Virgin Islands Form of Anti-Money Laundering Compliance Policy refers to the specific set of guidelines and regulations implemented by the authorities in the U.S. Virgin Islands to combat money laundering activities within its jurisdiction. This policy acts as a vital tool to deter, detect, and prevent money laundering, terrorist financing, and other illicit activities. Keyword variations may include U.S. Virgin Islands AML Compliance Policy, Virgin Islands Anti-Money Laundering Regulations, and U.S. Virgin Islands AML Guidelines. The Virgin Islands Form of Anti-Money Laundering Compliance Policy follows international best practices and standards established by organizations like the Financial Action Task Force (FATF) and the Caribbean Financial Action Task Force (CFATG). By implementing these policies, the U.S. Virgin Islands government aims to maintain the integrity and stability of its financial sector, protect its economy, and fulfill its international obligations to combat money laundering and terrorist financing. There are several types of Virgin Islands Form of Anti-Money Laundering Compliance Policies, each catering to different financial institutions and entities operating within the jurisdiction. These may include: 1. Virgin Islands Form of Anti-Money Laundering Compliance Policy for Banks: This policy focuses on the specific requirements and obligations applicable to banking institutions in the U.S. Virgin Islands. It outlines the necessary steps, procedures, and reporting mechanisms that banks must adhere to in order to mitigate the risks associated with money laundering. 2. Virgin Islands Form of Anti-Money Laundering Compliance Policy for Money Service Businesses (MSB's): This policy targets MSB's such as money transfer services, currency exchanges, and payment processors. It provides guidance on customer due diligence, record-keeping, reporting suspicious transactions, and implementing effective internal controls. 3. Virgin Islands Form of Anti-Money Laundering Compliance Policy for Casinos and Gaming Establishments: This policy is designed to regulate the anti-money laundering measures taken by casinos and other gaming establishments. It focuses on monitoring and reporting high-value transactions, player identity verification, and the requirement to develop robust internal systems to combat money laundering risks. 4. Virgin Islands Form of Anti-Money Laundering Compliance Policy for Designated Non-Financial Businesses and Professions (Debts): Debts encompass entities like lawyers, accountants, real estate agents, and dealers of high-value goods. This policy mandates these professionals to implement specific controls and procedures to prevent the misuse of their services for money laundering or terrorist financing purposes. These different types of Anti-Money Laundering Compliance Policies ensure that various sectors within the U.S. Virgin Islands are equipped with tailored measures to mitigate the risk of money laundering effectively. By implementing such policies, the Virgin Islands demonstrates its commitment to maintaining a transparent and compliant financial ecosystem while safeguarding its reputation as a responsible international financial center.

