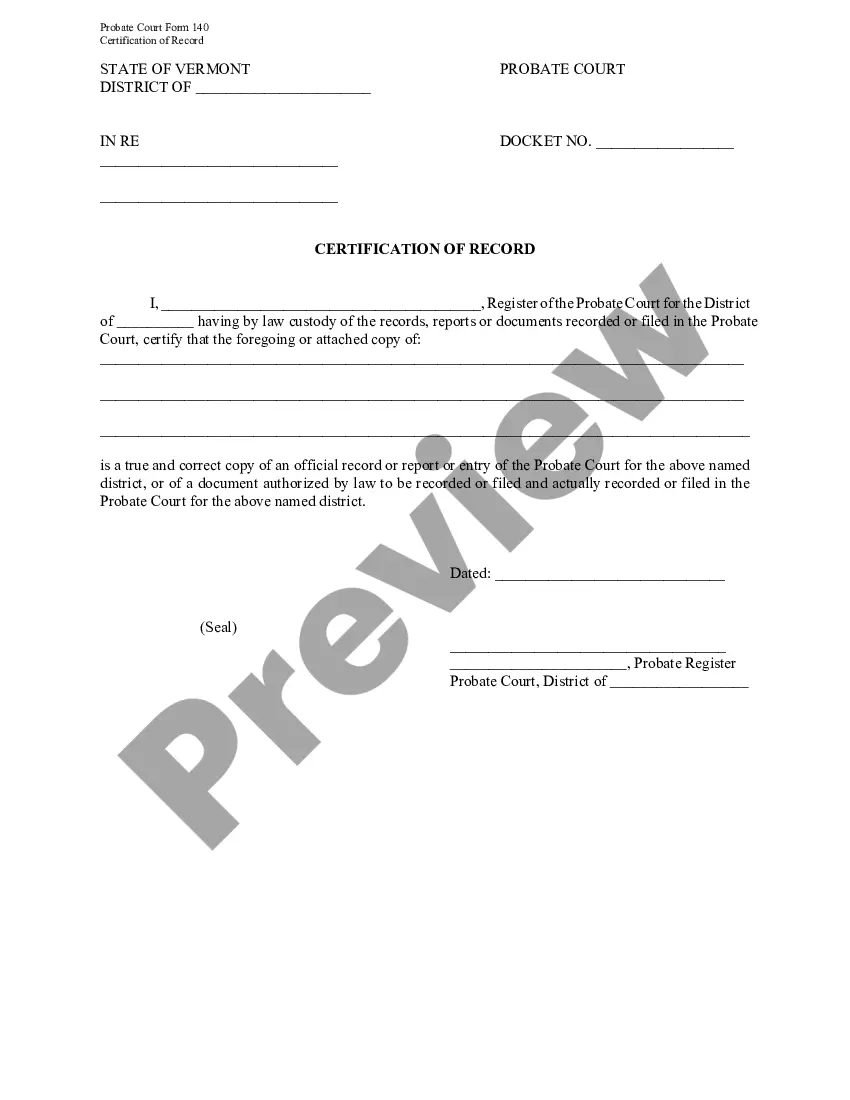

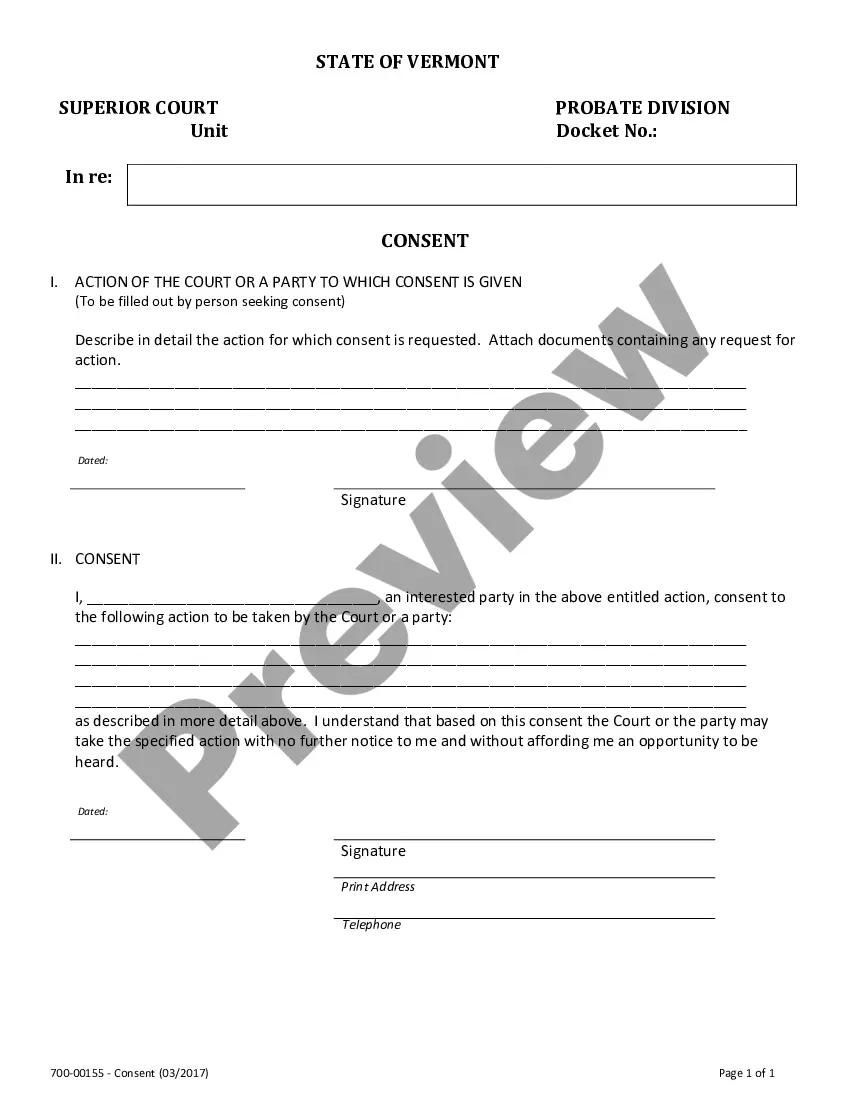

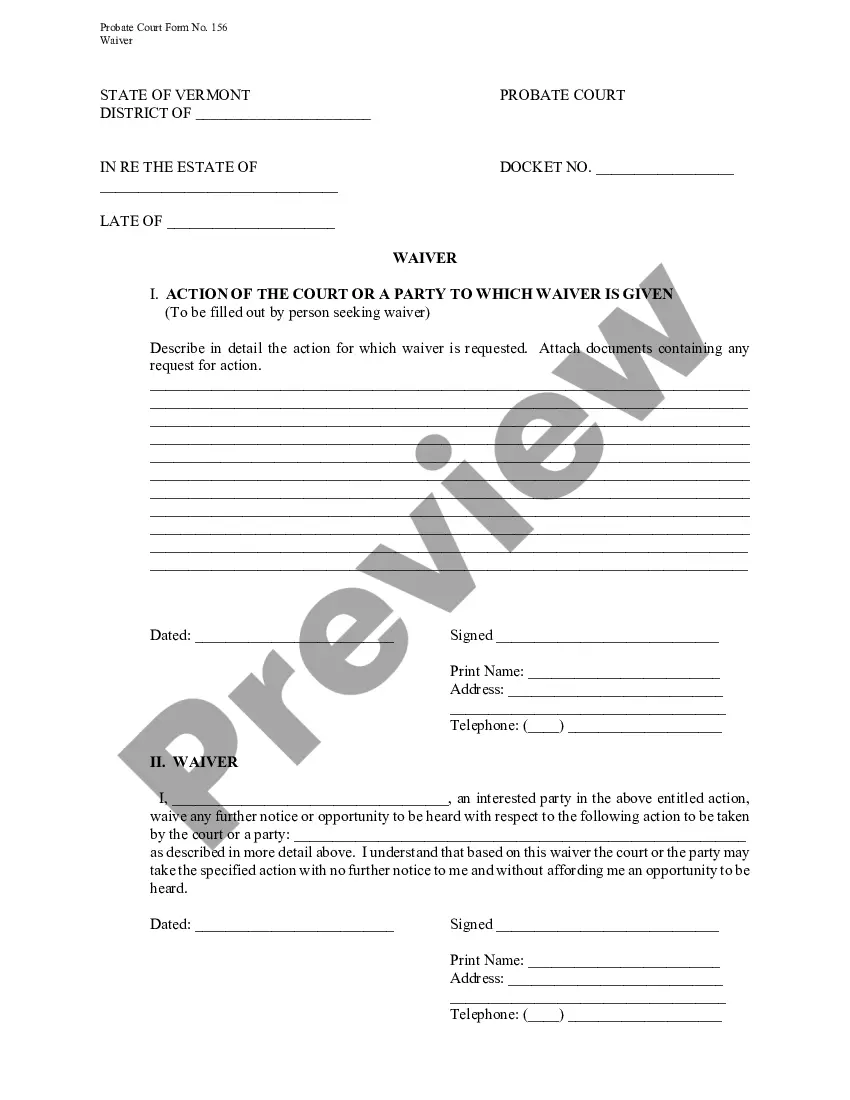

This form is used by a beneficiary or heir in an estate to verify receipt of monies or properties and acknowledge full satisfaction of their interest in an estate, fully discharging the estate of all liability to the beneficiary/heir. This is one of over 150 Official Probate forms for the state of Vermont.

Vermont Receipt

Description

How to fill out Vermont Receipt?

Searching for a Vermont Receipt on the internet can be stressful. All too often, you see files that you just think are ok to use, but discover later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Have any document you are looking for quickly, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will automatically be included to the My Forms section. If you don’t have an account, you need to sign up and pick a subscription plan first.

Follow the step-by-step instructions below to download Vermont Receipt from our website:

- See the form description and hit Preview (if available) to verify whether the form suits your requirements or not.

