Virgin Islands Exhibit D to Operating Agreement Insurance — Form 1 is a legal document that pertains to insurance provisions within a company's operating agreement in the Virgin Islands. This exhibit provides comprehensive details about insurance coverage to protect the company and its stakeholders. The purpose of this Virgin Islands Exhibit D is to outline the different types of insurance coverage required for the business, ensuring that potential risks are adequately addressed. This exhibit includes specific provisions related to insurance policies and the responsibilities of the parties involved. Some relevant keywords associated with the Virgin Islands Exhibit D to Operating Agreement Insurance — Form 1 include: 1. Insurance coverage: This exhibit details the types of coverage required to protect the company, such as general liability insurance, property insurance, workers' compensation insurance, and professional liability insurance, among others. Each type of coverage is explained in detail, including the specific risks it addresses. 2. Policy limits: The exhibit specifies the maximum amount of coverage provided by each insurance policy. The limits may vary based on the nature of the risk, the financial capacity of the company, and legal requirements in the Virgin Islands. Policy limits ensure that potential losses are covered up to a predetermined amount. 3. Deductibles: Deductibles represent the initial amount the insured party must pay before the insurance coverage kicks in. This exhibit includes information on deductibles for each type of insurance policy. Deductibles could differ based on the policy and may affect premium costs. 4. Additional insured: Certain parties associated with the company may need to be listed as additional insured to benefit from the insurance coverage. This exhibit explains who qualifies as an additional insured and the process of adding them to the policy. 5. Certificate of insurance: The exhibit outlines the requirements for obtaining and maintaining a certificate of insurance. This document serves as proof that the company has valid insurance coverage and can be provided to clients, vendors, or other relevant parties as requested. Different variations or types of the Virgin Islands Exhibit D to Operating Agreement Insurance — Form 1 may exist depending on the specific industry, legal jurisdiction, or company requirements. These variations may include specialized insurance provisions unique to the Virgin Islands geographical location or regulations imposed by local authorities. Some potential variations include: 1. Construction insurance provisions: This type of exhibit D may focus on insurance coverage requirements specific to construction-related risks, such as builder's risk insurance, contractor's general liability insurance, or professional indemnity insurance for architects and engineers. 2. Health industry insurance provisions: In the healthcare sector, a variation of this exhibit could address medical malpractice insurance, patient liability coverage, or cyber liability insurance, considering the unique risks inherent in providing medical services. 3. Technology industry insurance provisions: For businesses in the technology sector, a variation of this exhibit might cover data breach insurance, intellectual property liability insurance, or errors and omissions (E&O) insurance tailored to technology-related risks. It is essential to consult legal professionals or advisors experienced in Virgin Islands law to ensure that the Exhibit D to Operating Agreement Insurance — Form 1 aligns with local regulations and adequately protects the company's interests.

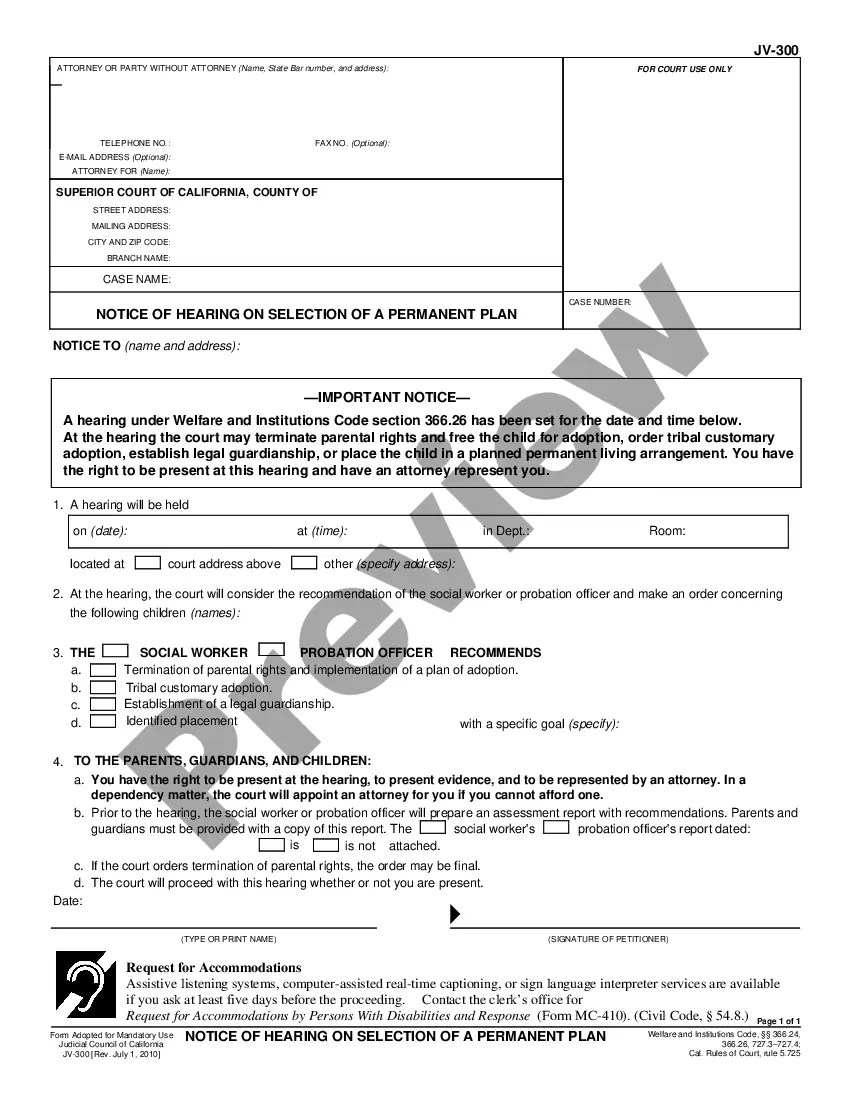

Virgin Islands Exhibit D to Operating Agreement Insurance - Form 1

Description

How to fill out Virgin Islands Exhibit D To Operating Agreement Insurance - Form 1?

If you want to full, obtain, or print out legitimate file templates, use US Legal Forms, the most important collection of legitimate varieties, that can be found on the web. Use the site`s easy and practical look for to obtain the paperwork you need. Different templates for company and specific uses are categorized by classes and says, or keywords. Use US Legal Forms to obtain the Virgin Islands Exhibit D to Operating Agreement Insurance - Form 1 within a few click throughs.

In case you are already a US Legal Forms buyer, log in in your profile and click on the Down load key to get the Virgin Islands Exhibit D to Operating Agreement Insurance - Form 1. You may also access varieties you in the past saved from the My Forms tab of your profile.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your right area/nation.

- Step 2. Make use of the Preview choice to look over the form`s articles. Don`t neglect to read the information.

- Step 3. In case you are not happy together with the type, use the Research industry near the top of the screen to discover other types of your legitimate type design.

- Step 4. Upon having identified the shape you need, click the Purchase now key. Pick the prices program you favor and put your qualifications to register on an profile.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal profile to finish the transaction.

- Step 6. Choose the formatting of your legitimate type and obtain it on your own system.

- Step 7. Complete, edit and print out or indicator the Virgin Islands Exhibit D to Operating Agreement Insurance - Form 1.

Every single legitimate file design you acquire is the one you have for a long time. You might have acces to each and every type you saved with your acccount. Select the My Forms area and decide on a type to print out or obtain once again.

Contend and obtain, and print out the Virgin Islands Exhibit D to Operating Agreement Insurance - Form 1 with US Legal Forms. There are many specialist and status-distinct varieties you can use for your personal company or specific requirements.