Virgin Islands Investment Intent Letter and Appointment of the Representative Agreement are important legal documents related to the ownership and transfer of common stock in the Virgin Islands. These documents outline the intentions of an investor and provide a framework for appointing a representative to manage and oversee the shares. The Investment Intent Letter serves as a formal statement of an individual or entity's intention to invest in issued shares of common stock in the Virgin Islands. It acts as a legally binding commitment from the investor to purchase a specified number of shares at an agreed-upon price. This letter outlines the key details of the investment, such as the number of shares, the purchase price, and any conditions or prerequisites that need to be met for the investment to proceed. The Appointment of the Representative Agreement, on the other hand, establishes the role and responsibilities of a representative appointed by the investor to act on their behalf in managing the issued shares of common stock. This agreement specifies the rights and powers granted to the representative, including the ability to make decisions regarding voting, dividends, and other matters related to the shares. It also outlines the obligations and fiduciary duties of the representative to act in the best interests of the investor when dealing with the shares. In the Virgin Islands, there may be different types or variations of these documents, depending on the specific circumstances and requirements of the parties involved. Some variations could include: 1. Virgin Islands Investment Intent Letter for Restricted Shares of Common Stock: This type of letter may be used when an investor intends to invest in restricted shares, which are subject to certain limitations on transferability or resale. 2. Virgin Islands Investment Intent Letter for Newly Issued Shares of Common Stock: This variation may be used when an investor intends to invest in recently issued shares of common stock, such as during an initial public offering (IPO) or a private placement. 3. Virgin Islands Investment Intent Letter and Appointment of the Representative Agreement for Multiple Investors: This type of agreement may be utilized in cases where multiple investors are pooling their resources to collectively invest in issued shares of common stock in the Virgin Islands. It would outline the collective investment intentions and appoint a representative or representatives to act on behalf of the group. These are just a few examples of the potential variations of Virgin Islands Investment Intent Letters and Appointment of the Representative Agreements regarding issued shares of common stock. The specific type of document required would depend on the unique circumstances and objectives of the parties involved in the investment transaction.

