Virgin Islands Affidavit of Heirship for Small Estates

Description

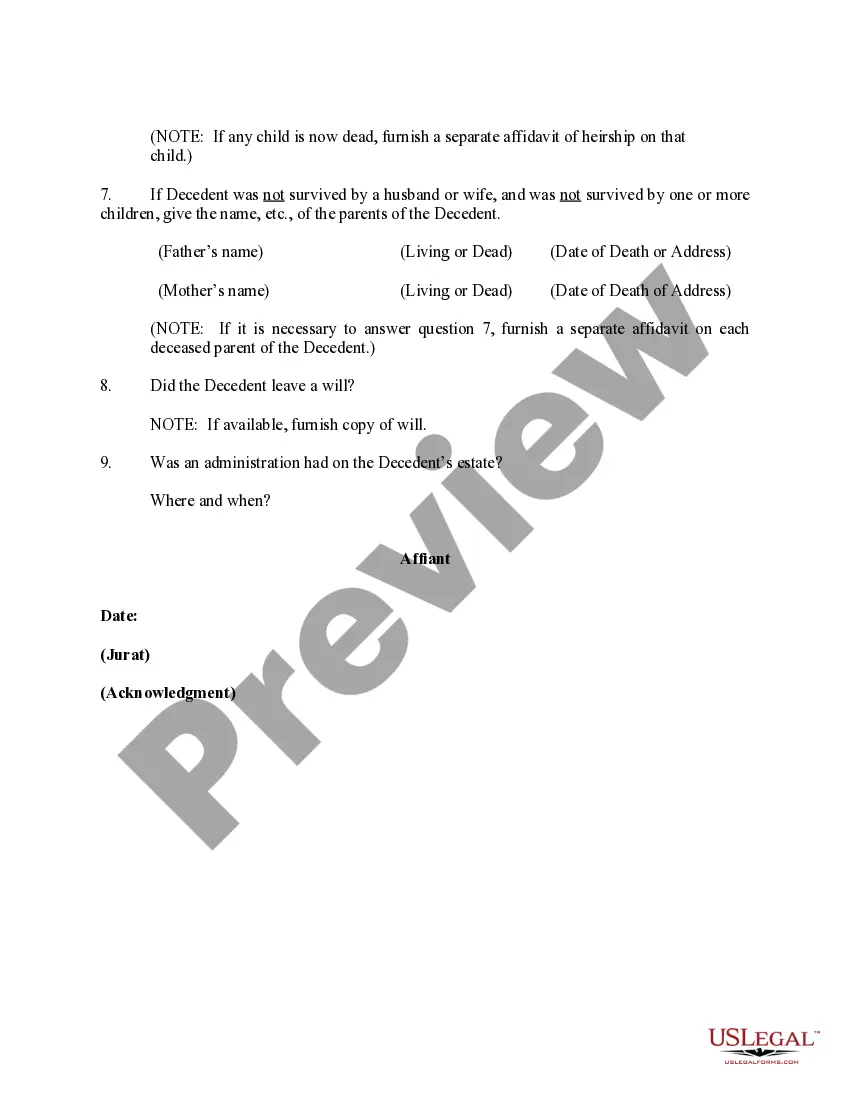

How to fill out Affidavit Of Heirship For Small Estates?

Choosing the right legitimate document format might be a struggle. Of course, there are a lot of web templates accessible on the Internet, but how do you discover the legitimate kind you want? Utilize the US Legal Forms internet site. The assistance gives 1000s of web templates, including the Virgin Islands Affidavit of Heirship for Small Estates, that can be used for enterprise and private requires. Every one of the types are inspected by specialists and meet up with state and federal needs.

Should you be presently signed up, log in in your bank account and then click the Down load key to get the Virgin Islands Affidavit of Heirship for Small Estates. Utilize your bank account to appear from the legitimate types you have acquired formerly. Visit the My Forms tab of your respective bank account and have one more backup of your document you want.

Should you be a whole new customer of US Legal Forms, listed below are easy directions that you should follow:

- Initial, make sure you have selected the appropriate kind for your personal town/area. It is possible to look over the form making use of the Preview key and read the form description to guarantee this is basically the best for you.

- In the event the kind fails to meet up with your expectations, utilize the Seach industry to discover the correct kind.

- Once you are positive that the form is proper, click the Purchase now key to get the kind.

- Choose the prices prepare you need and enter the needed info. Make your bank account and buy the order with your PayPal bank account or bank card.

- Select the data file structure and obtain the legitimate document format in your device.

- Total, revise and printing and indication the obtained Virgin Islands Affidavit of Heirship for Small Estates.

US Legal Forms is the biggest local library of legitimate types in which you can find different document web templates. Utilize the company to obtain expertly-produced papers that follow status needs.

Form popularity

FAQ

Unlike the affidavit of heirship, the small estate affidavit only transfers the title of the decedent's homestead. Only a surviving spouse or minor child can inherit property through this affidavit type. The other types of the deceased person's real property cannot be transferred by submitting a small estate affidavit.

It is not necessary to hire a lawyer to file a small estate affidavit. In fact, many probate courts provide forms on their website for the public's use.

Exempt property includes: The homestead for the use and benefit of a surviving spouse and minor children. Up to $100,000 ($50,000 for a single adult) worth of property intended for the use and benefit of a spouse, minor children, unmarried adult children still living at home, and incapacitated adult children.

Under Virginia Code Section 64.2-601, when the total estate does not exceed $50,000.00, a successor in interest, usually an heir-at-law or a beneficiary of the Will, can collect and distribute the assets without having to go through the full probate process.

The form must include: The witnesses' names and addresses. Relationships to the decedent. Decedent's date of death. Decedent's marital history. Decedent's family history (children, grandchildren, parents, siblings, nieces/nephews)

The small estate affidavit itself does not have to be filed with the court if the signatures have been notarized. If signatures have not been notarized, then the affidavit has to be filed with the court.

The SEA must be signed and sworn to by each heir before a notary. and can be determined by reviewing Chapter 201, Texas Estates Code. Filing fee is $263, but no additional fees are required to file amended SEAs.

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.