Virgin Islands Election of 'S' Corporation Status and Instructions - IRS 2553

Description

How to fill out Election Of 'S' Corporation Status And Instructions - IRS 2553?

Are you presently within a position where you need files for both company or person uses nearly every working day? There are a lot of lawful file layouts available on the Internet, but discovering types you can depend on isn`t easy. US Legal Forms gives a large number of type layouts, such as the Virgin Islands Election of 'S' Corporation Status and Instructions - IRS 2553, that are written to satisfy state and federal requirements.

Should you be currently acquainted with US Legal Forms site and get your account, simply log in. After that, you may obtain the Virgin Islands Election of 'S' Corporation Status and Instructions - IRS 2553 web template.

If you do not provide an account and need to begin using US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is for your appropriate metropolis/area.

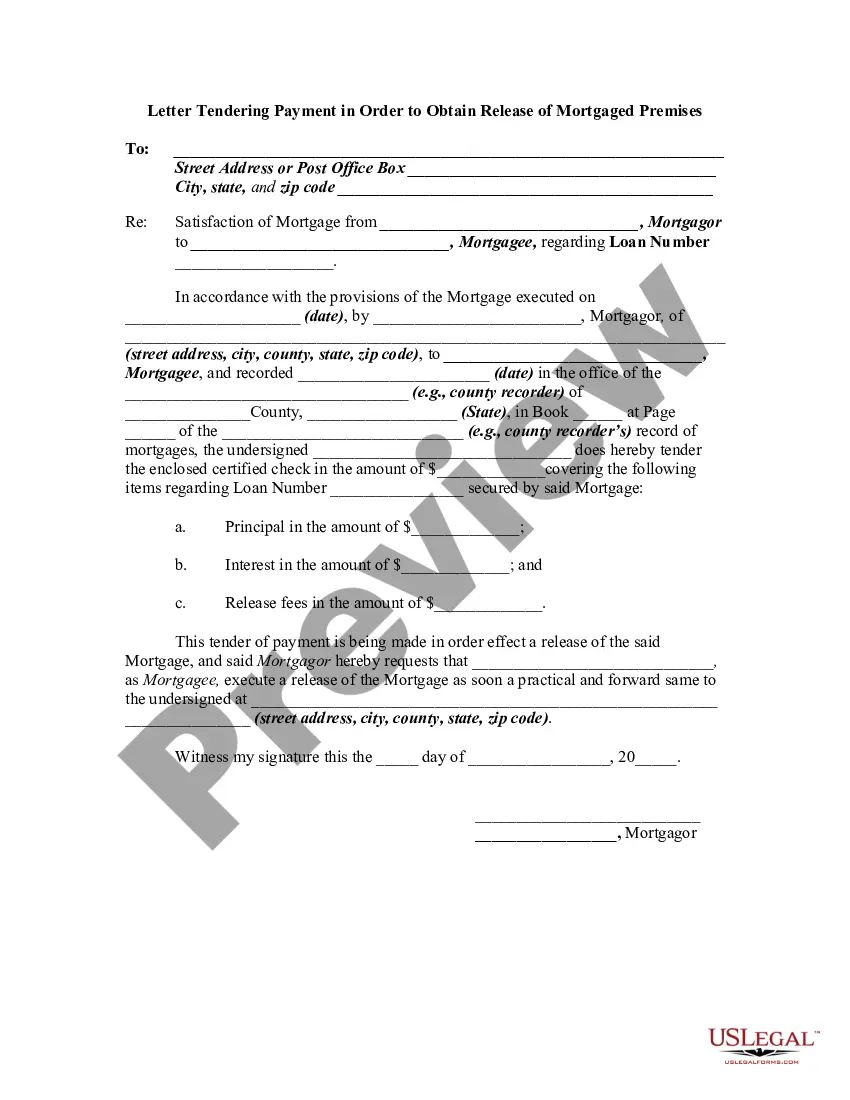

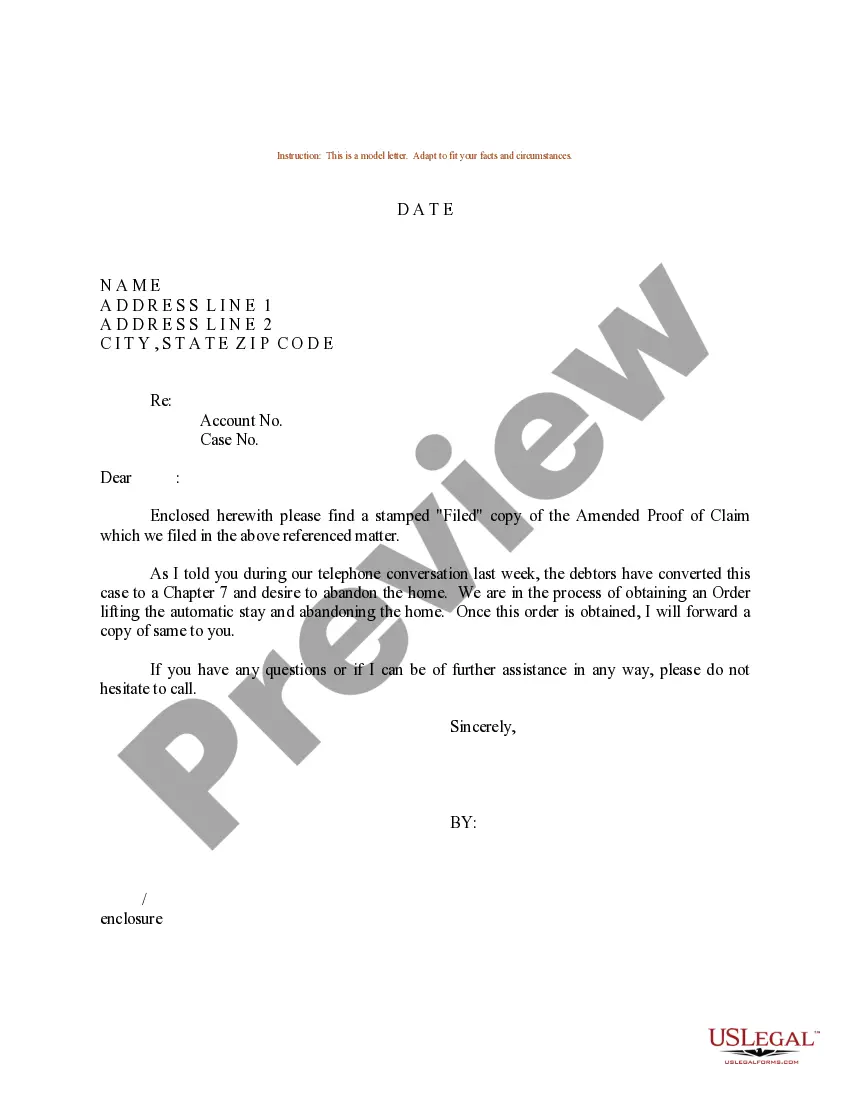

- Take advantage of the Preview key to check the shape.

- See the description to ensure that you have selected the appropriate type.

- If the type isn`t what you are seeking, use the Lookup industry to find the type that fits your needs and requirements.

- When you find the appropriate type, click Get now.

- Opt for the costs program you desire, complete the desired information to produce your money, and purchase the order making use of your PayPal or bank card.

- Pick a hassle-free file formatting and obtain your version.

Get all of the file layouts you have bought in the My Forms food selection. You may get a more version of Virgin Islands Election of 'S' Corporation Status and Instructions - IRS 2553 at any time, if necessary. Just select the required type to obtain or print the file web template.

Use US Legal Forms, probably the most comprehensive selection of lawful kinds, to save time as well as steer clear of mistakes. The services gives professionally produced lawful file layouts which you can use for an array of uses. Create your account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

