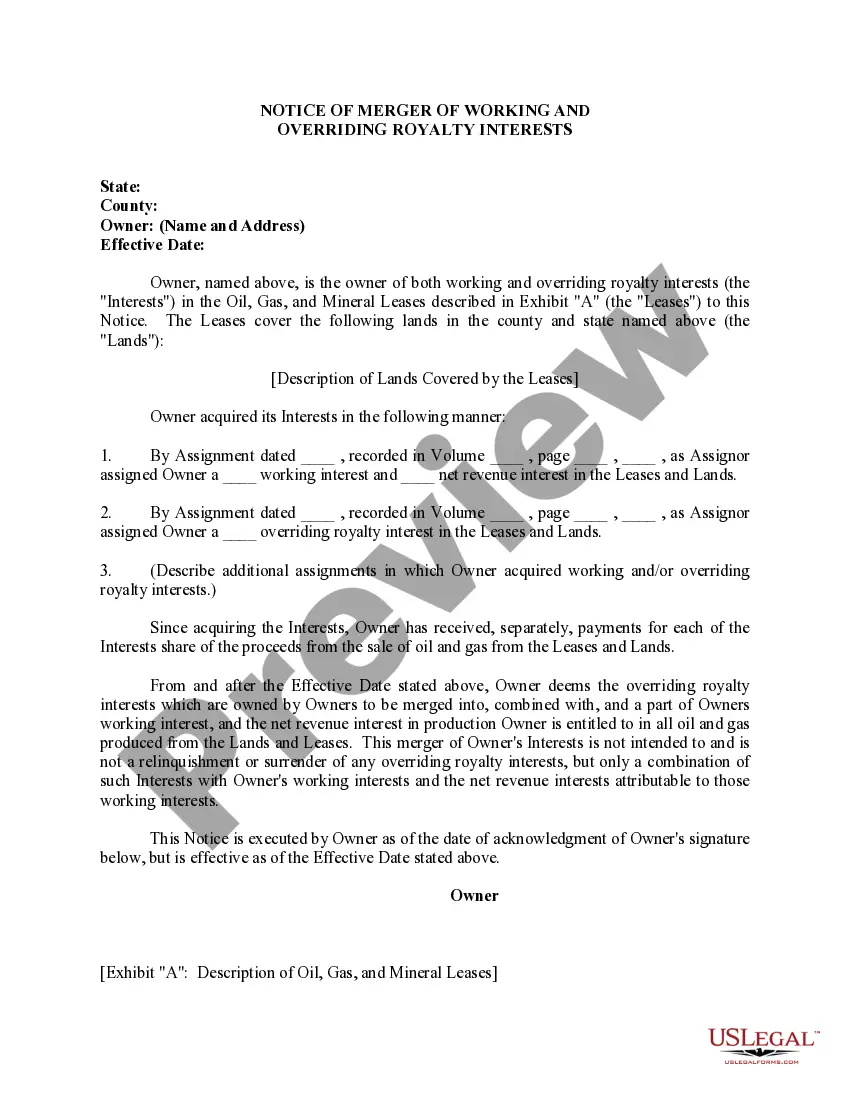

This form is used by the Owner to provide notice that the overriding royalty interests which are owned by Owners are to be merged into, combined with, and a part of Owners working interest, and the net revenue interest in production Owner is entitled to in all oil and gas produced from the Lands and Leases.

Virgin Islands Notice of Merger of Working and Overriding Royalty Interests

Description

How to fill out Notice Of Merger Of Working And Overriding Royalty Interests?

You are able to spend hrs online searching for the lawful papers format which fits the federal and state specifications you require. US Legal Forms provides 1000s of lawful forms that are reviewed by specialists. It is possible to download or print the Virgin Islands Notice of Merger of Working and Overriding Royalty Interests from your service.

If you already have a US Legal Forms bank account, you can log in and then click the Obtain key. Next, you can total, edit, print, or signal the Virgin Islands Notice of Merger of Working and Overriding Royalty Interests. Every single lawful papers format you buy is the one you have forever. To have one more copy associated with a obtained kind, visit the My Forms tab and then click the related key.

If you use the US Legal Forms website initially, keep to the simple guidelines beneath:

- Very first, make certain you have selected the correct papers format to the state/city of your choosing. Look at the kind outline to make sure you have picked out the appropriate kind. If readily available, utilize the Review key to look from the papers format also.

- In order to find one more version from the kind, utilize the Look for industry to find the format that fits your needs and specifications.

- Once you have discovered the format you desire, click on Acquire now to carry on.

- Choose the rates prepare you desire, key in your references, and register for an account on US Legal Forms.

- Full the financial transaction. You may use your credit card or PayPal bank account to pay for the lawful kind.

- Choose the file format from the papers and download it to your system.

- Make adjustments to your papers if necessary. You are able to total, edit and signal and print Virgin Islands Notice of Merger of Working and Overriding Royalty Interests.

Obtain and print 1000s of papers templates utilizing the US Legal Forms web site, which provides the greatest variety of lawful forms. Use specialist and express-certain templates to deal with your organization or person requirements.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.