Virgin Islands Masonry Services Contract - Self-Employed

Description

How to fill out Virgin Islands Masonry Services Contract - Self-Employed?

Are you presently within a place in which you need paperwork for possibly organization or individual uses virtually every day? There are a lot of authorized document themes available on the Internet, but discovering versions you can rely on isn`t easy. US Legal Forms delivers a huge number of kind themes, such as the Virgin Islands Masonry Services Contract - Self-Employed, which can be written in order to meet state and federal demands.

Should you be currently acquainted with US Legal Forms site and possess a merchant account, just log in. After that, it is possible to download the Virgin Islands Masonry Services Contract - Self-Employed web template.

If you do not offer an profile and need to begin using US Legal Forms, follow these steps:

- Find the kind you want and ensure it is for that correct town/state.

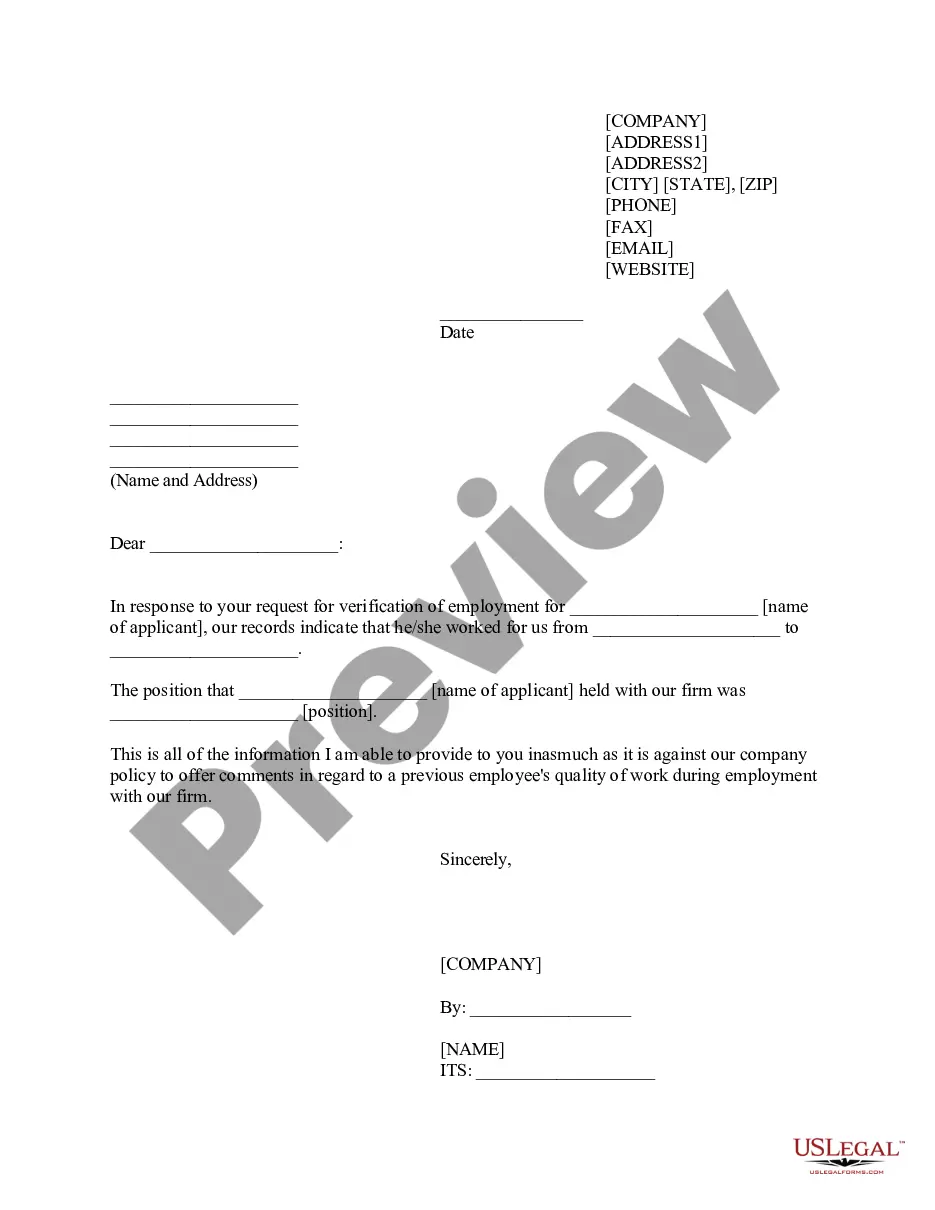

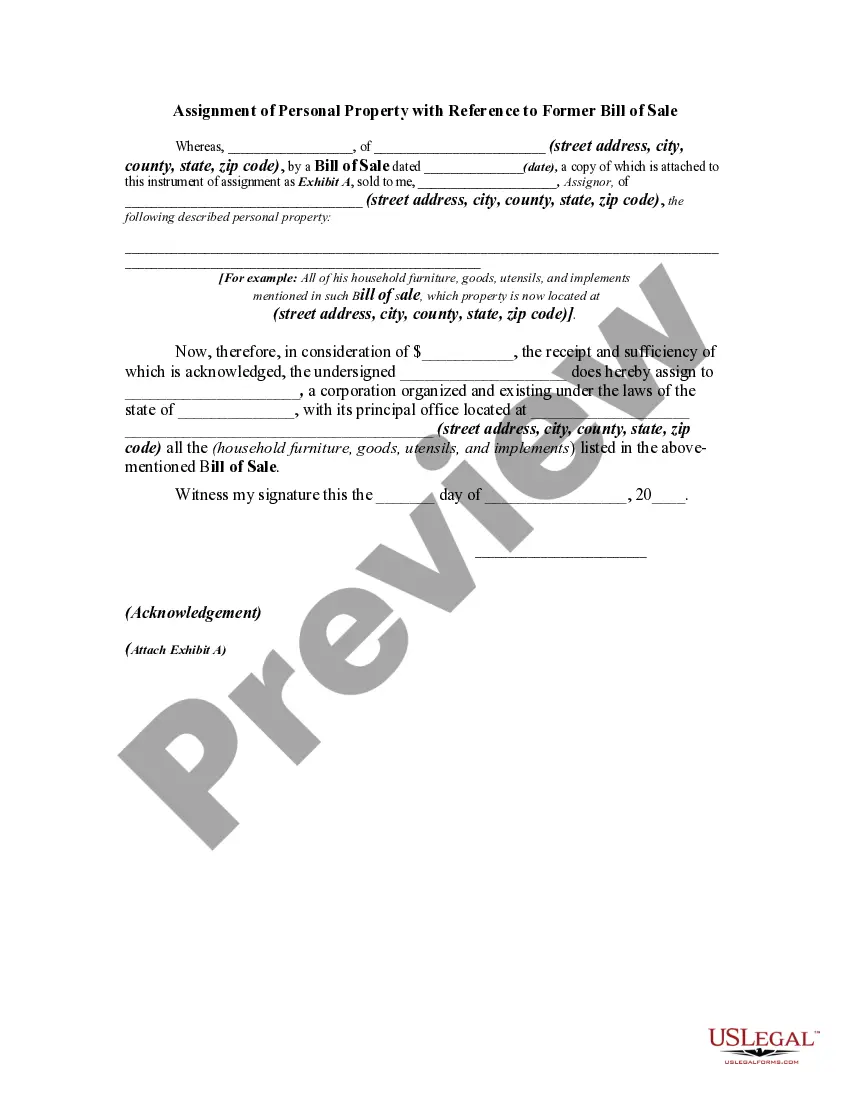

- Make use of the Preview button to review the shape.

- Read the outline to actually have selected the correct kind.

- In case the kind isn`t what you are searching for, utilize the Search discipline to obtain the kind that fits your needs and demands.

- Once you get the correct kind, click Buy now.

- Select the prices prepare you want, complete the desired info to generate your bank account, and buy an order with your PayPal or credit card.

- Decide on a hassle-free document structure and download your duplicate.

Get all of the document themes you may have purchased in the My Forms menu. You can get a more duplicate of Virgin Islands Masonry Services Contract - Self-Employed any time, if necessary. Just go through the needed kind to download or produce the document web template.

Use US Legal Forms, the most extensive selection of authorized kinds, to conserve time and prevent errors. The assistance delivers expertly created authorized document themes that you can use for an array of uses. Produce a merchant account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

Cost plus fixed fee contract In cost plus fixed fee, the owner pays the contractor an agreed amount over and above the documented cost of work. This is a negotiated type of contract where actual and direct costs are paid for and additional fee is given for overhead and profit is normally negotiated among parties.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Whilst a contractor usually belongs to an outside organisation or is self-employed, an employee with a fixed-term contract is hired by an organisation and has all the same rights and benefits as permanent employees, they're just only employed for a specific period of time.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.