The Virgin Islands Correction Assignment to Correct Amount of Interest is a legal process undertaken in the Virgin Islands (both US and British) to rectify any discrepancies or errors related to the calculation or application of interest on any financial transaction. This assignment aims to ensure accurate and fair interest charges, maintaining transparency and integrity in financial dealings. Keywords: Virgin Islands, correction assignment, amount of interest, rectify discrepancies, errors, calculation, application, financial transaction, accurate, fair interest charges, transparency, integrity, financial dealings. Types of Virgin Islands Correction Assignment to Correct Amount of Interest: 1. Commercial Loan Correction Assignment: This type of correction assignment is specific to commercial loans, aiming to rectify any mistakes made in interest calculation or application on loans provided to businesses in the Virgin Islands. 2. Retail Loan Correction Assignment: Retail loan correction assignment is designed to address any errors related to interest charges on loans extended to individual customers for personal purposes, such as a mortgage, car loan, or educational loan within the Virgin Islands. 3. Credit Card Correction Assignment: This type of correction assignment focuses on rectifying any inaccuracies or mistakes in the interest rates applied to credit card transactions made by individuals or businesses in the Virgin Islands. 4. Investment Correction Assignment: Investment correction assignment pertains to correcting errors or miscalculations concerning interest payments, dividends, or returns on investments made in the Virgin Islands, ensuring accurate and fair compensation to investors. 5. Government Bond Correction Assignment: This specific type of correction assignment deals with any issues regarding interest calculations or payments related to government-issued bonds within the Virgin Islands, safeguarding the interests of investors and maintaining financial stability. In all these types of correction assignments, the goal is to rectify any errors promptly and accurately, ensuring that the correct interest amounts are charged or paid, thus fostering trust and credibility in the financial system of the Virgin Islands.

Virgin Islands Correction Assignment to Correct Amount of Interest

Description

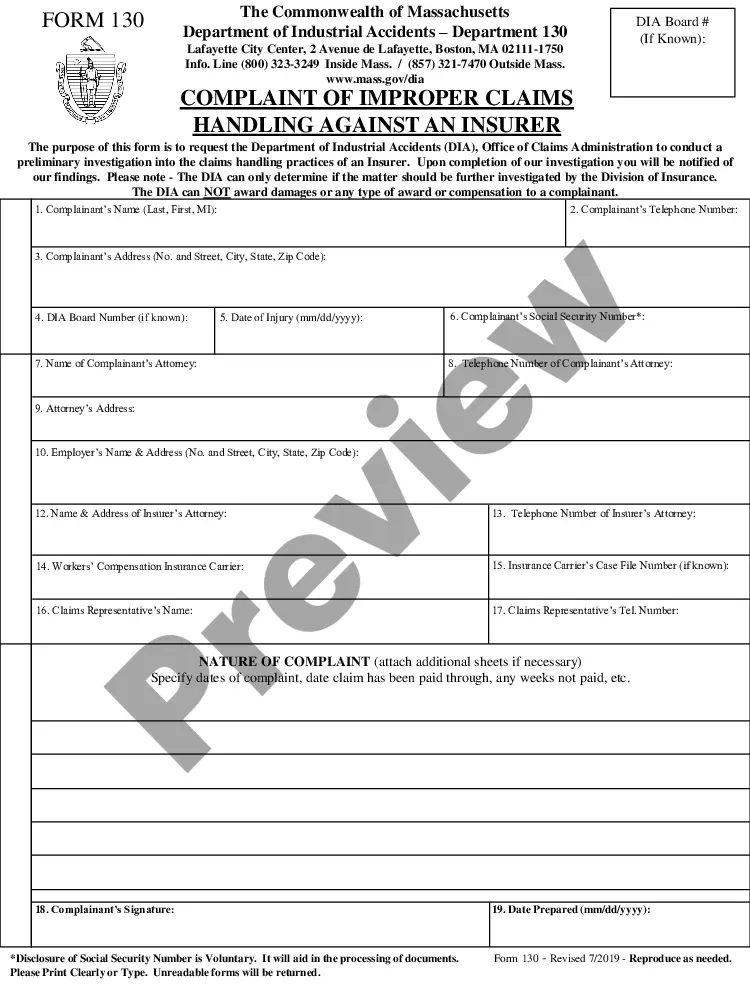

How to fill out Virgin Islands Correction Assignment To Correct Amount Of Interest?

If you wish to complete, download, or produce lawful papers templates, use US Legal Forms, the most important collection of lawful varieties, which can be found on-line. Use the site`s simple and easy hassle-free lookup to get the files you will need. Numerous templates for business and specific uses are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to get the Virgin Islands Correction Assignment to Correct Amount of Interest within a number of click throughs.

Should you be presently a US Legal Forms customer, log in in your profile and click the Down load button to have the Virgin Islands Correction Assignment to Correct Amount of Interest. You can also entry varieties you previously downloaded from the My Forms tab of the profile.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the correct area/country.

- Step 2. Utilize the Review option to examine the form`s content material. Do not forget to see the explanation.

- Step 3. Should you be unsatisfied with all the form, make use of the Search field at the top of the monitor to locate other versions in the lawful form web template.

- Step 4. After you have found the form you will need, select the Buy now button. Opt for the prices plan you favor and add your credentials to register for an profile.

- Step 5. Approach the transaction. You can utilize your bank card or PayPal profile to accomplish the transaction.

- Step 6. Select the file format in the lawful form and download it on your own system.

- Step 7. Complete, edit and produce or indicator the Virgin Islands Correction Assignment to Correct Amount of Interest.

Each lawful papers web template you buy is your own property eternally. You have acces to every single form you downloaded inside your acccount. Select the My Forms segment and select a form to produce or download once again.

Be competitive and download, and produce the Virgin Islands Correction Assignment to Correct Amount of Interest with US Legal Forms. There are millions of professional and state-particular varieties you can use for your business or specific demands.

Form popularity

FAQ

4 Independent erification Worksheet. Your application was selected for review in a process called ?erification.? In this process, the school will be comparing information from your Free Application for Federal Student Aid (FAFSA), by verifying your high school completion and your identity.

Reconciliation ? The process by which the appraiser evaluates, chooses, and selects from among alternative conclusions to reach a final value estimate. During the appraisal process, generally more than one approach is applied, and each approach typically results in a different indication of value.

The verification process involves submitting documents such as tax transcripts and W-2 forms so the financial aid office at your college can see that the information on these documents matches your FAFSA application.

The V4 and V5 groups will be required to submit proof of identity and a signed statement of educational purpose (SEP); however, they will no longer be able to use expired documents for proof of identity. In addition, Identity documents must be presented in the financial aid office at the time the SEP is signed.

Reconciliation ? The process by which the appraiser evaluates, chooses, and selects from among alternative conclusions to reach a final value estimate. During the appraisal process, generally more than one approach is applied, and each approach typically results in a different indication of value.