Content: The Virgin Islands Term Sheet — Simple Agreement for Future Equity (SAFE) is a legal document commonly used in the startup world to facilitate investments. It outlines the terms and conditions of an investment agreement between a startup company and an investor. The purpose of this document is to provide a framework for future equity investment in the company, allowing both parties to agree on certain key terms before finalizing a more comprehensive investment agreement. There are different types of the Virgin Islands Term Sheet — Simple Agreement for Future Equity (SAFE) that can be employed, each tailored to meet specific requirements and preferences. Let's explore a few of these variations: 1. Standard SAFE: This is the most common type of SAFE used in startup investments. It includes provisions such as the valuation cap, discount rate, and details regarding the conversion of the SAFE into equity in the future funding round. 2. Valuation Cap SAFE: In this variation, the investor agrees to place a cap on the valuation of the company at the time of conversion into equity. This cap ensures that the investor receives a maximum ownership percentage, protecting them from excessive dilution in subsequent funding rounds. 3. Discount SAFE: The Discount SAFE offers investors the advantage of purchasing shares at a discounted price during the conversion. This allows them to acquire a larger stake in the company compared to other investors participating in the same funding round. 4. Most Favored Nation (MFN) SAFE: With an MFN SAFE, the investor is granted the right to benefit from any more favorable terms offered to subsequent investors in the company. This means that if the company offers better terms to future investors, the original investor will automatically receive those enhanced terms as well. 5. Equity Kicker SAFE: This type of SAFE grants the investor additional benefits, often in the form of equity or a percentage of the company's revenue. These extra incentives provide the investor with additional potential returns beyond the standard conversion into equity. It is essential for both startups and investors to carefully review and negotiate the terms presented in the Virgin Islands Term Sheet — Simple Agreement for Future Equity (SAFE). Consulting legal professionals with expertise in startup investments is highly recommended ensuring that the agreement aligns with the specific goals and circumstances of both parties. In conclusion, the Virgin Islands Term Sheet — Simple Agreement for Future Equity (SAFE) is a vital document in the startup investment ecosystem. By setting out the preliminary terms and conditions, this agreement helps to streamline the final investment process, enabling startups to secure capital and investors to back promising ventures.

Virgin Islands Term Sheet - Simple Agreement for Future Equity (SAFE)

Description

How to fill out Virgin Islands Term Sheet - Simple Agreement For Future Equity (SAFE)?

Are you presently in the position the place you need documents for either business or specific functions just about every day? There are plenty of lawful file web templates available on the Internet, but discovering kinds you can rely on is not effortless. US Legal Forms offers a huge number of type web templates, such as the Virgin Islands Term Sheet - Simple Agreement for Future Equity (SAFE), that happen to be written in order to meet state and federal needs.

In case you are currently informed about US Legal Forms web site and have an account, just log in. Afterward, you can download the Virgin Islands Term Sheet - Simple Agreement for Future Equity (SAFE) design.

Should you not come with an account and want to begin to use US Legal Forms, follow these steps:

- Find the type you will need and make sure it is for the appropriate town/state.

