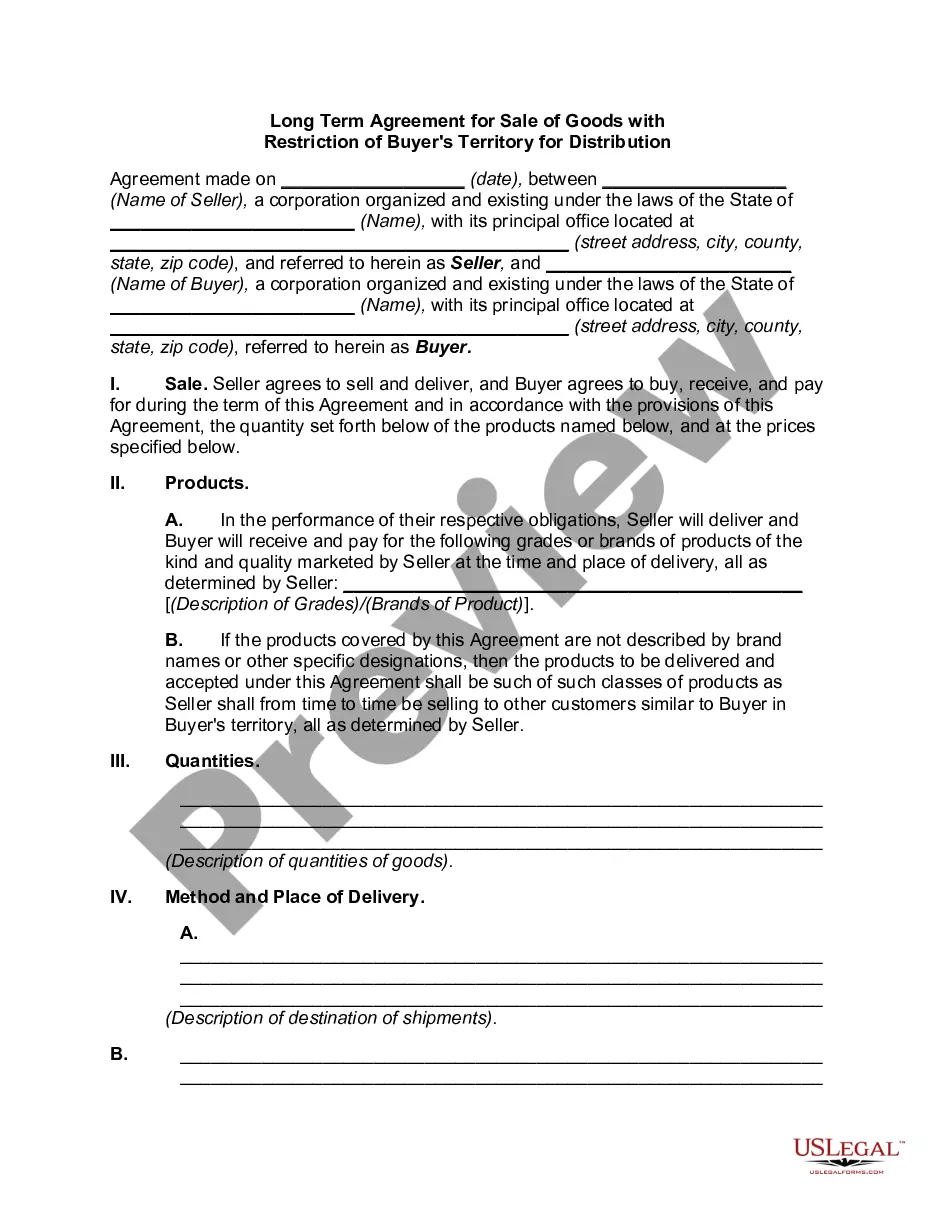

The Virgin Islands Registration Rights Agreement is a legally binding document that outlines the rights and obligations of Visible Genetics, Inc. and the purchasers of common shares in the company. This agreement is specifically applicable in the Virgin Islands jurisdiction and ensures the protection of investors' interests. The agreement encompasses various provisions that grant certain registration rights to the purchasers of common shares. These rights guarantee the ability to register their shares with the relevant regulatory authorities. By registering their shares, investors can freely trade them in the public market, providing liquidity and potential returns on their investment. One of the primary objectives of the Virgin Islands Registration Rights Agreement is to facilitate transparency and disclosure in the market. It requires Visible Genetics, Inc. to provide the purchasers with timely and accurate information about the company's financial status, operations, and any material changes that may impact the value of the shares. The agreement may also include restrictions on the sale of shares by the purchasers. These restrictions aim to prevent any market disruption or abrupt sell-offs that could negatively affect the company's stock price. However, the exact nature and duration of these restrictions may vary depending on the specific type of agreement. There are several types of Virgin Islands Registration Rights Agreements that may exist between Visible Genetics, Inc. and the purchasers of common shares. These can include: 1. Standard Registration Rights Agreement: This type of agreement outlines the basic registration rights granted to the purchasers. It typically establishes a specified timeline within which Visible Genetics, Inc. must file a registration statement with the regulatory authorities. 2. Demand Registration Rights Agreement: This agreement grants the purchasers the right to demand that Visible Genetics, Inc. register their shares with the regulatory authorities. The company is obligated to comply with such demands within a specified timeframe. 3. Piggyback Registration Rights Agreement: A piggyback registration right allows the purchasers to include their shares in a registration statement filed by Visible Genetics, Inc. This provision enables them to take advantage of any potential public offering or sale of securities by the company. 4. S-3 Shelf Registration Rights Agreement: This agreement pertains to purchasers who meet certain eligibility criteria, such as being a large shareholder or institutional investor. It allows them to have their shares registered on a Form S-3, which streamlines the registration process. In conclusion, the Virgin Islands Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares is a crucial legal document that safeguards the interests of investors in the company. It grants registration rights, promotes transparency, and may include restrictions on share sales. The exact type of agreement may vary, encompassing standard, demand, piggyback, or S-3 shelf registration rights.

Virgin Islands Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company

Description

How to fill out Virgin Islands Registration Rights Agreement Between Visible Genetics, Inc. And The Purchasers Of Common Shares Of The Company?

US Legal Forms - one of several largest libraries of authorized types in the States - delivers a wide array of authorized record templates you can down load or print. While using web site, you can get 1000s of types for business and person uses, sorted by types, says, or search phrases.You will discover the most recent versions of types much like the Virgin Islands Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company within minutes.

If you already possess a monthly subscription, log in and down load Virgin Islands Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company from the US Legal Forms local library. The Down load option can look on each kind you view. You gain access to all formerly acquired types inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms the very first time, listed below are straightforward recommendations to get you started out:

- Make sure you have chosen the best kind to your city/area. Go through the Preview option to examine the form`s content material. Browse the kind description to actually have selected the right kind.

- If the kind does not match your needs, make use of the Look for field on top of the screen to get the one which does.

- Should you be content with the form, confirm your choice by clicking on the Acquire now option. Then, select the prices plan you want and give your qualifications to sign up to have an bank account.

- Method the purchase. Utilize your Visa or Mastercard or PayPal bank account to finish the purchase.

- Select the format and down load the form on the gadget.

- Make adjustments. Fill up, change and print and indication the acquired Virgin Islands Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company.

Each and every format you added to your bank account does not have an expiry day and it is yours permanently. So, if you want to down load or print yet another copy, just check out the My Forms section and click in the kind you will need.

Gain access to the Virgin Islands Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company with US Legal Forms, one of the most extensive local library of authorized record templates. Use 1000s of skilled and state-certain templates that meet your business or person needs and needs.