How to file taxes as an S corporation Prepare your financial statements. One of the first things your tax professional will ask for are financial statements. ... Issue Forms W-2. ... Prepare information return Form 1120-S. ... Distribute Schedules K-1. ... File Form 1040. A Beginner's Guide to S Corporation Taxes - The Motley Fool fool.com ? small-business ? articles ? s-corp... fool.com ? small-business ? articles ? s-corp...

If you don't file Form 2553 by the deadline, your business will not receive S Corporation status until the following tax year, unless you qualify for late election relief.

If you want to make the S corporation election, you need to file IRS Form 2553, Election by a Small Business Corporation. If you file Form 2553, you do not need to file Form 8832, Entity Classification Election, as you would for a C-Corporation. You can file your Form 2553 with the IRS online, by fax, or by mail. What is an S corp election? - ? articles ? what-is-an-s-... ? articles ? what-is-an-s-...

If you file Form 2553 before the date on line E (the date the election will go into effect), you only need to list the current shareholders. If you file the form after the date on line E, list anyone who held stock between that date (the effective date) and the filing date (the election date).

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form. S Corporations | Internal Revenue Service IRS (.gov) ? small-businesses-self-employed IRS (.gov) ? small-businesses-self-employed

After filing Form 2553, the IRS will send either an acceptance or denial letter to the business within 60 days of filing. If the election is accepted, the letter will show the effective date. Form 2553 late filing: Making up for lost time on S Corp elections blockadvisors.com ? small-business-services blockadvisors.com ? small-business-services

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

A corporation or other entity eligible to be treated as a corporation files Form 2553 to make an election to be an S corporation. An S corporation elects to pass income, deductions, loss, and credits to its shareholders for federal tax purposes.