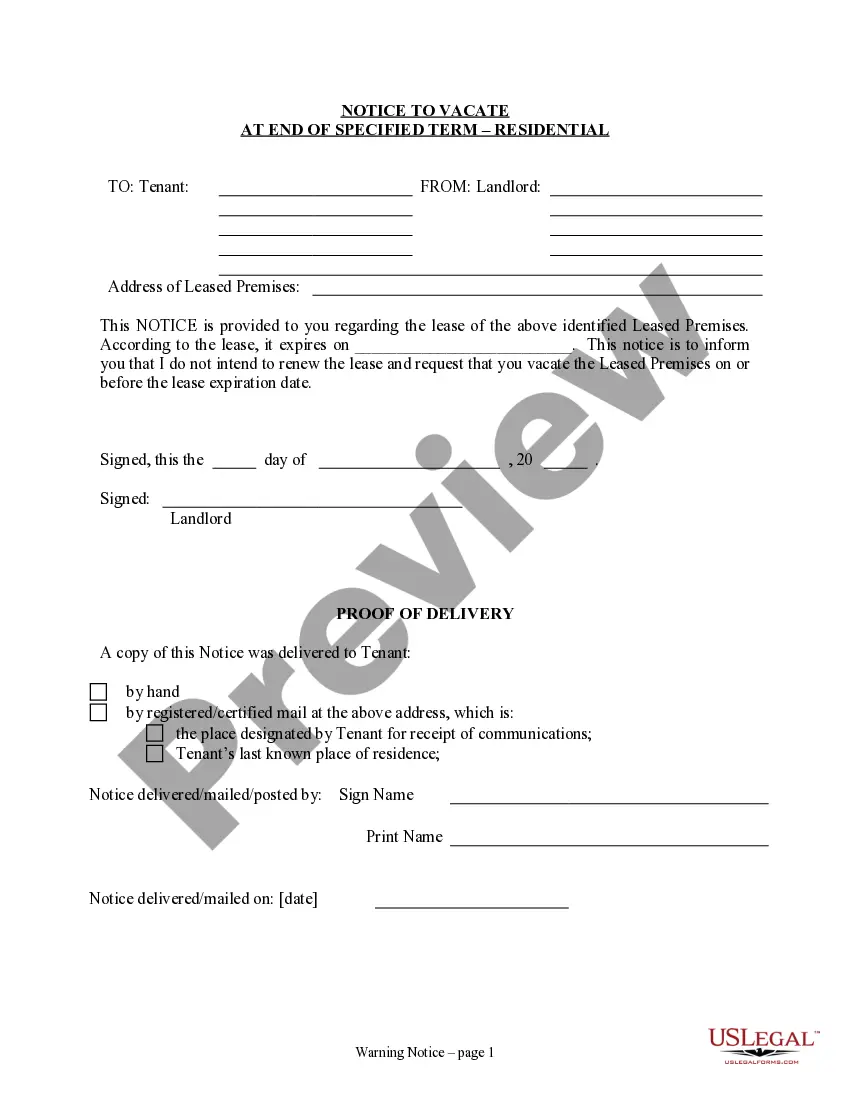

- Take advantage of the Preview key to analyze the form.

- See the information to actually have selected the right type.

- In the event the type is not what you are searching for, take advantage of the Look for field to discover the type that meets your requirements and needs.

- When you get the appropriate type, just click Get now.

- Choose the pricing plan you desire, submit the required information and facts to create your account, and buy the transaction utilizing your PayPal or bank card.

- Choose a practical data file structure and download your version.

Locate all of the file web templates you possess purchased in the My Forms menus. You can aquire a more version of Virgin Islands Term Sheet - Simple Agreement for Future Equity (SAFE) at any time, if required. Just click the necessary type to download or printing the file design.

Use US Legal Forms, probably the most considerable selection of lawful forms, to save lots of time and stay away from mistakes. The services offers professionally created lawful file web templates which you can use for an array of functions. Produce an account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

CREATE A FREE PROJECT POSTING. A SAFE note term sheet is a legal document that aligns early-stage startup funding interests by outlining the key investment agreement terms for entrepreneurs.

FAQs Determine the Term Sheet Agreements' purpose. Summarise the terms and conditions in a few words. List the terms of the offer. Dividends, Liquidation Preference, and Provisions should all be included. Determine your participation rights. Establish a board of directors.

A good example of a safe term sheet is one that gives both parties enough time to negotiate, but not so much time that it becomes an obstacle. This investment instrument allows investors to provide capital to a startup in exchange for the right to receive equity at a later date.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A SAFE note is a security that is going to convert to stock at a future point, usually at a pre-negotiated price cap. Let's look at an example. A person might invest in a SAFE note with a $10 million cap. If the company is bought for $100 million, that's great news.

Suppose a SAFE is issued with a 20% discount. This means if the SAFE investor invested $40,000 in a startup whose price per share at the time of future investment comes out to be $10, he'll get the share at a 20% discounted price, which is $8. This means he'll get 5000 shares instead of 4000.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.