Virgin Islands Moving Services Contract - Self-Employed

Description

How to fill out Virgin Islands Moving Services Contract - Self-Employed?

Are you currently in a place that you need documents for sometimes business or specific purposes virtually every time? There are tons of lawful file layouts available on the Internet, but discovering kinds you can depend on isn`t straightforward. US Legal Forms gives a huge number of form layouts, like the Virgin Islands Moving Services Contract - Self-Employed, which can be created to meet state and federal requirements.

When you are already familiar with US Legal Forms internet site and have your account, simply log in. After that, you can download the Virgin Islands Moving Services Contract - Self-Employed web template.

If you do not have an account and wish to begin using US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is to the appropriate area/county.

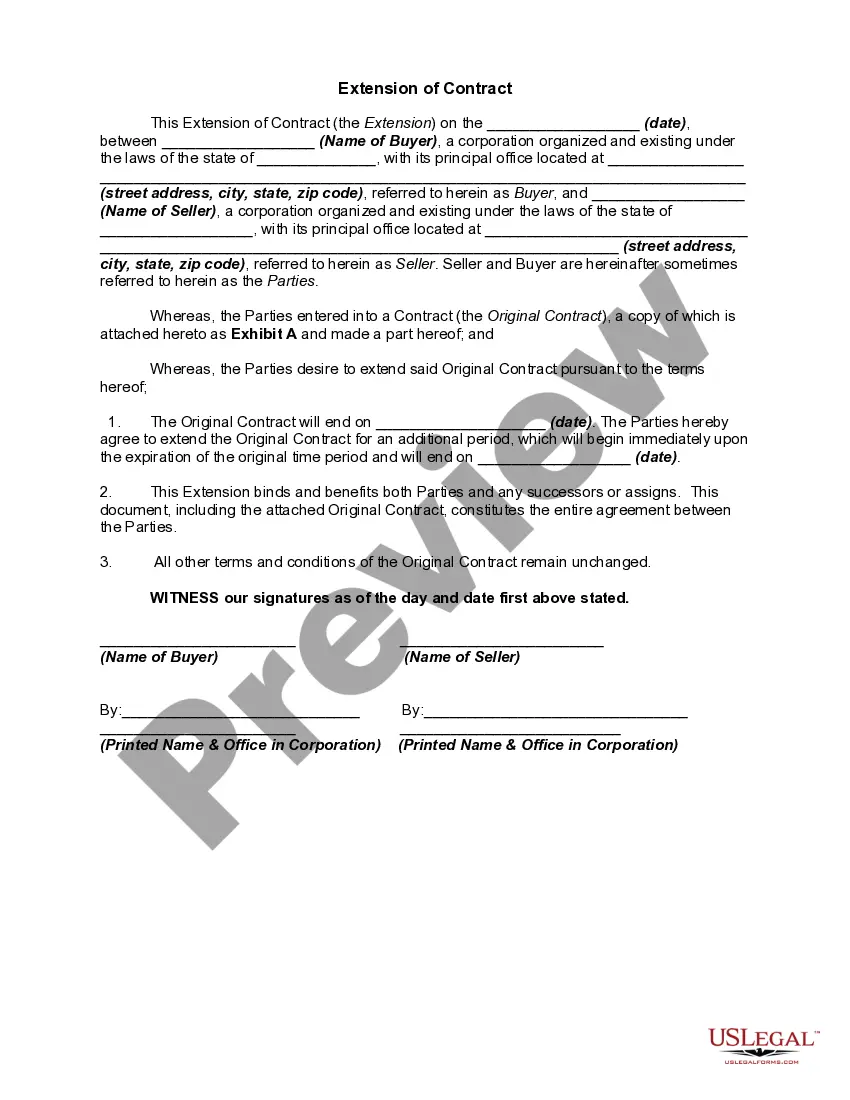

- Utilize the Preview switch to check the shape.

- Look at the outline to ensure that you have selected the right form.

- In case the form isn`t what you are looking for, use the Research field to find the form that meets your needs and requirements.

- If you find the appropriate form, simply click Buy now.

- Opt for the rates plan you need, fill out the required details to make your account, and pay for your order with your PayPal or credit card.

- Decide on a practical file formatting and download your version.

Discover all of the file layouts you might have bought in the My Forms food list. You may get a further version of Virgin Islands Moving Services Contract - Self-Employed at any time, if possible. Just go through the required form to download or print out the file web template.

Use US Legal Forms, one of the most comprehensive variety of lawful kinds, to save lots of time as well as stay away from errors. The service gives appropriately created lawful file layouts which can be used for a variety of purposes. Produce your account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

An applicant for permanent residence must reside in the Virgin Islands consecutively for a period of 20 years before application can be considered. An applicant can only be absent from the Territory for 90 days in any calendar year except when pursuing further education or as a result of illness.

There are no local income taxes or surcharges imposed on individuals over and above the mirror system rates so that the overall rate of income tax for individuals is equivalent to the rate that a resident of a state without a state income tax would pay.

The U.S. Virgin Islands uses a mirror system of taxation, also known as the Mirror Code, meaning that USVI taxpayers pay taxes to the Virgin Islands Bureau of Internal Revenue ("BIR") generally to the same extent as U.S. taxpayers would under the Code to the U.S. Internal Revenue Service.

Taxes imposed on residents of the Virgin Islands include: Federal Income Tax (same as US mainland) Property Tax. Employers are required to remove social security, Medicare and income tax from employee pay.

Where to file. You must file identical tax returns with the United States and the USVI. If you are not enclosing a check or money order, file your original tax return (including Form 8689) with the Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 USA.

A taxpayer will qualify as a bona fide resident of the Virgin Islands if the taxpayer can satisfy all of the following three criteria: (1) The presence test. (2) The tax home test. (3) The closer connection test.

There is no electronic filing in the Virgin Islands at this time. Taxpayers must drop off in person or mail the returns to the Bureau for processing. For more information about filing requirements for bona fide residents, please call the Office of Chief Counsel at 715-1040, ext. 2249.

Dominica. The Commonwealth of Dominicawhich should not be confused with the Dominican Republicis a pure tax haven with no income tax, corporate tax, or tax imposed on income or capital gains earned outside its jurisdiction. It does not impose any withholding taxes, gift taxes, or estate and inheritance taxes either.

Form 8689 is a tax form distributed by the Internal Revenue Service (IRS) for use by U.S. citizens and resident aliens who earned income from sources in the U.S. Virgin Islands (USVI) but are not bona fide residents. The U.S. Virgin Islands are considered an unincorporated territory of the United States.

Individual U.S. citizens and permanent residents who are bona fide residents of the Virgin Islands are subject to the same tax rates as are applicable to individuals under the U.S. Internal Revenue Code but they pay their tax on worldwide income to the U.S. Virgin Islands Bureau of Internal Revenue rather than to the