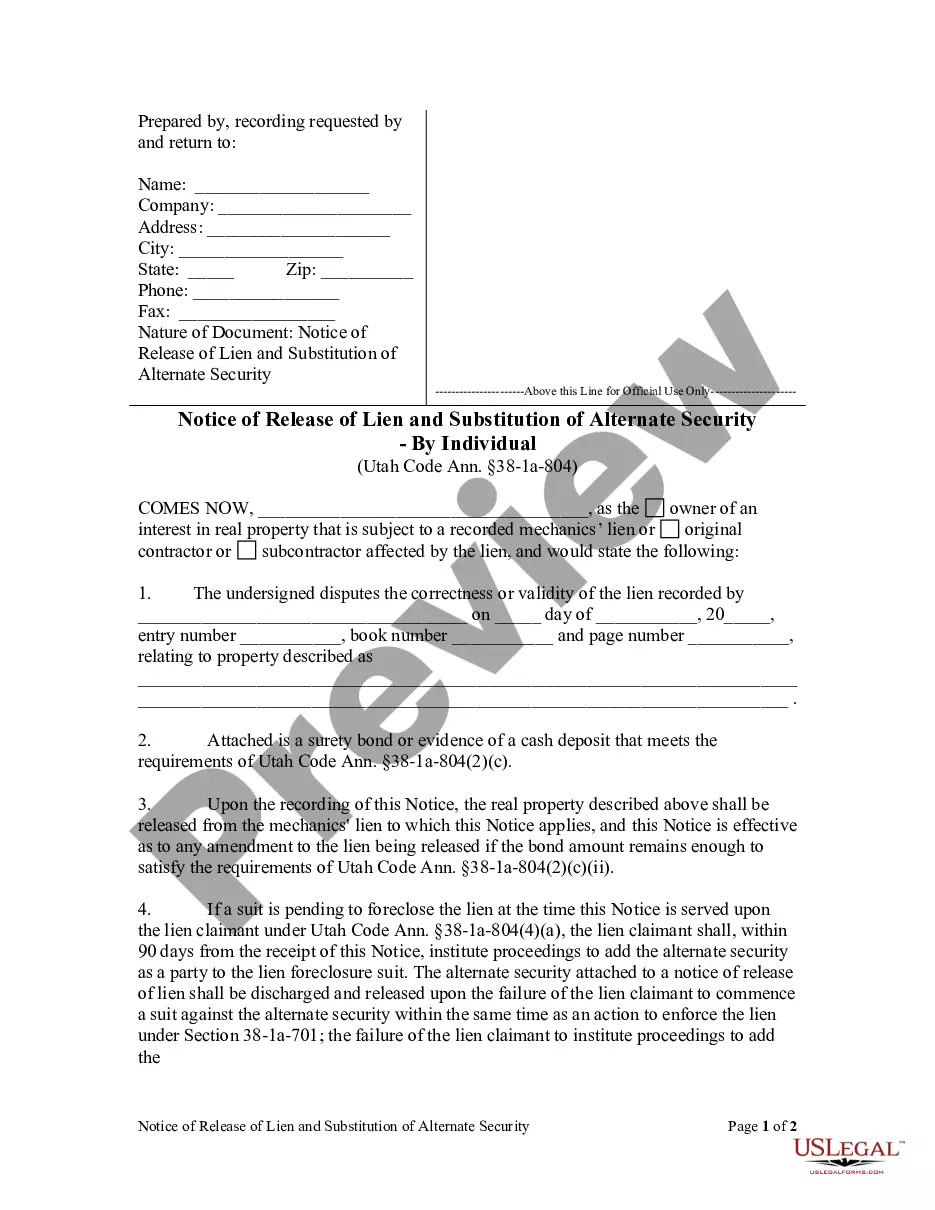

This form is used by a trustee to provide a periodic accounting of the trust estate to the court. This form has accounting schedules A through J (forms VT-056.1-P through VT-056.10-P) attached. For form 117 only without the schedules, see form VT-117WS-P. This is one of over 150 Official Probate forms for the state of Vermont.

Vermont Summary of Account of Trustee with Schedules A-J Attached

Description

How to fill out Vermont Summary Of Account Of Trustee With Schedules A-J Attached?

Looking for a Vermont Summary of Account of Trustee with Schedules A-J Attached online might be stressful. All too often, you find documents that you simply think are alright to use, but discover later on they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any document you are searching for in minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll immediately be included to your My Forms section. In case you don’t have an account, you must sign up and choose a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Summary of Account of Trustee with Schedules A-J Attached from our website:

- Read the document description and click Preview (if available) to check whether the form meets your expectations or not.

- If the document is not what you need, get others with the help of Search engine or the provided recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- After downloading it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms library. In addition to professionally drafted templates, customers may also be supported with step-by-step guidelines regarding how to get, download, and fill out templates.

Form popularity

FAQ

A trustee is any type of person or organization that holds the legal title of an asset or group of assets for another person, referred to as the beneficiary. A trustee is granted this type of legal title through a trust, which is an agreement between two consenting parties.

While there is a general power to pay a trustee for providing services, there is no such general power to pay a trustee for carrying out trustee duties. Charities cannot do this unless they have a suitable authority, either in the charity's governing document, or one provided by the commission or the court.

Trustee: a person or persons designated by a trust document to hold and manage the property in the trust. Beneficiary: a person or entity for whom the trust was established, most often the trustor, a child or other relative of the trustor, or a charitable organization.

The role of a trustee may include: preserving and managing estate assets for minor beneficiaries until they reach 18 years of age. preserving and managing estate assets until a beneficiary attains a specific age as nominated by the testator, for example, 30.

Trustees' fees A trustee's fee is the amount the trust pays to compensate the trustee for his or her time. There is no set trustee's fee. You can choose to base it on a small percentage of the market value of the assets plus a percentage of the income earned by the trust.

Most corporate Trustees will receive between 1% to 2%of the Trust assets. For example, a Trust that is valued at $10 million, will pay $100,000 to $200,000 annually as Trustee fees. This is routine in the industry and accepted practice in the view of most California courts.

An all-in fee will start between 1% and 2%, and usually covers the trust's investment manager, fiduciary and trust administration, and record-keeping and disbursements, but typically not asset-management fees. So, you might pay $30,000 to $50,000 a year on a $3 million trust.

It's quite common to be both a trustee and a beneficiary of a trust. The surviving spouse, for example, is almost always the successor trustee and beneficiary of a family trust. And it's quite common for one adult child to be the trustee and all the siblings to be beneficiaries of their parents' trusts.

The Trustee can pay themselves from the trust funds based on the terms of the trust or the state's laws. Some trusts stipulate hourly or flat fees for trustee duties. Professional trustees can earn over $100 per hour, while corporate trustees make 1-2% of the trust's assets as annual compensation.