- If the form is not what you need, find others with the help of Search field or the provided recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms library. In addition to professionally drafted samples, users are also supported with step-by-step instructions regarding how to find, download, and fill out forms.

Form popularity

FAQ

You are domiciled in Vermont, or. You maintain a permanent home in Vermont, and you are present in Vermont for more than 183 days of the taxable year.

So, The Vermont Loophole is totally real. Totally do-able. As long as you aren't in a rush.

Years old or newer, use form TA-VT-05 or have buyer and seller both sign the back of the title. Purchase and Use Tax is due at the time of registration and/or title at the rate of 6% of the purchase price or the N.A.D.A. value, whichever is higher; minus the value of any trade-in vehicle or any other allowable credit.

So, The Vermont Loophole is totally real. Totally do-able. As long as you aren't in a rush.

Utility bill (must list service address). Property tax bill with physical location. Lease or Landlord statement. Vermont EBT (Electronic Benefit Transfer) card or Vermont AIM (Advanced Information Management) identification card. Homeowners/Renters insurance (policy/proof of claim).

Do I have to be a Vermont resident to register a vehicle in Vermont? No. Anyone can register a vehicle in the state of Vermont.

The online system allows for the issuance of a temporary plate and registration for all types of vehicles that are sold, transported and registered in Vermont.Temporary plates and registrations are valid for 60 days and can be used for inspection of the vehicle if required.

Pay Stub Utility bill Telephone bill. Gas bill. Cable TV bill. The following items must be the original mailed statement showing the client's name and Alberta address.

Voter registration. Vehicle registration. State where you have your driver's license. Location of your bank. Location of your legal and medical professionals. Location of any business that you own and operate. Contact periods with a state. Location of your property.