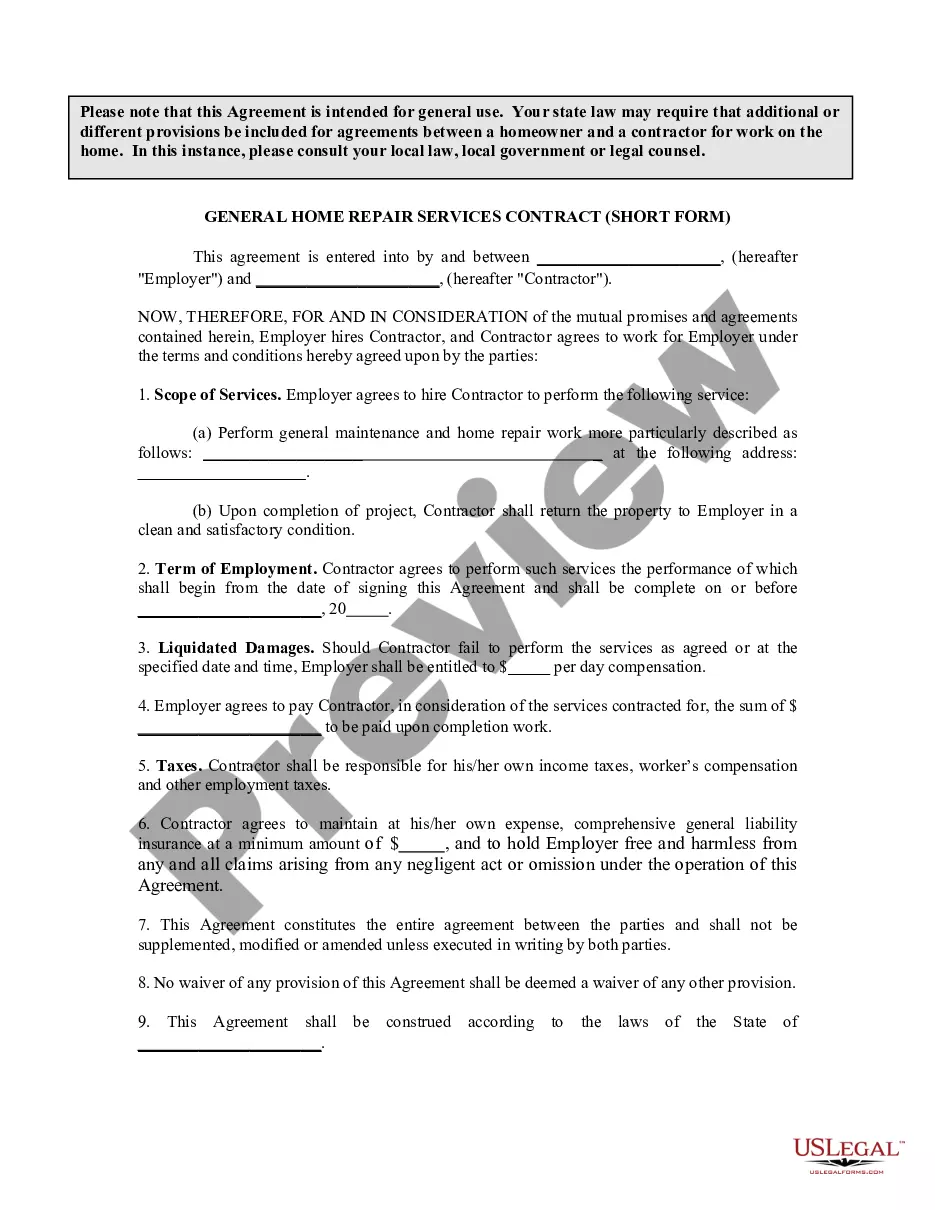

Virgin Islands General Home Repair Services Contract - Short Form - Self-Employed

Description

How to fill out Virgin Islands General Home Repair Services Contract - Short Form - Self-Employed?

It is possible to spend several hours on the web trying to find the authorized record format that fits the state and federal requirements you require. US Legal Forms provides 1000s of authorized types which can be evaluated by professionals. You can actually download or printing the Virgin Islands General Home Repair Services Contract - Short Form - Self-Employed from the services.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Acquire option. Afterward, it is possible to full, revise, printing, or sign the Virgin Islands General Home Repair Services Contract - Short Form - Self-Employed. Each and every authorized record format you buy is your own permanently. To acquire one more backup for any obtained develop, go to the My Forms tab and click on the related option.

If you use the US Legal Forms site for the first time, keep to the simple directions listed below:

- First, be sure that you have chosen the proper record format for that region/city of your choice. Look at the develop description to make sure you have selected the appropriate develop. If accessible, utilize the Preview option to appear from the record format at the same time.

- If you wish to get one more variation from the develop, utilize the Lookup discipline to find the format that fits your needs and requirements.

- When you have found the format you need, simply click Get now to carry on.

- Find the costs strategy you need, type your accreditations, and sign up for an account on US Legal Forms.

- Complete the deal. You may use your credit card or PayPal accounts to purchase the authorized develop.

- Find the format from the record and download it to the product.

- Make modifications to the record if possible. It is possible to full, revise and sign and printing Virgin Islands General Home Repair Services Contract - Short Form - Self-Employed.

Acquire and printing 1000s of record themes while using US Legal Forms Internet site, which provides the largest collection of authorized types. Use skilled and status-specific themes to handle your organization or individual needs.

Form popularity

FAQ

Schedule SE is one of many schedules of Form 1040, the form you use to file your individual income tax return. You use it to calculate your total self-employment tax, which you must report on another schedule of Form 1040Schedule 4 (line 57).

More In Forms and Instructions Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment.

The short SE version is gone. Instead, if you didn't have very much self-employment, you might be able to use Part II of the 2020 Schedule SE. This is an option if your SE profits were less than $6,107 and also less than 72.189 percent of your gross income.

About Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

The net income information on Schedule C is used to determine the amount of self-employment tax you owe (for Social Security and Medicare taxes). Schedule SE is used to calculate the self-employment tax amount.

25b6 Go to for instructions and the latest information.

Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employ- ment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

Schedule SE has been changed for the 2020 tax year, with the elimination of the short form option and the addition of a new Part III to calculate an optional deferral of part of self-employment taxes for 2020.

Schedule SE has been changed for the 2020 tax year, with the elimination of the short form option and the addition of a new Part III to calculate an optional deferral of part of self-employment taxes for 2020.