Virgin Islands Form of Anti-Money Laundering Compliance Policy

Description

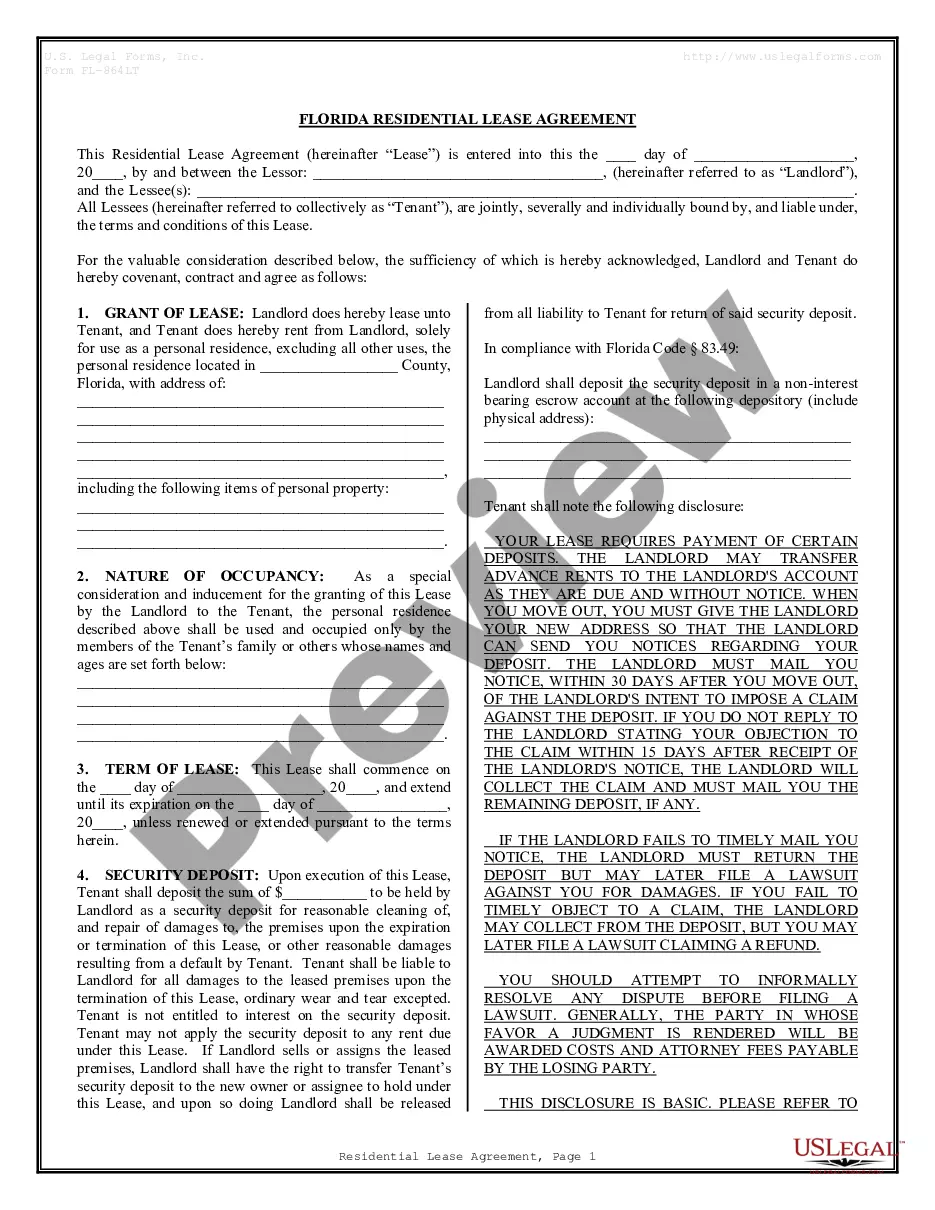

How to fill out Virgin Islands Form Of Anti-Money Laundering Compliance Policy?

If you wish to complete, obtain, or print out legitimate file templates, use US Legal Forms, the greatest selection of legitimate types, that can be found online. Use the site`s simple and handy look for to find the files you want. Different templates for business and specific uses are categorized by categories and says, or search phrases. Use US Legal Forms to find the Virgin Islands Form of Anti-Money Laundering Compliance Policy within a few click throughs.

If you are currently a US Legal Forms client, log in to the profile and click on the Obtain switch to obtain the Virgin Islands Form of Anti-Money Laundering Compliance Policy. You can even access types you formerly downloaded in the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for the right city/region.

- Step 2. Use the Preview solution to examine the form`s content material. Don`t forget to see the description.

- Step 3. If you are not happy using the kind, take advantage of the Search area near the top of the display to locate other variations of your legitimate kind format.

- Step 4. Once you have found the shape you want, click the Buy now switch. Opt for the costs plan you like and add your credentials to sign up for the profile.

- Step 5. Method the transaction. You can utilize your charge card or PayPal profile to complete the transaction.

- Step 6. Find the formatting of your legitimate kind and obtain it on your own device.

- Step 7. Full, revise and print out or signal the Virgin Islands Form of Anti-Money Laundering Compliance Policy.

Each and every legitimate file format you acquire is the one you have permanently. You might have acces to every single kind you downloaded in your acccount. Click on the My Forms section and select a kind to print out or obtain yet again.

Contend and obtain, and print out the Virgin Islands Form of Anti-Money Laundering Compliance Policy with US Legal Forms. There are many skilled and express-specific types you can use for your business or specific needs.

Form popularity

FAQ

At a minimum, an AML Program must be in writing and must include: Development and maintenance of written policies and procedures, and supervisory controls; Reasonably designed to ensure compliance with the BSA and assist a firm in detecting and reporting suspicious activity; Designation of a compliance officer;

The AML Code is the BVI anti-money laundering and terrorist financing legislation that spells out in detail what a DNFBP , its management and staff are required to do to combat money laundering and terrorist financing.

Firms must comply with the Bank Secrecy Act and its implementing regulations ("AML rules"). The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

An anti-money laundering (AML) compliance program helps businesses, including traditional financial institutions?as well as those entities identified in government regulations, such as money-service businesses and insurance companies?uncover suspicious activity associated with criminal acts, including money laundering ...

They must instruct and coach other staff members on regulatory issues and business standards linked to compliance. The AML compliance officers handle external regulatory and legal requirements in addition to internal compliance guidelines and practices.

British Virgin Islands is categorised by the US State Department as a Country/Jurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes. The British Virgin Islands (BVI) is a United Kingdom (UK) overseas territory with an economy dependent on tourism and financial services.

An anti-money laundering (AML) compliance program helps businesses, including traditional financial institutions?as well as those entities identified in government regulations, such as money-service businesses and insurance companies?uncover suspicious activity associated with criminal acts, including money laundering ...

This guide contains the steps to developing an effective compliance program: Appoint an AML compliance officer (AMLCO)? ... Conduct employee training. ... Perform risk assessment. ... Develop internal policies and procedures. ... Detect suspicious activity and report it. ... Organize independent audits.