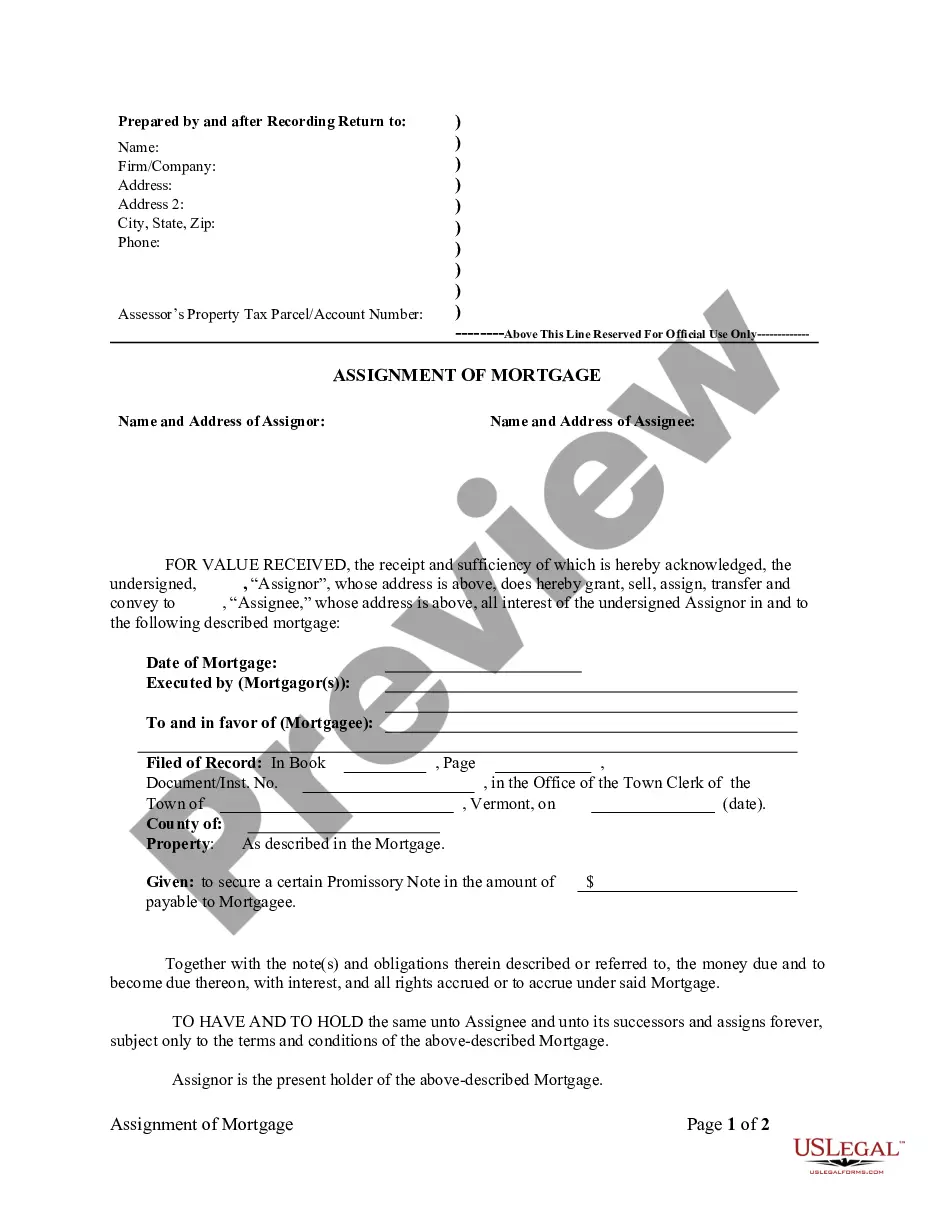

Assignment of Mortgage by Corporate Mortgage Holder

Assignments Generally:

Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee (person

who received the assignment) steps into the place of the original lender

or assignor. To effectuate an assignment, the general rule is that the

assignment must be in proper written format and recorded to provide notice

of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Vermont Law

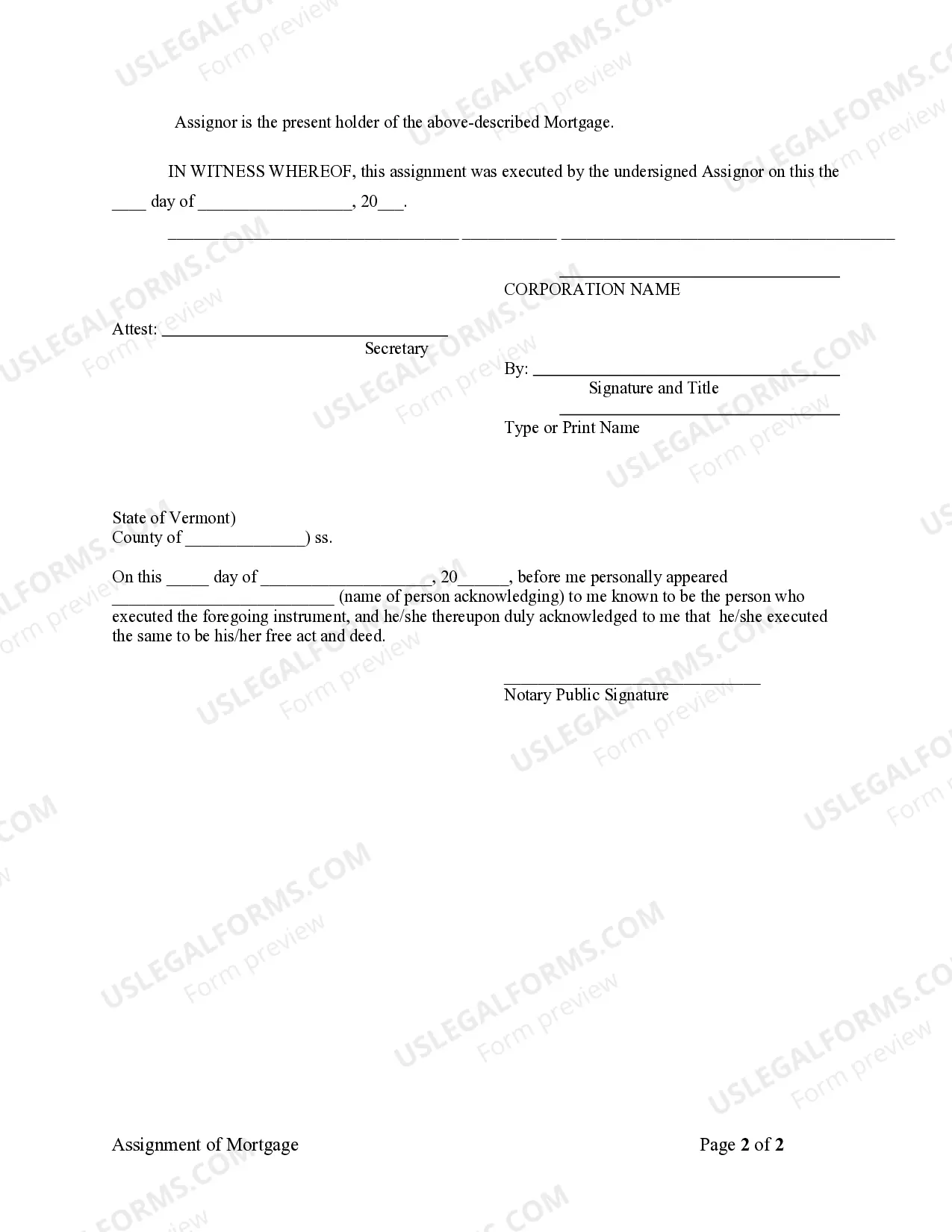

Execution of Assignment or Satisfaction:

Shall be executed by the mortgagee or authorized agent.

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

Following full pay-off, mortgagor is not required to notify mortgagee, who must, within 30 days,

satisfy the mortgage of record.

Recording Satisfaction:

An assignment or discharge of a mortgage or judgment lien shall be duly recorded in the

records of the town.

Marginal Satisfaction:

Mortgages may be discharged by an entry on the margin of the record thereof in the record

of deeds, acknowledging satisfaction of the mortgage, signed by the mortgagee

and witnessed by the clerk having custody of the record.

Penalty:

In addition to any statutory damages ($25.00 per day after the expiration of the 30 days following full pay-off,

up to an aggregate maximum of $5,000.00), the mortgagee shall also be liable

for consequential damages, punitive damages, court costs and reasonable

attorney's fees to any aggrieved party who substantially prevails in an

action.

Acknowledgment:

An assignment or satisfaction must contain a proper Vermont

acknowledgment, or other acknowledgment approved by Statute.

