A Virgin Islands Mineral Deed with Granter Reserving Nonparticipating Royalty Interest is a legal document that facilitates the transfer of mineral rights ownership from the granter to the grantee, while also reserving a royalty interest for the granter, commonly known as nonparticipating royalty interest (NPR). This type of deed is commonly used in the Virgin Islands to establish ownership and royalty arrangements for mineral rights. The NPR, also called an overriding royalty interest, allows the granter to retain a specified percentage or fractional share of the mineral production proceeds. This means that even after selling the mineral rights, the granter continues to receive a specified percentage of the royalties or profits derived from the mineral extraction. This arrangement provides an ongoing financial interest to the granter, even if they no longer own the mineral rights. It is important to note that the granter does not have any input or participation in the operation or management of the associated mineral lease or venture. The Virgin Islands Mineral Deed with Granter Reserving Nonparticipating Royalty Interest is designed to protect the interests of both the granter and grantee. The granter ensures a secure source of income from mineral production even after transferring ownership, while the grantee obtains exclusive ownership and control over the mineral rights for exploration, extraction, and development activities. There may be variations of the Virgin Islands Mineral Deed with Granter Reserving Nonparticipating Royalty Interest, depending on specific terms and conditions agreed upon by the parties involved. Some of these variations may include: 1. Percentage or Fractional Interest: This refers to the specific percentage or a fractional share of the royalties that the granter will retain. Common percentages range from 1% to 20%, but it can vary based on negotiation and local laws. 2. Duration of NPR: This specifies the duration or term for which the granter's nonparticipating royalty interest will remain in effect. It can be for a fixed period, until a certain amount of revenue is generated, or for the lifetime of a specific mineral lease. 3. Transference of NPR: This provision may allow the granter to sell, assign, or transfer their nonparticipating royalty interest to a third party, providing an opportunity for the granter to monetize the future income stream. Overall, a Virgin Islands Mineral Deed with Granter Reserving Nonparticipating Royalty Interest serves as a legally binding agreement that establishes the rights and obligations of both parties regarding the transfer of mineral rights while ensuring an ongoing financial interest for the granter. It is advised to consult with legal professionals and experts in mineral rights to ensure the deed accurately reflects the intentions and protects the interests of both parties involved.

Virgin Islands Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

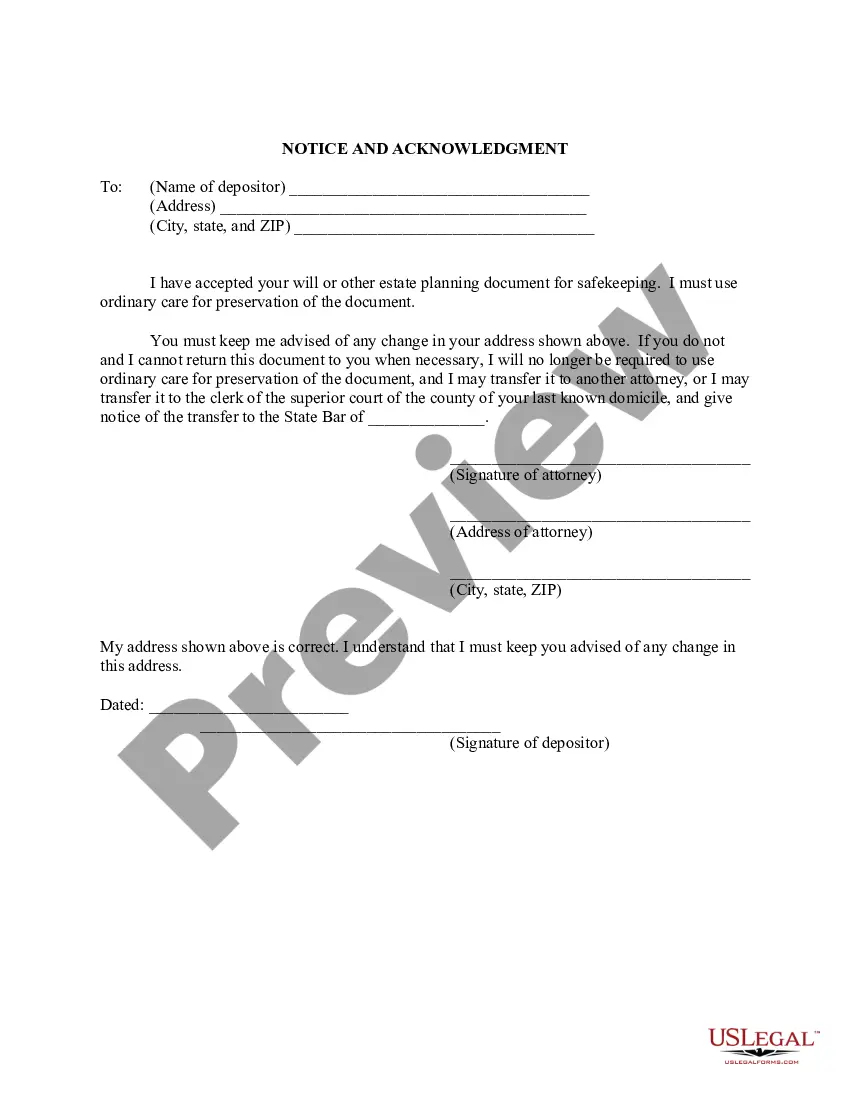

How to fill out Virgin Islands Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

You may invest hrs online trying to find the authorized record format which fits the federal and state demands you require. US Legal Forms offers a large number of authorized types that are reviewed by professionals. It is possible to download or print the Virgin Islands Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest from my services.

If you have a US Legal Forms bank account, you can log in and click on the Acquire switch. Next, you can complete, change, print, or indication the Virgin Islands Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest. Every single authorized record format you get is your own for a long time. To have yet another duplicate of any bought type, go to the My Forms tab and click on the related switch.

If you use the US Legal Forms website initially, stick to the straightforward guidelines beneath:

- Initially, make sure that you have chosen the proper record format for that county/city of your choosing. Look at the type description to ensure you have picked the correct type. If accessible, take advantage of the Review switch to search with the record format as well.

- If you wish to locate yet another variation of the type, take advantage of the Lookup discipline to obtain the format that suits you and demands.

- Once you have located the format you would like, click Get now to proceed.

- Find the rates program you would like, type in your qualifications, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal bank account to cover the authorized type.

- Find the formatting of the record and download it to the device.

- Make modifications to the record if necessary. You may complete, change and indication and print Virgin Islands Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest.

Acquire and print a large number of record themes using the US Legal Forms Internet site, that offers the biggest selection of authorized types. Use professional and express-certain themes to take on your organization or individual requires.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Royalty Interest (RI) ? this type of mineral interest is obtained when an owner decides to lease their mineral interest to a company that plans to drill and operate a well on the land.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.