The Virgin Islands Sample Founder Stock Purchase Agreement is a legal document that outlines a formal agreement between Machine Communications, Inc. (hereinafter referred to as "Machine") and Peter D. Olson, an individual (hereinafter referred to as the "Founder"). This agreement pertains to the purchase and issuance of founder stock in Machine. The Founder Stock Purchase Agreement establishes the terms and conditions regarding the purchase, allocation, and transfer of stock in Machine to the Founder. It sets out the number of shares, the purchase price, and other essential details related to the transaction. Under the agreement, Machine agrees to issue the Founder a specific number of shares in exchange for certain considerations, which can include cash payments or services rendered. The agreement specifies the purchase price per share and the total purchase price, which is calculated by multiplying the number of shares by the purchase price. Additionally, the agreement may outline any restrictions on the transfer of shares, such as lock-up provisions or right of first refusal. It can also address the vesting schedule, which determines when the Founder's shares will become fully owned by them. Different types of the Virgin Islands Sample Founder Stock Purchase Agreements between Machine Communications, Inc. and Peter D. Olson may include: 1. Early Stage Founder Stock Purchase Agreement: This type of agreement is typically used when the company is in its early stage of development, and the Founder is contributing significant value, such as intellectual property or expertise. 2. Vesting Founder Stock Purchase Agreement: This agreement includes a vesting schedule that dictates when and how the Founder's shares will fully vest or become fully owned by them. Vesting is often used to incentivize the Founder to remain with the company for a certain period. 3. Restricted Stock Purchase Agreement: In this agreement, the Founder's shares may be subject to restrictions on transferability or certain conditions that must be met before the shares can be sold or transferred. 4. Reverse Vesting Founder Stock Purchase Agreement: This agreement establishes a reverse vesting schedule, where the Founder initially holds all the shares, but the company has the option to repurchase the shares if certain conditions are not met, such as the Founder's termination. It is important to note that the specific terms and structures of the Founder Stock Purchase Agreement may differ based on the unique circumstances and requirements of Machine Communications, Inc., and Peter D. Olson. It is advisable to consult with legal professionals or use appropriate templates when drafting a Founder Stock Purchase Agreement.

Virgin Islands Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Virgin Islands Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

If you need to comprehensive, acquire, or printing lawful papers templates, use US Legal Forms, the biggest variety of lawful forms, that can be found on-line. Take advantage of the site`s easy and hassle-free lookup to discover the documents you need. A variety of templates for business and personal reasons are sorted by categories and states, or keywords. Use US Legal Forms to discover the Virgin Islands Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson with a handful of mouse clicks.

When you are already a US Legal Forms consumer, log in for your account and click on the Download key to get the Virgin Islands Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson. Also you can gain access to forms you earlier acquired within the My Forms tab of your account.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that proper area/nation.

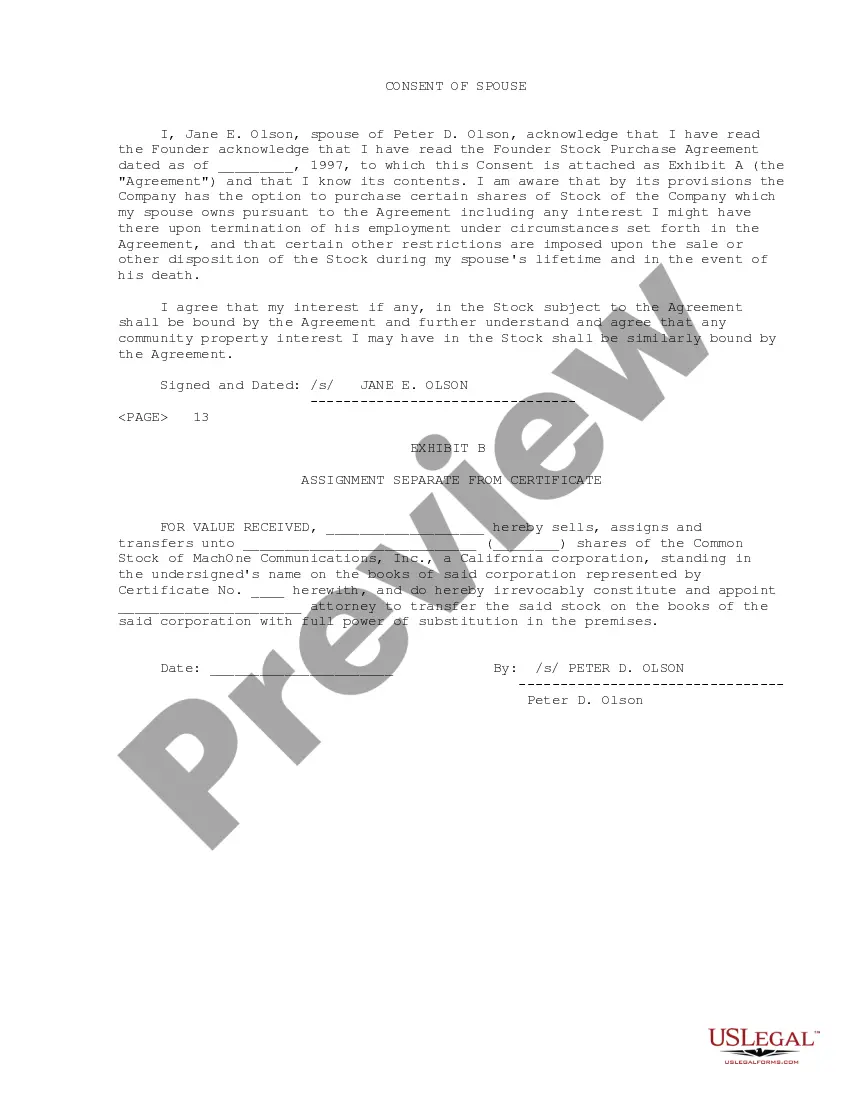

- Step 2. Make use of the Review solution to look through the form`s content. Do not neglect to read through the outline.

- Step 3. When you are not happy with the type, utilize the Search industry near the top of the monitor to discover other types of the lawful type design.

- Step 4. When you have located the shape you need, select the Acquire now key. Select the costs plan you prefer and add your accreditations to sign up for the account.

- Step 5. Method the transaction. You can use your Мisa or Ьastercard or PayPal account to accomplish the transaction.

- Step 6. Choose the structure of the lawful type and acquire it on the system.

- Step 7. Total, edit and printing or indication the Virgin Islands Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson.

Each and every lawful papers design you buy is your own forever. You possess acces to every single type you acquired with your acccount. Click on the My Forms portion and choose a type to printing or acquire once again.

Remain competitive and acquire, and printing the Virgin Islands Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson with US Legal Forms. There are many professional and express-distinct forms you can use to your business or personal requires.