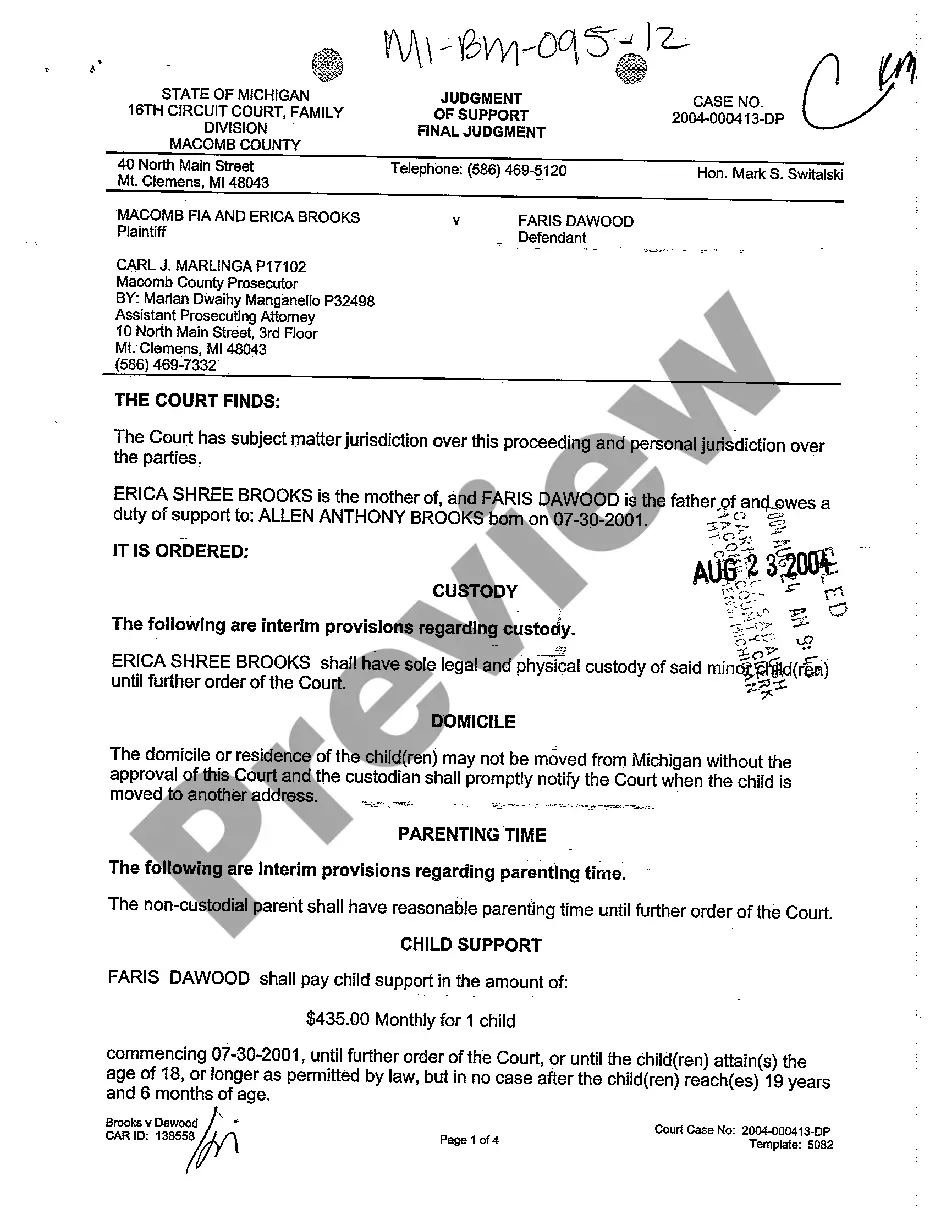

This office lease clause should be used in an expense stop, stipulated base or office net lease. When the building is not at least 95% occupied during all or a portion of any lease year, the landlord shall make an appropriate adjustment for each lease year to determine what the building operating costs. Such an adjustment shall be made by the landlord increasing the variable components of such variable costs included in the building operating costs which vary based on the level of occupancy of the building.

Virgin Islands Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease

Description

How to fill out Gross Up Clause That Should Be Used In An Expense Stop Stipulated Base Or Office Net Lease?

US Legal Forms - one of many largest libraries of legitimate kinds in the United States - delivers a variety of legitimate document layouts you can download or printing. Using the website, you may get thousands of kinds for organization and person functions, sorted by categories, claims, or keywords.You will discover the latest models of kinds much like the Virgin Islands Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease in seconds.

If you currently have a monthly subscription, log in and download Virgin Islands Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease in the US Legal Forms catalogue. The Obtain key can look on every form you perspective. You gain access to all in the past saved kinds from the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, listed below are basic guidelines to get you started:

- Be sure you have selected the right form for your personal metropolis/county. Click on the Review key to examine the form`s information. Read the form explanation to actually have chosen the right form.

- In the event the form doesn`t suit your specifications, make use of the Look for industry on top of the screen to find the the one that does.

- Should you be satisfied with the form, verify your choice by simply clicking the Purchase now key. Then, choose the rates plan you want and supply your accreditations to register to have an bank account.

- Method the financial transaction. Make use of credit card or PayPal bank account to complete the financial transaction.

- Choose the structure and download the form in your gadget.

- Make changes. Complete, modify and printing and indication the saved Virgin Islands Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease.

Each template you included in your account does not have an expiration time and it is your own property forever. So, if you wish to download or printing another duplicate, just visit the My Forms segment and click on in the form you will need.

Gain access to the Virgin Islands Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease with US Legal Forms, by far the most extensive catalogue of legitimate document layouts. Use thousands of professional and status-specific layouts that meet your organization or person requires and specifications.

Form popularity

FAQ

Expense stops protect the lessee from unexpected changes in market rents. A gross lease is riskier for the lessor than a net lease. Net operating income is the income after deduction of mortgage payments. If a lease has free rent earlier in its term, its default risk might be considered slightly higher.

Definition of tax stop clause in a lease that stops a lessor from paying property taxes above a certain amount. a clause in a lease that stops a lessor from paying property taxes above a certain amount.

Landlords will also have a clear idea of their maximum operating expenses each year, allowing them to budget for that limit. For tenants, an expense stop can be beneficial because it reduces their required contribution to the landlord's operating expenses.

An expense stop is the maximum amount a landlord will spend on operating expenses. Any amount above the expensive stop becomes the tenant's responsibility.

So, what is a gross-up provision? Simply stated, the concept of ?gross up provision? stipulates that if a building has significant vacancy, the landlord can estimate what the variable operating expense would have been had the building been fully occupied, and charge the tenants their pro-rata share of that cost.

In a full service gross lease, the tenant pays a base rental rate, and landlord is typically responsible for paying any additional expenses (such as CAM fees), except for those that go above a specific amount, called an expense stop.

A mechanism in a Full Service Gross Lease, the Expense Stop is a fixed amount of operating expense above which the tenant is responsible to pay. Thus, the landlord is responsible to pay for all operating expenses below the Expense Stop, while the tenant is responsible for any amount above the Expense Stop.