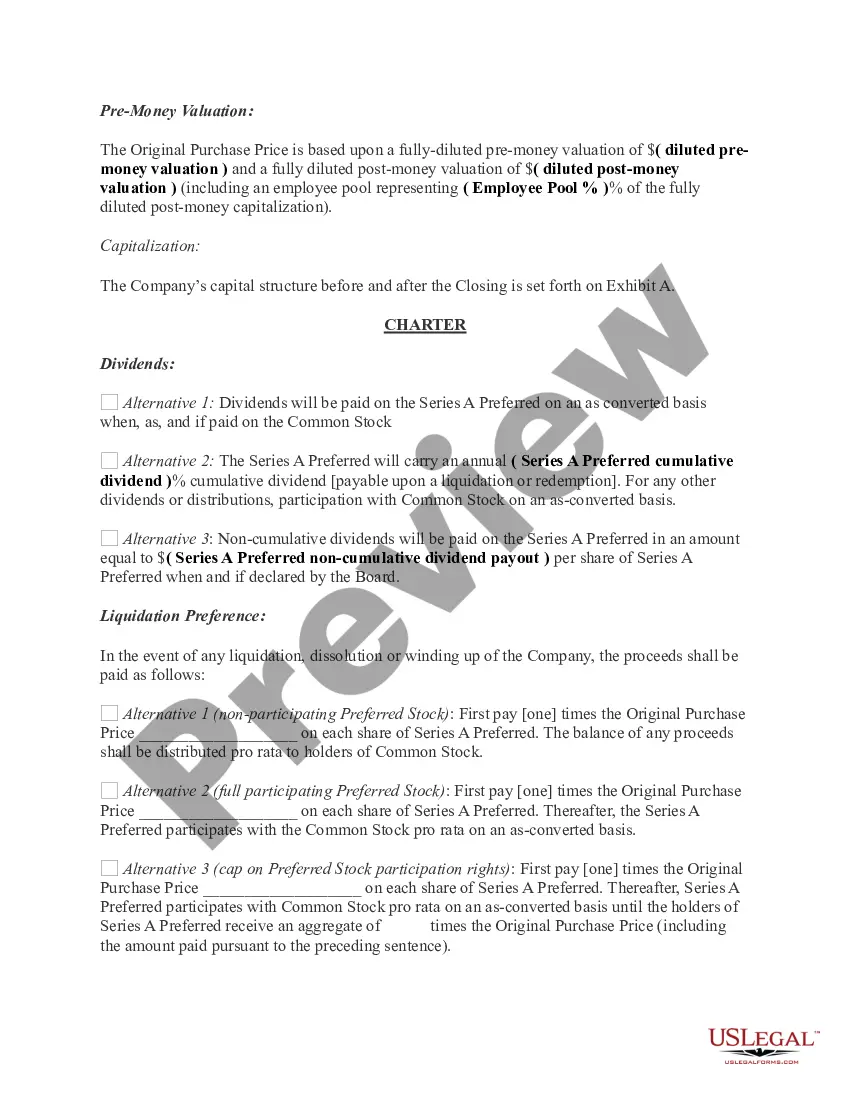

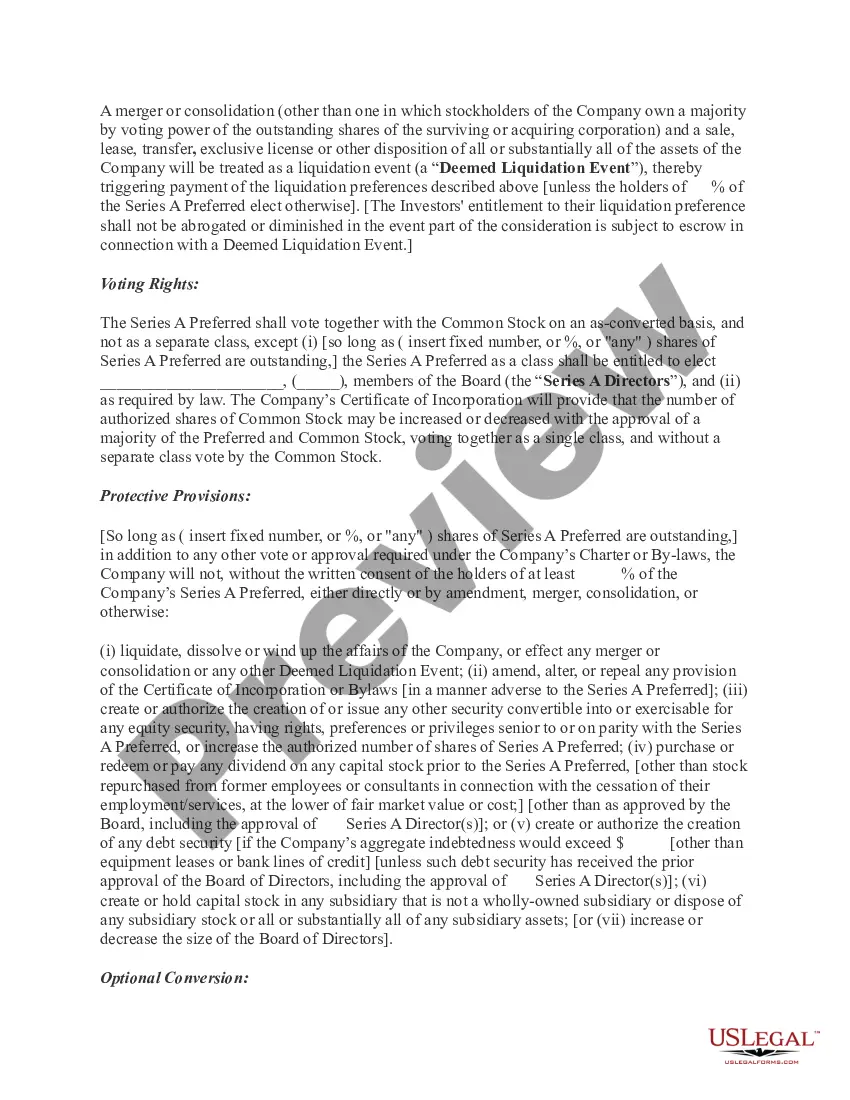

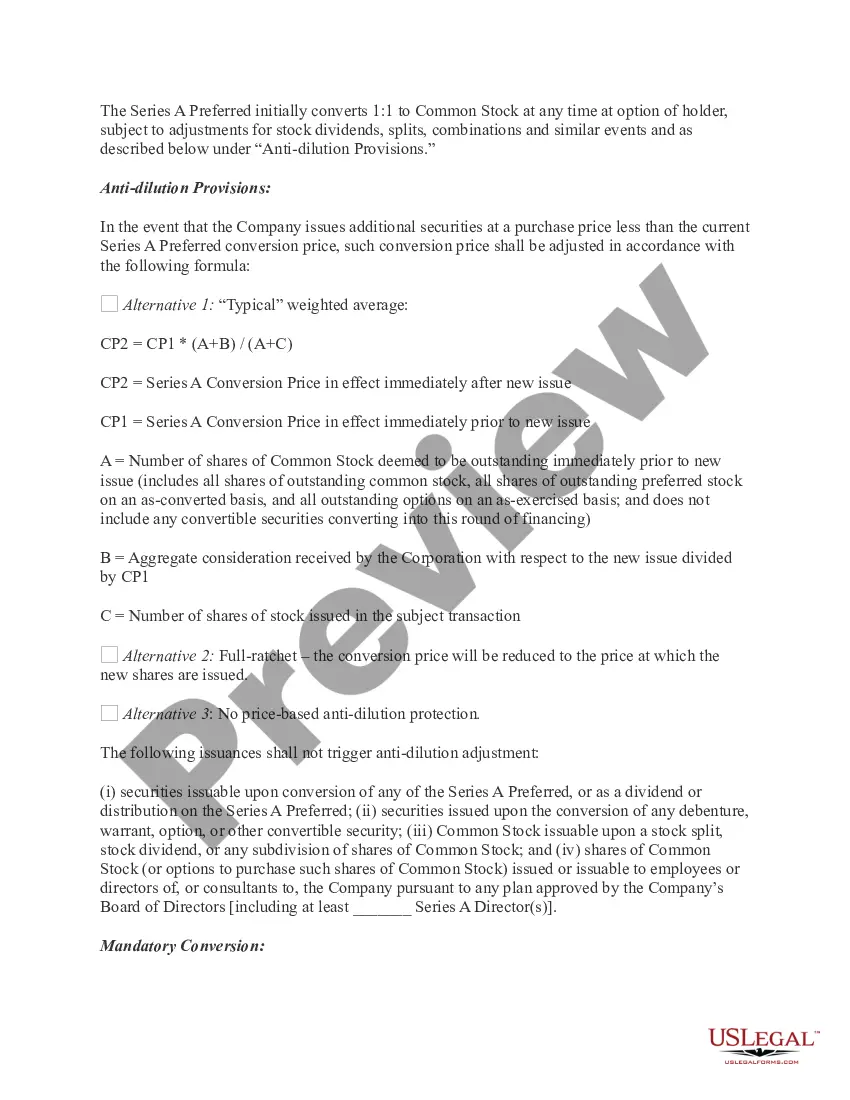

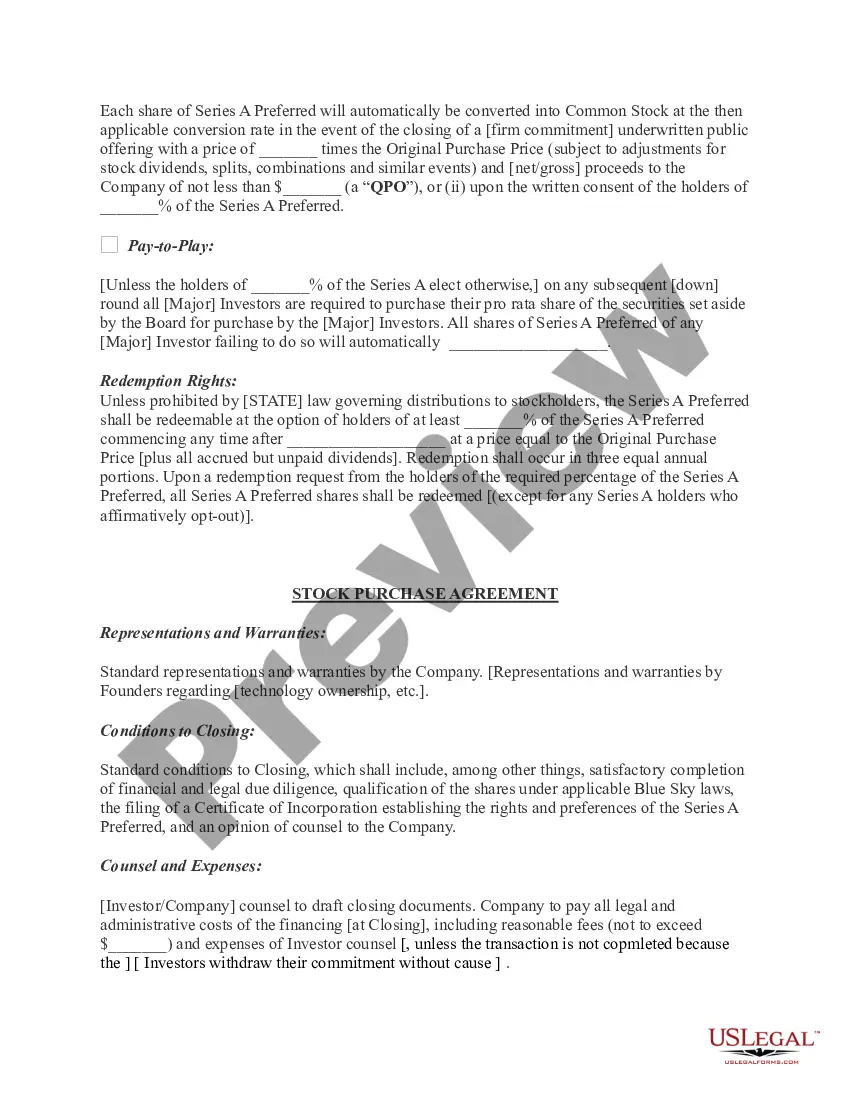

A Virgin Islands Term Sheet — Series A Preferred Stock Financing is a legally binding document that outlines the key terms and conditions of an investment agreement between a company seeking capital and potential investors. This term sheet specifically refers to the preferred stock financing arrangements in the United States Virgin Islands. This financing option is typically pursued by startups or early-stage companies looking to raise funds for growth and expansion. The term sheet provides a comprehensive overview of the terms and expectations associated with the financing round. It serves as a starting point for negotiation and allows both parties to evaluate whether they are aligned on key aspects of the investment. Here are some essential elements often covered in a Virgin Islands Term Sheet — Series A Preferred Stock Financing: 1. Equity Investment: This section outlines the investment amount or investment cap, specifying the desired ownership percentage or number of shares the investor intends to acquire in exchange for their investment. 2. Preferred Stock Rights: It details the rights and preferences associated with the preferred stock, which typically include priority in liquidation proceeds, voting power, anti-dilution protection, conversion rights, dividend preferences, and participation rights. These terms ensure that preferred stockholders receive certain privileges and protections over common stockholders. 