Virgin Islands Percentage Exchange Agreement

Description

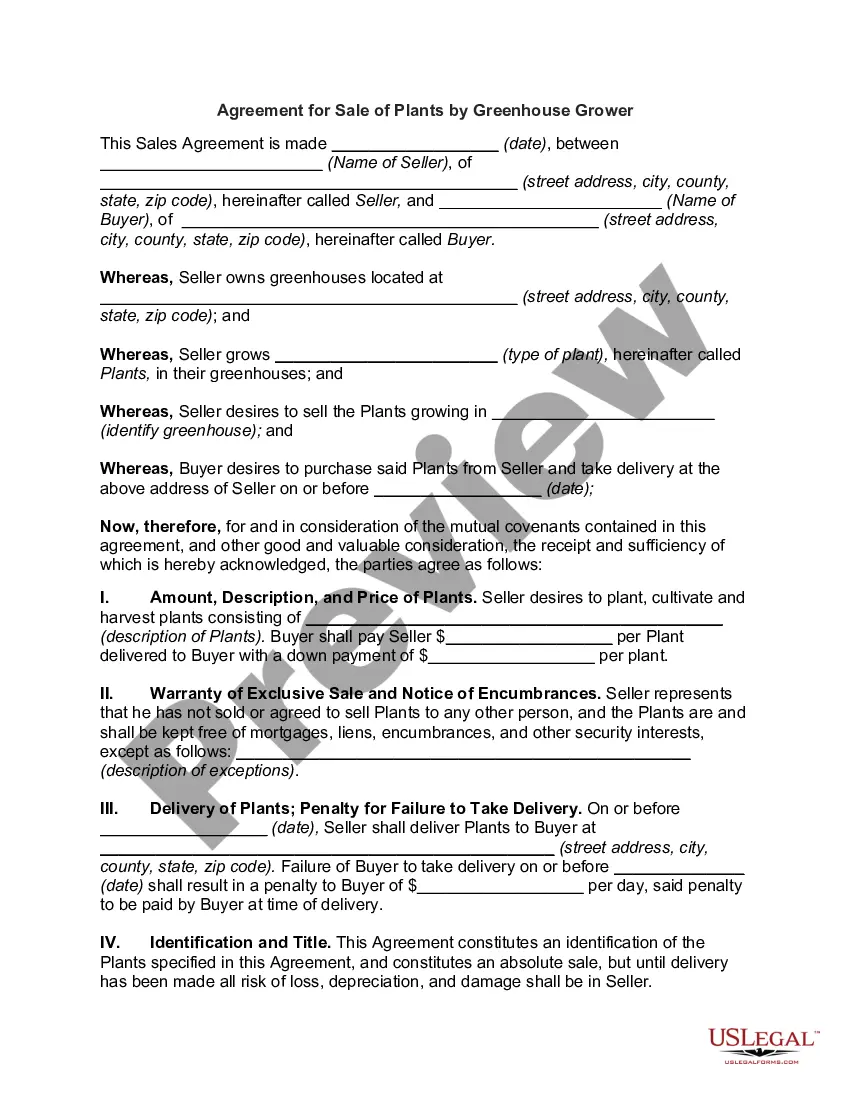

How to fill out Virgin Islands Percentage Exchange Agreement?

You may commit time on the web searching for the legal record format that fits the state and federal needs you want. US Legal Forms gives thousands of legal varieties that happen to be analyzed by professionals. It is possible to acquire or print the Virgin Islands Percentage Exchange Agreement from your service.

If you currently have a US Legal Forms accounts, you may log in and click the Acquire button. After that, you may complete, edit, print, or signal the Virgin Islands Percentage Exchange Agreement. Every legal record format you get is yours for a long time. To obtain one more backup of any purchased develop, check out the My Forms tab and click the related button.

If you are using the US Legal Forms website for the first time, follow the easy instructions under:

- Very first, make sure that you have selected the correct record format for your area/city of your choosing. Browse the develop explanation to ensure you have picked out the correct develop. If readily available, use the Review button to appear with the record format as well.

- If you would like find one more version of the develop, use the Search discipline to obtain the format that fits your needs and needs.

- After you have identified the format you want, just click Get now to proceed.

- Pick the pricing plan you want, enter your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You should use your Visa or Mastercard or PayPal accounts to pay for the legal develop.

- Pick the format of the record and acquire it in your gadget.

- Make adjustments in your record if needed. You may complete, edit and signal and print Virgin Islands Percentage Exchange Agreement.

Acquire and print thousands of record web templates while using US Legal Forms website, that offers the biggest assortment of legal varieties. Use expert and status-certain web templates to handle your small business or person demands.

Form popularity

FAQ

British Virgin Islands contract law is almost entirely based upon English common law. The British Virgin Islands has no equivalent of the Contracts (Rights of Third Parties) Act 1999, and applies strict privity of contract.

See Table 3 of the Tax Treaty Tables for the general effective date of each treaty and protocol.A. Armenia. Australia. Austria. Azerbaijan.B. Bangladesh. Barbados. Belarus. Belgium.C. Canada. China. Cyprus. Czech Republic.D. Denmark.H. Hungary.K. Kazakhstan. Korea. Kyrgyzstan.L. Latvia. Lithuania. Luxembourg.M. Malta. Mexico. Moldova. Morocco.More items...

VAT There is no VAT or sales tax system in the BVI. Foreign tax credit The BVI does not have any double tax arrangements in place. Dividends No tax is withheld on dividends paid to a non-resident.

Green card holders can only qualify under the bona fide resident test if they hold a passport of a country that has a tax treaty with the U.S. The BVI does not currently have a tax treaty with the U.S.

There is no secrecy in the case of the British Virgin Islands, rather there is a zero percent taxation policy- no capital gains tax, gift tax, inheritance tax, sales tax or value-added tax. And this allows businesses to set up offshore companies and evade tax.

There are no withholding taxes in the BVI.

Generally, you must be a nonresident alien student, apprentice, or trainee in order to claim a tax treaty exemption for remittances from abroad (including scholarship and fellowship grants) for study and maintenance in the United States.

Green card holders can only qualify under the bona fide resident test if they hold a passport of a country that has a tax treaty with the U.S. The BVI does not currently have a tax treaty with the U.S.

BVI companies are listed on the World's leading international stock exchanges. They are recognised as efficient, tax neutral vehicles, for use accessing international capital in financial centres from London and New York to Singapore and Hong Kong.