A Virgin Islands Employee Retirement Agreement is a legal document that outlines the terms and conditions of retirement for employees working in the U.S. Virgin Islands. This agreement serves as a binding contract between the employer and the employee, establishing the rights, benefits, and obligations related to retirement. The Virgin Islands Employee Retirement Agreement typically entails various provisions such as the eligibility criteria for retirement, the calculation method for retirement benefits, and the retirement age. It outlines the specific benefits and compensations an employee is entitled to receive upon retirement, including pension plans, 401(k) plans, and other retirement savings plans. Apart from the general retirement agreement, there may be different types of agreements available for employees in the Virgin Islands. Some common types include: 1. Defined Benefit Plan: This type of retirement agreement guarantees a specific payout amount based on factors such as salary history, years of service, and age at retirement. The employer bears the investment risk and is responsible for managing and funding the plan. 2. Defined Contribution Plan: In this type of agreement, both the employer and the employee contribute to a retirement account. The final retirement benefit depends on factors such as the amount contributed, investment returns, and market performance. Common examples of defined contribution plans include 401(k) plans and Individual Retirement Accounts (IRAs). 3. Cash Balance Plan: A cash balance plan is a hybrid form of retirement agreement that combines features of both defined benefit and defined contribution plans. It provides employees with a specified account balance that grows based on employer contributions, interest credits, and investment returns. The Virgin Islands Employee Retirement Agreement also includes essential clauses related to vesting schedules, early retirement options, survivor benefits, and rules for distribution of retirement funds. It may establish conditions and penalties for early withdrawal or early retirement, as well as protocols for dispute resolution. To ensure the legality and effectiveness of the Virgin Islands Employee Retirement Agreement, it is advisable for both employers and employees to consult with legal professionals familiar with the Virgin Islands retirement laws. This will help ensure compliance with applicable regulations and the protection of the rights and interests of both parties involved.