3. Valuation: The term sheet specifies the pre-money valuation of the company, which determines the per-share price of the preferred stock. This valuation is often based on the company's financial performance, market potential, intellectual property, and future growth prospects. 4. Liquidation Preferences: It outlines the order in which investors will receive their investment back in the event of a sale or liquidation of the company. Liquidation preferences typically prioritize preferred stockholders to common stockholders, ensuring they recoup their investment before other shareholders. 5. Anti-Dilution Protection: This provision protects investors from dilution of their ownership stake if the company later issues stock at a lower price than what the investor initially paid. The term sheet may specify the type of anti-dilution protection, such as full-ratchet or weighted average, which determines the adjustment to the conversion price of the preferred stock. 6. Board Seat and Control: If the investment amount is significant, the investor may negotiate the right to appoint a representative to the company's board of directors or obtain certain governance rights. This section defines the extent of the investor's control and involvement in the major decision-making processes of the company. 7. Exit Strategy: The term sheet may also touch upon the preferred exit strategy for the investors, such as the company's timeline for an initial public offering (IPO), acquisition, or other liquidity events that allow investors to cash out their investment. While the general structure of a Virgin Islands Term Sheet — Series A Preferred Stock Financing remains similar, variations may arise depending on the specific requirements and preferences of the parties involved. It is crucial for both the company and investors to carefully review and negotiate the terms to ensure they are mutually beneficial.

Virgin Islands Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Virgin Islands Term Sheet - Series A Preferred Stock Financing Of A Company?

Have you been within a position that you need to have documents for sometimes organization or person functions almost every time? There are plenty of authorized document layouts available online, but finding versions you can depend on isn`t effortless. US Legal Forms gives a huge number of develop layouts, much like the Virgin Islands Term Sheet - Series A Preferred Stock Financing of a Company, which can be published to satisfy federal and state requirements.

When you are presently informed about US Legal Forms web site and possess a free account, just log in. Following that, you are able to download the Virgin Islands Term Sheet - Series A Preferred Stock Financing of a Company design.

If you do not provide an profile and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you need and ensure it is for that correct area/area.

- Utilize the Preview button to check the shape.

- See the explanation to actually have chosen the right develop.

- When the develop isn`t what you are seeking, make use of the Research area to discover the develop that meets your needs and requirements.

- Once you obtain the correct develop, simply click Acquire now.

- Select the pricing program you would like, submit the necessary information to generate your account, and purchase the transaction using your PayPal or Visa or Mastercard.

- Decide on a hassle-free file file format and download your backup.

Find every one of the document layouts you have bought in the My Forms menu. You may get a additional backup of Virgin Islands Term Sheet - Series A Preferred Stock Financing of a Company at any time, if possible. Just select the essential develop to download or produce the document design.

Use US Legal Forms, by far the most considerable variety of authorized kinds, to save lots of time as well as steer clear of errors. The services gives skillfully produced authorized document layouts that you can use for a selection of functions. Generate a free account on US Legal Forms and commence making your life easier.