Virgin Islands Agreement Designating Agent to Lease Mineral Interests

Description

How to fill out Agreement Designating Agent To Lease Mineral Interests?

Choosing the best authorized document design can be quite a have difficulties. Naturally, there are a variety of themes available on the net, but how will you get the authorized kind you will need? Make use of the US Legal Forms web site. The support provides 1000s of themes, like the Virgin Islands Agreement Designating Agent to Lease Mineral Interests, which can be used for organization and personal needs. Each of the forms are checked by pros and meet federal and state demands.

In case you are previously signed up, log in to your bank account and click the Download switch to find the Virgin Islands Agreement Designating Agent to Lease Mineral Interests. Make use of your bank account to look with the authorized forms you have purchased in the past. Visit the My Forms tab of your respective bank account and get another duplicate from the document you will need.

In case you are a brand new customer of US Legal Forms, here are simple guidelines that you should stick to:

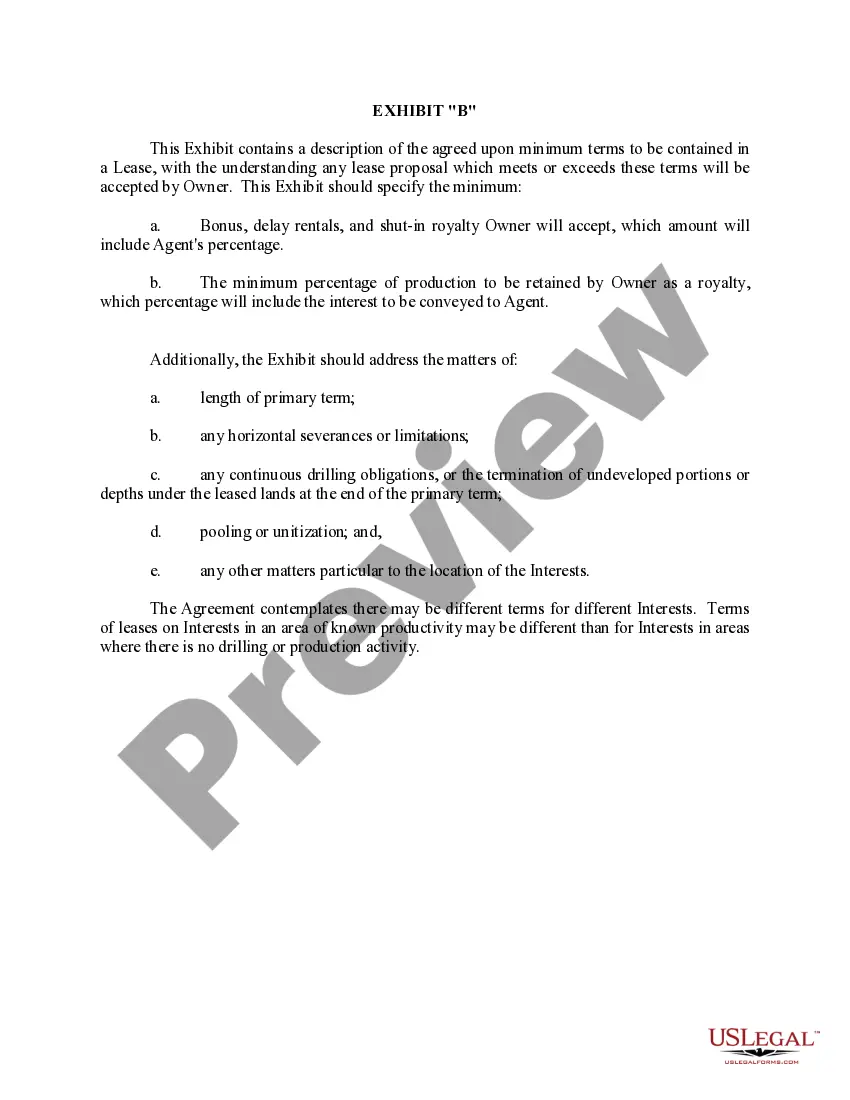

- Initially, make sure you have selected the proper kind for your city/county. You can examine the form using the Preview switch and study the form description to make certain it is the best for you.

- If the kind will not meet your requirements, use the Seach industry to find the appropriate kind.

- Once you are positive that the form is proper, go through the Get now switch to find the kind.

- Opt for the costs strategy you want and type in the necessary info. Design your bank account and pay money for the transaction making use of your PayPal bank account or Visa or Mastercard.

- Pick the data file formatting and obtain the authorized document design to your gadget.

- Full, edit and print and indication the obtained Virgin Islands Agreement Designating Agent to Lease Mineral Interests.

US Legal Forms may be the largest collection of authorized forms for which you will find different document themes. Make use of the company to obtain expertly-manufactured paperwork that stick to state demands.

Form popularity

FAQ

The cost basis for inherited mineral rights is ?fair value.? It's simply the book value of what you receive on the day you acquire it. If you sell your rights afterward, you'll have to pay capital gains tax on the difference between your cost basis and the sale price.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

The general rule of thumb for the value of mineral rights in Texas is 2x to 3x the lease bonus you received. For example, if you got $500/acre when you leased your property, you might expect to sell for somewhere between $1,000 to $1,500/acre if you were to sell mineral rights in Texas.

Owning a property's ?mineral rights? refers to ownership of the mineral deposits under the surface of a piece of land. The rights to the minerals usually belong to the owner of the surface property, or surface estate. In Texas, though, those rights can be transferred to another party.

GENERAL HOMESTEADS Any taxing unit, including a school district, city, county, or special district may offer exemption for up to 20% of your home's value. The amount of an optional exemption can't be less than $5,000 no matter what the percentage is.

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property. When do mineral interests become taxable? Mineral interests become taxable on January 1 of the year following the first production of the unit.

Taxability of Inherited Mineral Rights If they are transferred through a will or estate plan, they are considered a part of the estate and are subject to taxation. If they are transferred through a lease, the value of the mineral rights may be taxable. However, this will depend on the terms of the lease agreement.