Virgin Islands Employee Retirement Agreement

Description

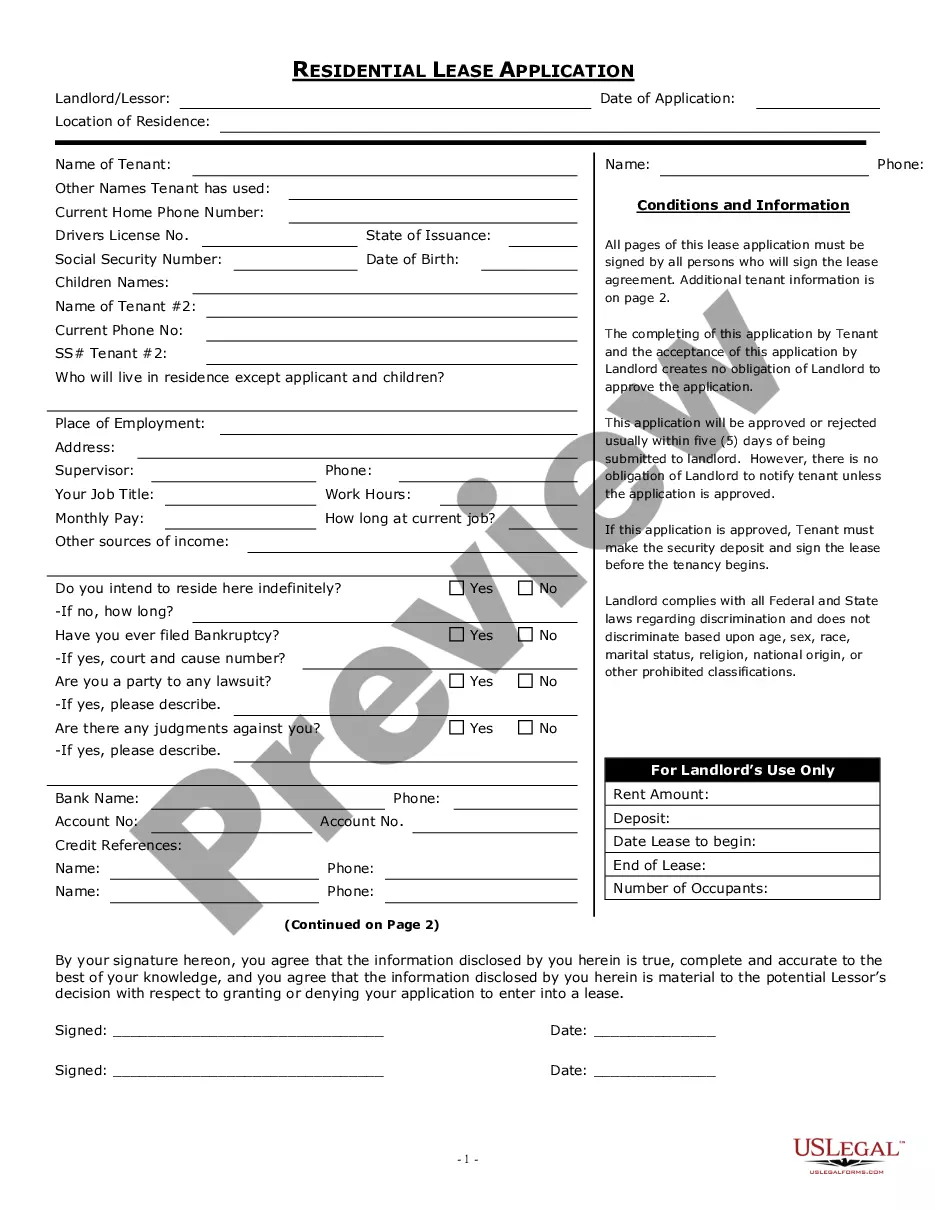

How to fill out Virgin Islands Employee Retirement Agreement?

US Legal Forms - one of the largest libraries of authorized varieties in the States - provides a variety of authorized document web templates you may down load or print out. Using the internet site, you can find 1000s of varieties for organization and specific functions, categorized by types, suggests, or keywords.You can find the most up-to-date variations of varieties such as the Virgin Islands Employee Retirement Agreement within minutes.

If you already have a registration, log in and down load Virgin Islands Employee Retirement Agreement from the US Legal Forms local library. The Down load option will show up on each kind you see. You have accessibility to all earlier downloaded varieties from the My Forms tab of your respective account.

If you want to use US Legal Forms the very first time, allow me to share easy guidelines to get you started off:

- Be sure you have picked the right kind for the metropolis/county. Go through the Preview option to analyze the form`s articles. Read the kind outline to ensure that you have chosen the correct kind.

- When the kind does not fit your demands, use the Lookup discipline near the top of the display screen to obtain the one which does.

- In case you are satisfied with the shape, confirm your decision by simply clicking the Buy now option. Then, choose the pricing strategy you prefer and provide your references to sign up for the account.

- Method the deal. Make use of your credit card or PayPal account to complete the deal.

- Pick the format and down load the shape on your product.

- Make alterations. Fill out, change and print out and indicator the downloaded Virgin Islands Employee Retirement Agreement.

Every web template you added to your account lacks an expiry date and is also the one you have eternally. So, if you wish to down load or print out an additional backup, just check out the My Forms segment and click on about the kind you need.

Obtain access to the Virgin Islands Employee Retirement Agreement with US Legal Forms, by far the most comprehensive local library of authorized document web templates. Use 1000s of skilled and state-certain web templates that meet your organization or specific requires and demands.

Form popularity

FAQ

Join a peer support group. Some senior service and other community organizations offer support groups for older adults making the transition into retirement. Talking to other people who understand what you're going through can help reduce feelings of stress, anxiety, and isolation.

Here are eight tips to help soon-to-be-retiring employees make a smooth exit. Avoid knowledge silos. ... Don't undervalue older workers. ... Cross-train employees. ... Consider alternatives to full retirement. ... Plan succession across all departments. ... Manage across generations. ... Make annual assessments. ... Don't wait till they're out the door.

Ready to Go: My research on this topic indicates that when it comes to retirement, three to six months advance notice has been considered standard, although given your perception of the company's attitude toward you, as well as your attitude toward the company, in my view three months seems generous.

The Retirement Age Act increased the compulsory retirement age from 60 to 65 years of age.