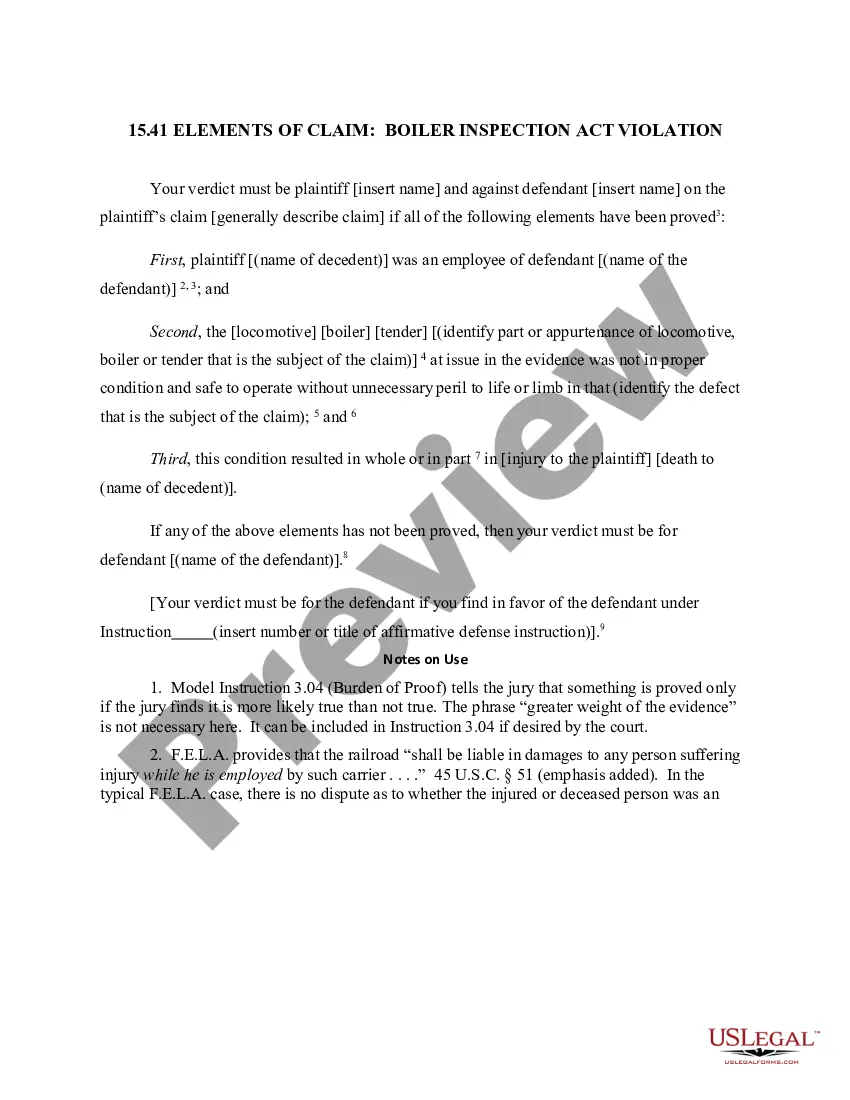

Virgin Islands Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock

Description

How to fill out Virgin Islands Investment Intent Letter And Appointment Of The Representative Agreement Regarding Issued Shares Of Common Stock?

US Legal Forms - one of many biggest libraries of authorized varieties in America - gives an array of authorized record templates you can acquire or print. Using the site, you can find a large number of varieties for enterprise and person uses, categorized by types, says, or search phrases.You can get the most recent variations of varieties such as the Virgin Islands Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock in seconds.

If you already possess a monthly subscription, log in and acquire Virgin Islands Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock through the US Legal Forms collection. The Acquire button will appear on every single form you view. You gain access to all earlier saved varieties within the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, allow me to share simple guidelines to obtain began:

- Ensure you have picked out the right form for your area/region. Click on the Review button to check the form`s content. See the form information to ensure that you have chosen the correct form.

- When the form doesn`t suit your needs, take advantage of the Research area near the top of the screen to discover the one which does.

- In case you are happy with the form, validate your decision by clicking on the Buy now button. Then, opt for the costs prepare you prefer and provide your references to register for the profile.

- Process the deal. Make use of your credit card or PayPal profile to finish the deal.

- Pick the format and acquire the form in your system.

- Make changes. Fill out, revise and print and sign the saved Virgin Islands Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock.

Each and every format you added to your bank account lacks an expiry date and it is the one you have eternally. So, if you wish to acquire or print yet another version, just go to the My Forms segment and click around the form you need.

Get access to the Virgin Islands Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock with US Legal Forms, probably the most comprehensive collection of authorized record templates. Use a large number of professional and state-particular templates that fulfill your organization or person requires and needs.

Form popularity

FAQ

A letter of intent is a document between two businesses that declares a preliminary commitment to doing business. The letter of intent should outline the terms of any future agreement and can be used to record negotiations and discussions.

Its purpose is to establish the main terms of a proposed transaction before executing a Purchase of Business Agreement. Shares in a business: A Letter of Intent to purchase or sell shares can help you outline and negotiate the main terms of a proposed transaction before creating a Share Purchase Agreement.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

The Letter of Intent to sell a business should contain a breakdown of intended timelines. It should specify proposed dates for closing and may also outline details such as options on real property and when those expire. The LOI should also clearly outline the seller's obligations post-sale.

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

Writing an investment contract can be simplified by examining related samples and including all the content listed below: The names and addresses of interested parties. The general investment structure. Purpose of the investment. Effective date agreed upon. Signatures by both/all parties.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

Despite having no binding effect in the law, a letter of intent is one of the most important agreements a seller of business shares will sign. It establishes the price and core terms of the deal and morally obligates the buyer to proceed with the transaction in good faith.