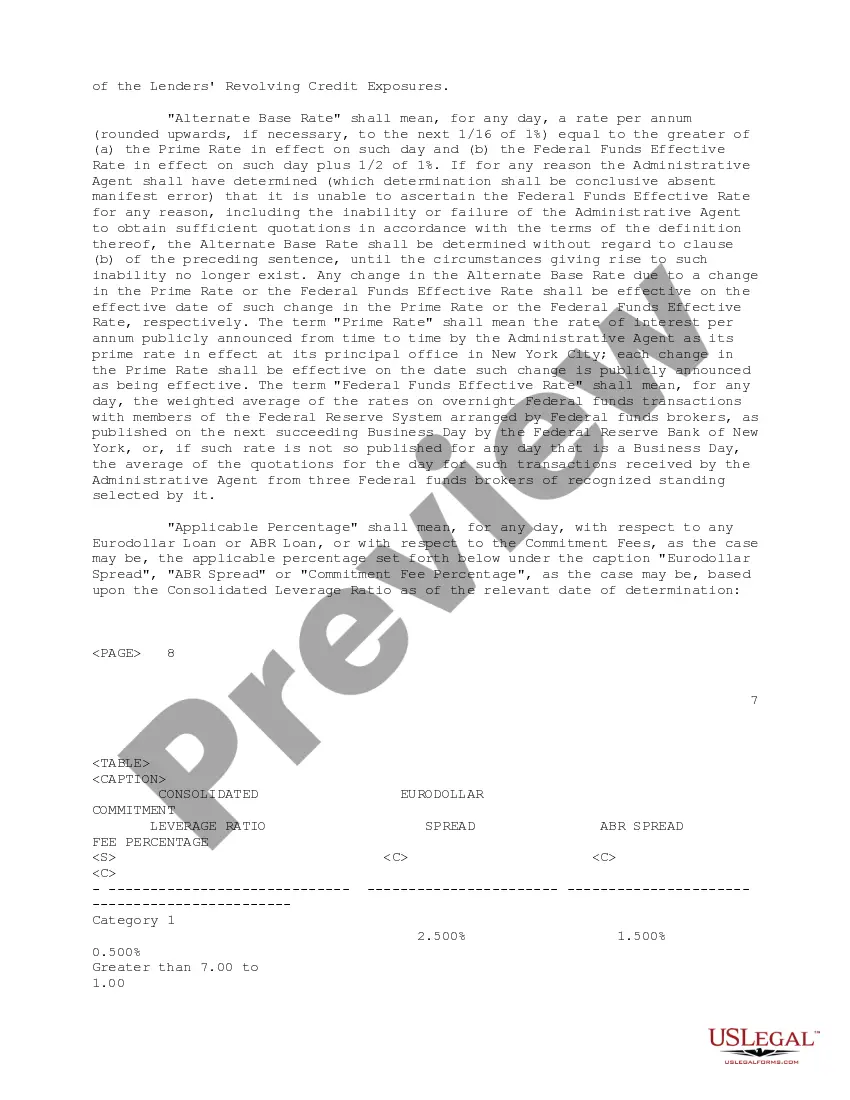

The Virgin Islands Credit Agreement is a legally binding contract that outlines the terms and conditions for extending credit to individuals or entities in the Virgin Islands. It establishes the rights and responsibilities of both the creditor and the borrower, ensuring a clear understanding of the obligations and expectations. Under this agreement, the creditor agrees to provide a certain amount of credit to the borrower, while the borrower agrees to repay the borrowed amount along with applicable interest and fees within a specified time frame. This agreement serves as a crucial tool in regulating credit transactions and promoting financial stability in the Virgin Islands. Key terms and clauses commonly found in the Virgin Islands Credit Agreement may include: 1. Loan Amount: Specifies the maximum amount of credit extended to the borrower. 2. Interest Rate: Determines the percentage of interest applied to the outstanding balance, often calculated on an annual basis. 3. Repayment Terms: Outlines the repayment schedule, including the frequency of payments and the due dates. 4. Late Payment Charges: Specifies the penalties or fees incurred if the borrower fails to make payments on time. 5. Default Clause: Defines the conditions under which the creditor can declare the borrower in default, triggering further legal actions. 6. Collateral: Identifies any assets that the borrower pledges as security for the credit provided. 7. Governing Law: Determines the jurisdiction and laws that will apply to the agreement in case of disputes or legal actions. Different types of Virgin Islands Credit Agreements may vary based on their specific purposes or target borrowers. Some notable variants include: 1. Personal Credit Agreement: Designed for individuals seeking personal credit for various purposes such as education, home renovations, or debt consolidation. 2. Business Credit Agreement: Tailored for businesses or entrepreneurs in need of credit to operate, expand, or invest in their ventures. 3. Mortgage Credit Agreement: Specifically intended for financing real estate purchases or property development projects. 4. Credit Card Agreement: Pertaining to the terms and conditions associated with credit card usage, including credit limits, interest rates, and payment requirements. In conclusion, the Virgin Islands Credit Agreement is a vital legal instrument that governs credit extension in the Virgin Islands. It ensures transparency, clarity, and fairness to all parties involved while safeguarding the financial integrity of both borrowers and creditors. By understanding and abiding by the terms set forth in the agreement, individuals and businesses can access credit facilities to meet their financial goals effectively.

Virgin Islands Credit Agreement regarding extension of credit

Description

How to fill out Virgin Islands Credit Agreement Regarding Extension Of Credit?

