Virgin Islands Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.

Description

How to fill out Demand For Information From Limited Liability Company LLC By Member Regarding Financial Records, Etc.?

Finding the right legitimate papers design can be quite a have difficulties. Of course, there are a variety of templates available on the Internet, but how will you obtain the legitimate kind you want? Utilize the US Legal Forms web site. The support gives thousands of templates, for example the Virgin Islands Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc., which can be used for organization and personal demands. All of the types are checked by professionals and meet up with state and federal requirements.

In case you are currently authorized, log in to your bank account and click the Down load key to find the Virgin Islands Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.. Utilize your bank account to look from the legitimate types you possess purchased previously. Check out the My Forms tab of your respective bank account and have yet another backup from the papers you want.

In case you are a new user of US Legal Forms, allow me to share straightforward recommendations for you to comply with:

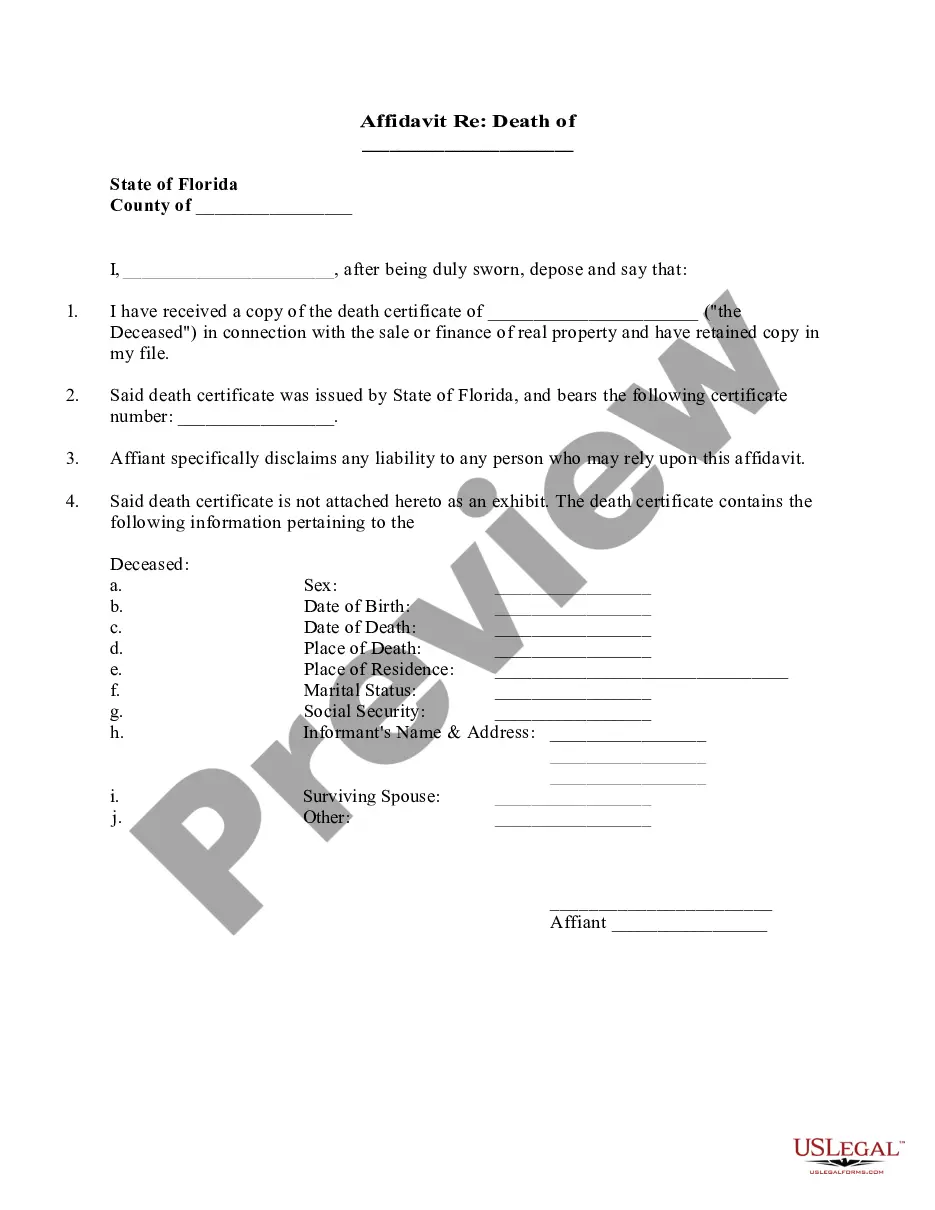

- Initially, make sure you have chosen the correct kind to your metropolis/county. It is possible to look through the shape utilizing the Review key and study the shape outline to ensure it is the best for you.

- In the event the kind does not meet up with your expectations, take advantage of the Seach industry to get the correct kind.

- Once you are certain that the shape would work, go through the Get now key to find the kind.

- Choose the pricing strategy you want and type in the needed info. Design your bank account and pay money for the transaction with your PayPal bank account or credit card.

- Pick the data file file format and acquire the legitimate papers design to your system.

- Full, revise and print out and sign the obtained Virgin Islands Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc..

US Legal Forms will be the biggest catalogue of legitimate types that you can discover different papers templates. Utilize the company to acquire appropriately-produced documents that comply with status requirements.