Virgin Islands Storage Services Contract - Self-Employed

Description

How to fill out Virgin Islands Storage Services Contract - Self-Employed?

Finding the right lawful file design might be a have a problem. Needless to say, there are a variety of web templates available online, but how do you get the lawful form you will need? Utilize the US Legal Forms site. The service delivers thousands of web templates, like the Virgin Islands Storage Services Contract - Self-Employed, which you can use for enterprise and private requirements. All of the varieties are examined by professionals and satisfy federal and state needs.

Should you be currently signed up, log in in your bank account and click the Acquire button to obtain the Virgin Islands Storage Services Contract - Self-Employed. Utilize your bank account to search through the lawful varieties you possess bought formerly. Proceed to the My Forms tab of your bank account and have another version of your file you will need.

Should you be a whole new consumer of US Legal Forms, here are basic directions for you to adhere to:

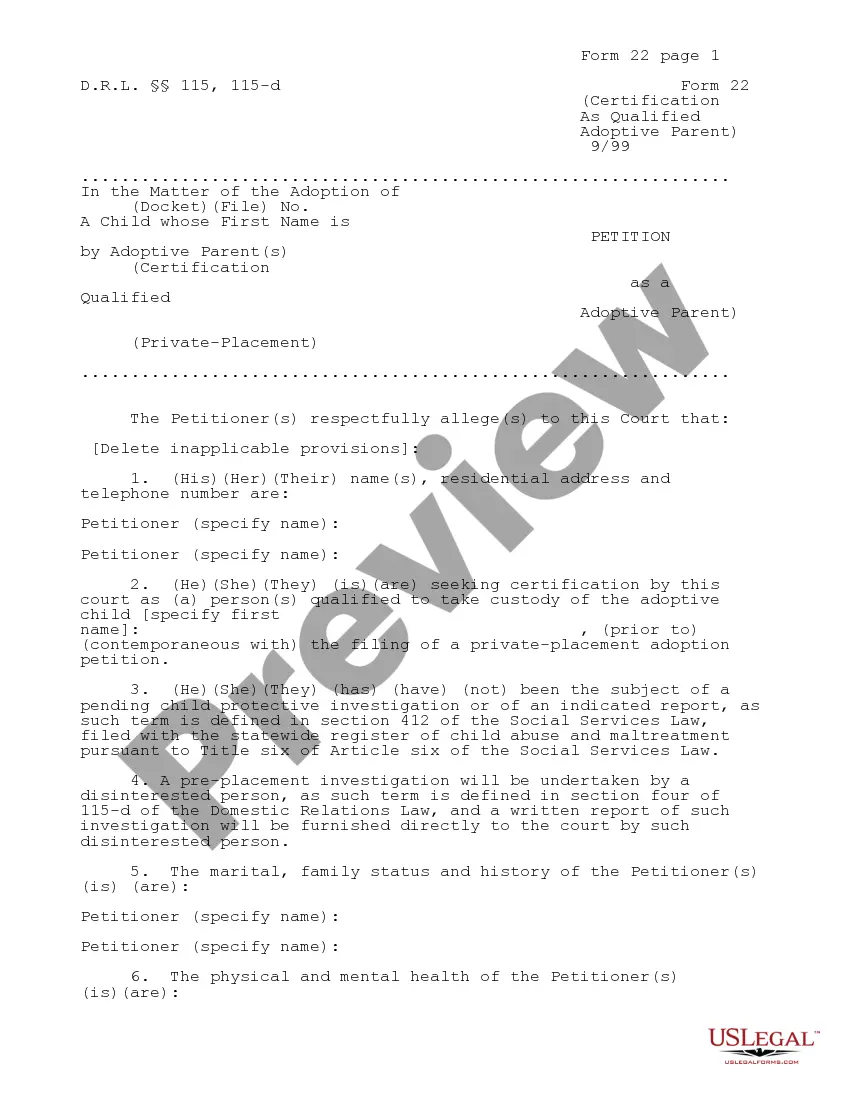

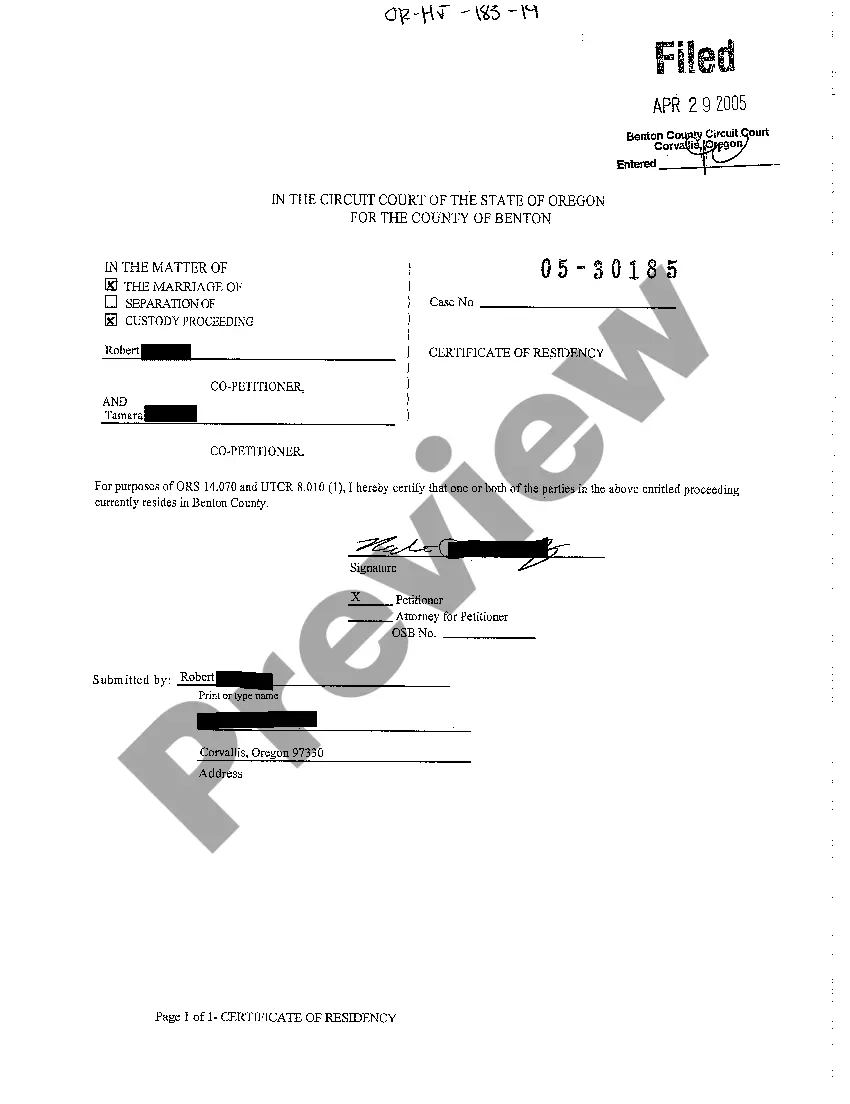

- Initially, make certain you have selected the proper form to your town/state. You are able to check out the form utilizing the Preview button and look at the form outline to make sure it will be the best for you.

- In case the form does not satisfy your expectations, take advantage of the Seach industry to get the right form.

- When you are positive that the form is acceptable, select the Buy now button to obtain the form.

- Pick the pricing program you would like and enter the required info. Make your bank account and buy an order using your PayPal bank account or credit card.

- Opt for the file format and acquire the lawful file design in your gadget.

- Complete, revise and print out and signal the obtained Virgin Islands Storage Services Contract - Self-Employed.

US Legal Forms is the greatest library of lawful varieties that you will find a variety of file web templates. Utilize the service to acquire expertly-created documents that adhere to condition needs.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

Service Contracts are agreements between a customer or client and a person or company who will be providing services. For example, a Service Contract might be used to define a work-agreement between a contractor and a homeowner. Or, a contract could be used between a business and a freelance web designer.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If there's a contract of service, meaning the payer controls what type of work you do and how it should be done, you have an employer-employee relationship. If there's a contract for service, meaning the payer can control only the outcome of the work, you're an independent contractor for the payer.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Whilst a contractor usually belongs to an outside organisation or is self-employed, an employee with a fixed-term contract is hired by an organisation and has all the same rights and benefits as permanent employees, they're just only employed for a specific period of time.

The Service Contract Act, also referred to as the McNamara-O'Hara Service Contract Act (SCA), is a federal statute which controls the aspect of service contracts entered into between individuals or companies and the federal government, including the District of Columbia, for the contractors to engage service employees

The McNamara-O'Hara Service Contract Act requires contractors and subcontractors performing services on prime contracts in excess of $2,500 to pay service employees in various classes no less than the wage rates and fringe benefits found prevailing in the locality, or the rates (including prospective increases)