Vermont Statutes

§ 461. By entry on record.

Mortgages may be discharged by an entry on the margin of

the record thereof in the record of deeds, acknowledging satisfaction

of the mortgage, signed by the mortgagee or by his executor, administrator,

assignee, attorney at law or attorney acting under a duly executed and

recorded power of attorney, such signature to be witnessed by the town

clerk or assistant town clerk having custody of such record. Such entry

shall have the same effect as a deed of release acknowledged and recorded.

§ 462. By acknowledgment of payment.

Mortgages may also be discharged by the mortgagee or by his executor,

administrator, assignee, attorney at law or attorney acting under a duly

executed and recorded power of attorney, acknowledging payment thereof

by an entry on the mortgage deed, signing the same in the presence of one

or more witnesses, which entry, upon being recorded on the margin of

the record of such mortgage in the record of deeds, shall discharge

such mortgage and bar all actions brought thereon.

§ 463. By separate instrument.

Mortgages may be discharged by an acknowledgment of satisfaction,

executed by the mortgagee or his attorney, executor, administrator or assigns.

§ 1158. Assignment or discharge of mortgage or judgment

lien.

An assignment or discharge of a mortgage or judgment lien

shall be duly recorded in the records of the town. A mortgage or judgment

lien may be discharged by the mortgagee, judgment creditor or assignee

of such mortgage or judgment lien in writing on the margin of the mortgage

record or judgment lien notice. A satisfaction or assignment of the mortgage

or judgment lien recorded elsewhere shall bear a marginal notation of the

book and page of the mortgage or judgment lien record and a corresponding

cross-reference shall be made on the margin of the mortgage or judgment

lien notice record.

§ 464. Liability of mortgagee for failure to provide payoff

statements and refusal to discharge.

(a) Within five business days after the mortgagee's

receipt of a written request for a statement of the amount of funds or

other obligations required to satisfy a note or other obligation secured

by a mortgage, the mortgagee shall provide a written payoff statement to

the mortgagor. The mortgagee shall not impose a fee or other charge for

providing the payoff statement, unless the request specifically asks for

expedited service. A request for a payoff statement shall include the name

of the mortgagor, the loan number assigned to the loan, and the address

of the property securing the loan. If a written payoff statement is not

deposited in the U.S. mail, delivered to a courier service, sent by facsimile,

or sent by other method of service customarily used for delivery of messages,

within five business days after receiving the request, the holder and any

servicer shall be jointly and severally liable to any aggrieved party in

a civil action for statutory damages equal to $25.00 per day after the

expiration of the five business days, up to an aggregate maximum of $5,000.00

for all aggrieved parties; provided, however, any servicer not authorized

to issue a payoff statement shall not be liable as set forth herein.

(b) Within 30 days after full performance of the

conditions of the mortgage, the mortgagee of record shall execute and

deliver a valid and complete discharge as provided in sections 461-463

of this title, together with any instrument necessary to establish the

mortgagee's record ownership of the mortgage and to establish the authority

to execute the discharge. As used in this section, the term "mortgagee"

shall mean both the holder of the mortgage at the time it is satisfied

and any servicer who receives the final payment satisfying the debt.

If a discharge is not executed and delivered within 30 days, the holder and

any servicer shall be jointly and severally liable to any aggrieved party

in a civil action for statutory damages equal to $25.00 per day after the

expiration of the 30 days, up to an aggregate maximum of $5,000.00 for

all aggrieved parties; provided, however, any servicer not authorized

to execute such discharge shall not be liable as set forth in this subsection.

With respect to a mortgagee securing an open-end line of credit, the 30-day

period to deliver a discharge commences after the mortgagor delivers to the address

designated for payments under the line of credit a written request to terminate

the line of credit and mortgage, together with payment in full of all amounts

secured by the mortgage.

(c) The aggrieved party may file an action under subsection

(a) or (b) of this section in superior court or, if the action is for monetary

damages only and if the ad damnum requested is equal to or less than the

maximum jurisdiction of a small claims proceeding, the complaint may be

filed as a small claims action.

(d) In addition to any statutory damages, the mortgagee

shall also be liable for consequential damages, punitive damages, court

costs and reasonable attorney's fees to any aggrieved party who substantially

prevails in an action under this section. An aggrieved party may file

an action to recover such damages, costs and fees in superior court. The

court shall equitably allocate punitive damages among multiple aggrieved

parties and may grant such other relief as the court deems appropriate.