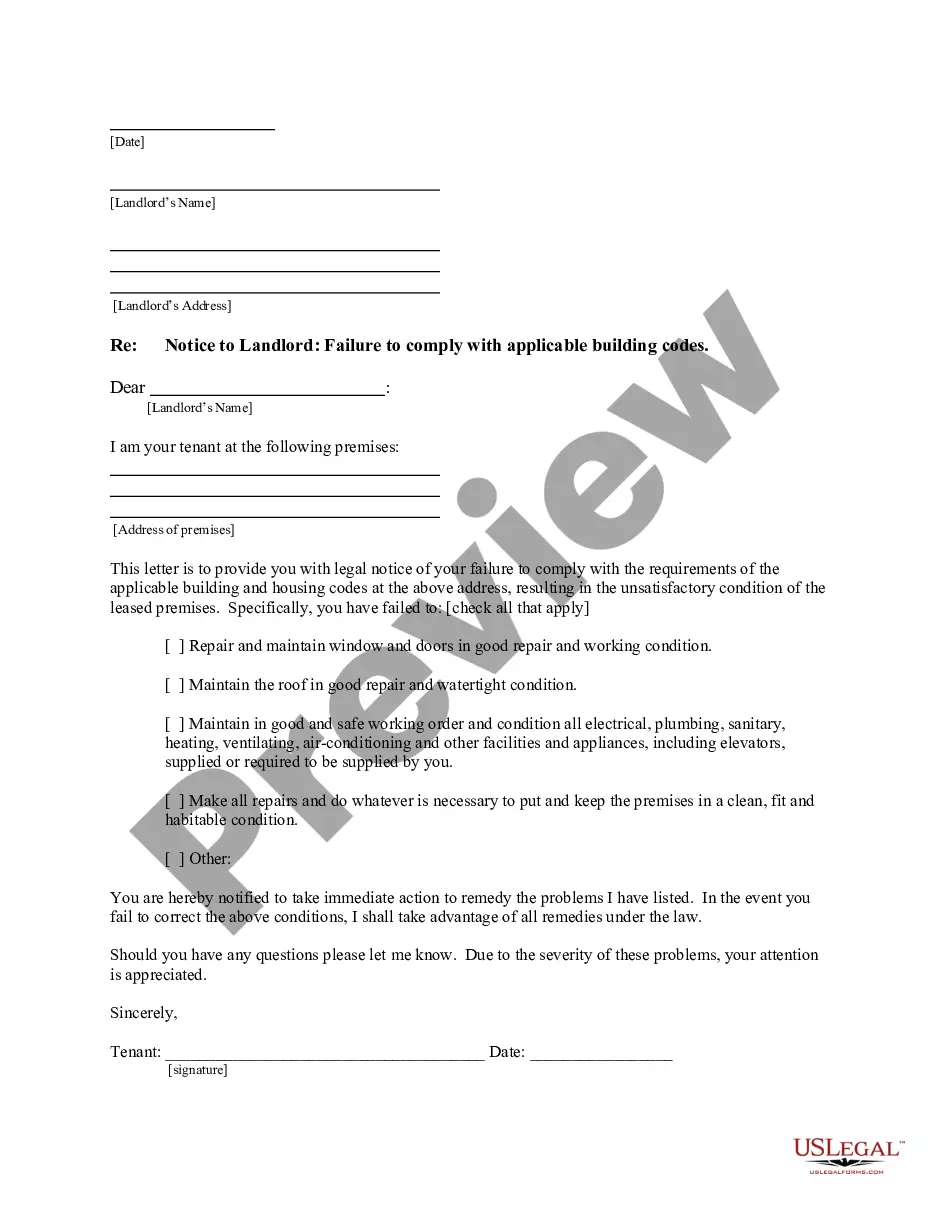

- Make use of the Preview option to review the shape.

- Browse the information to ensure that you have selected the appropriate type.

- When the type isn`t what you`re searching for, take advantage of the Look for industry to discover the type that fits your needs and demands.

- Once you get the appropriate type, just click Get now.

- Opt for the prices plan you would like, fill in the desired info to make your bank account, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free document file format and obtain your duplicate.

Discover each of the document web templates you possess bought in the My Forms food list. You can get a further duplicate of Virgin Islands Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. at any time, if required. Just go through the necessary type to obtain or printing the document web template.

Use US Legal Forms, one of the most extensive variety of authorized types, to save some time and stay away from blunders. The services provides professionally produced authorized document web templates that can be used for a range of uses. Make your account on US Legal Forms and commence making your daily life a little easier.