Finding the right legitimate papers web template could be a have a problem. Of course, there are tons of themes available online, but how will you obtain the legitimate form you require? Make use of the US Legal Forms internet site. The support offers a huge number of themes, for example the Virgin Islands Credit Agreement regarding extension of credit, that you can use for enterprise and personal requirements. All of the varieties are checked out by specialists and fulfill federal and state needs.

Should you be presently registered, log in to the profile and click the Download option to get the Virgin Islands Credit Agreement regarding extension of credit. Use your profile to look from the legitimate varieties you may have bought formerly. Go to the My Forms tab of the profile and have an additional duplicate of your papers you require.

Should you be a whole new customer of US Legal Forms, here are easy recommendations that you can comply with:

- Very first, be sure you have selected the appropriate form for your personal city/state. You may look over the form utilizing the Preview option and browse the form explanation to ensure it is the right one for you.

- In case the form does not fulfill your preferences, use the Seach area to discover the correct form.

- When you are certain the form is suitable, select the Purchase now option to get the form.

- Pick the prices plan you would like and enter in the required info. Build your profile and pay for the transaction using your PayPal profile or bank card.

- Choose the file formatting and download the legitimate papers web template to the product.

- Full, modify and print out and sign the attained Virgin Islands Credit Agreement regarding extension of credit.

US Legal Forms is the biggest local library of legitimate varieties where you can see different papers themes. Make use of the service to download skillfully-produced files that comply with status needs.

Form popularity

FAQ

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

A credit agreement can be (i) a credit facility; (ii) a credit transaction; (iii) a credit guarantee; or (iv) an incidental credit agreement. Below, each of these types of credit agreement is defined and illustrated with examples.

Section 61 of the Consumer Credit Act. Section 61 of the Consumer Credit Act stipulates that a credit agreement is not properly executed unless it contains all the prescribed terms and conforms to regulations made under section 60(1) of the Act, and is signed in the prescribed manner.

A credit agreement is a legally binding agreement entered into between a lender and a borrower. It outlines all of the terms of the borrowing relationship, such as the interest rate, costs of originating the loan, and other borrower and lender rights and obligations.

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

A credit agreement is a legally binding contract between two parties in which a loan is offered. These agreements detail all the conditions of the loan and the repayment process and are signed by both the Lender and the Borrower. Credit agreements are also often referred to as loan agreements.

The core elements include: Parties, Permitted Loan Amount, Payment, Interest Rate, Maturity Date, Default, Security Interest, Collateral, Warranties, Termination and Survival.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.