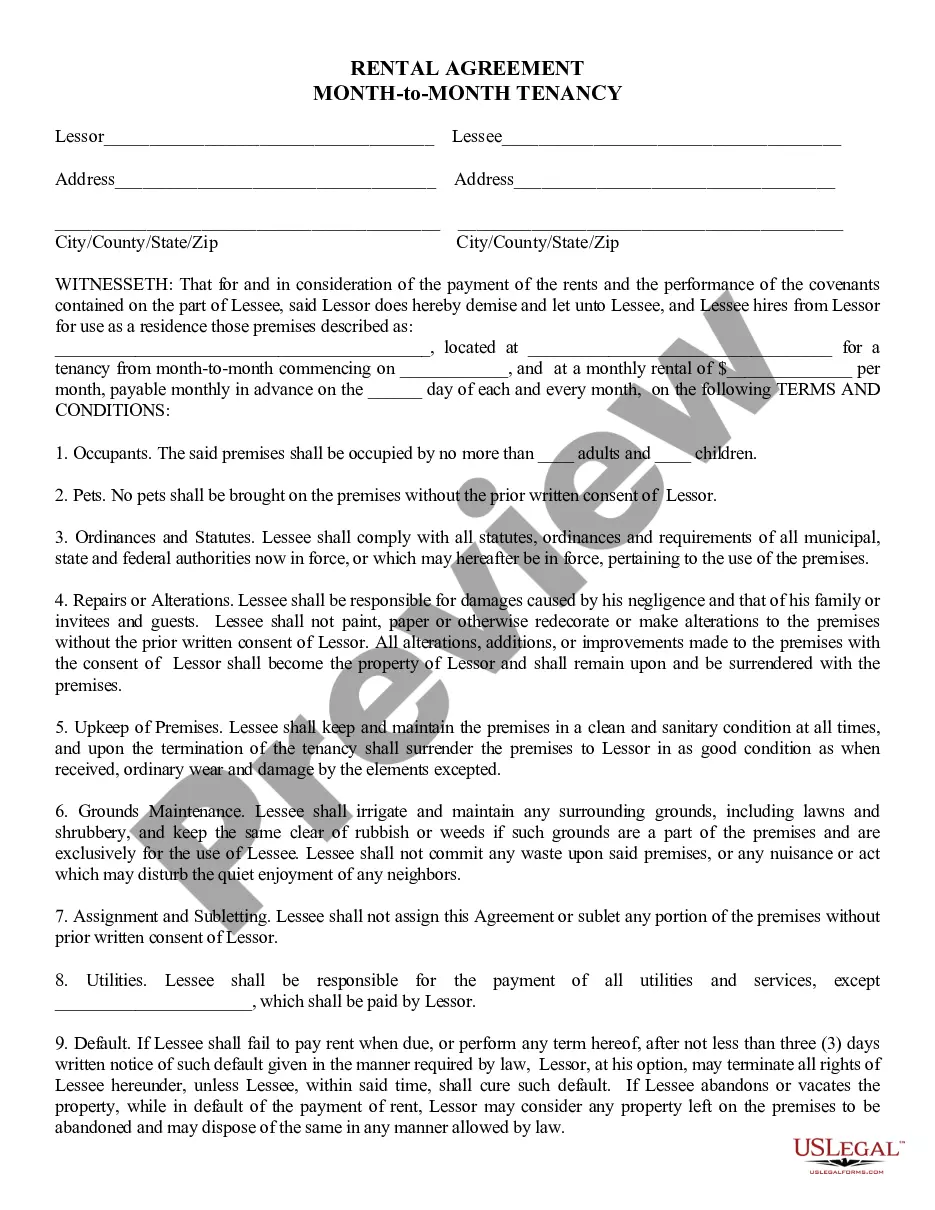

A retirement agreement is a contract that outlines the terms of an employee's retirement from service, typically after they have fulfilled their agreed-upon tenure with the company. Retirement agreements are usually signed by both parties to confirm that they agree with the terms outlined.

The employee's version was that with effect from his amendments to the employment contract in 2012 his retirement age became 65. A few years later in 2018, the SITA board passed a resolution that all employees would be subject to a retirement age of 60 if they joined the employer after 1999.

4?? Can an employer suggest to an older employee that they resign from their job? There is a line that an employer can't cross. An employer can ask if an employee plans to retire, but they cannot push an employee out, suggest that they retire, or tell them they don't belong anymore.

Here are eight tips to help soon-to-be-retiring employees make a smooth exit. Avoid knowledge silos. ... Don't undervalue older workers. ... Cross-train employees. ... Consider alternatives to full retirement. ... Plan succession across all departments. ... Manage across generations. ... Make annual assessments. ... Don't wait till they're out the door.