The chapter 13 plan contains, but is not limited to, information concerning plan payments and duration, distribution of plan payments, and lien avoidance.

Vermont Chapter 13 Plan

Description

How to fill out Vermont Chapter 13 Plan?

Searching for a Vermont Chapter 13 Plan on the internet might be stressful. All too often, you find files that you just think are ok to use, but find out afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Get any document you are searching for in minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll immediately be included to your My Forms section. In case you don’t have an account, you must register and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Vermont Chapter 13 Plan from the website:

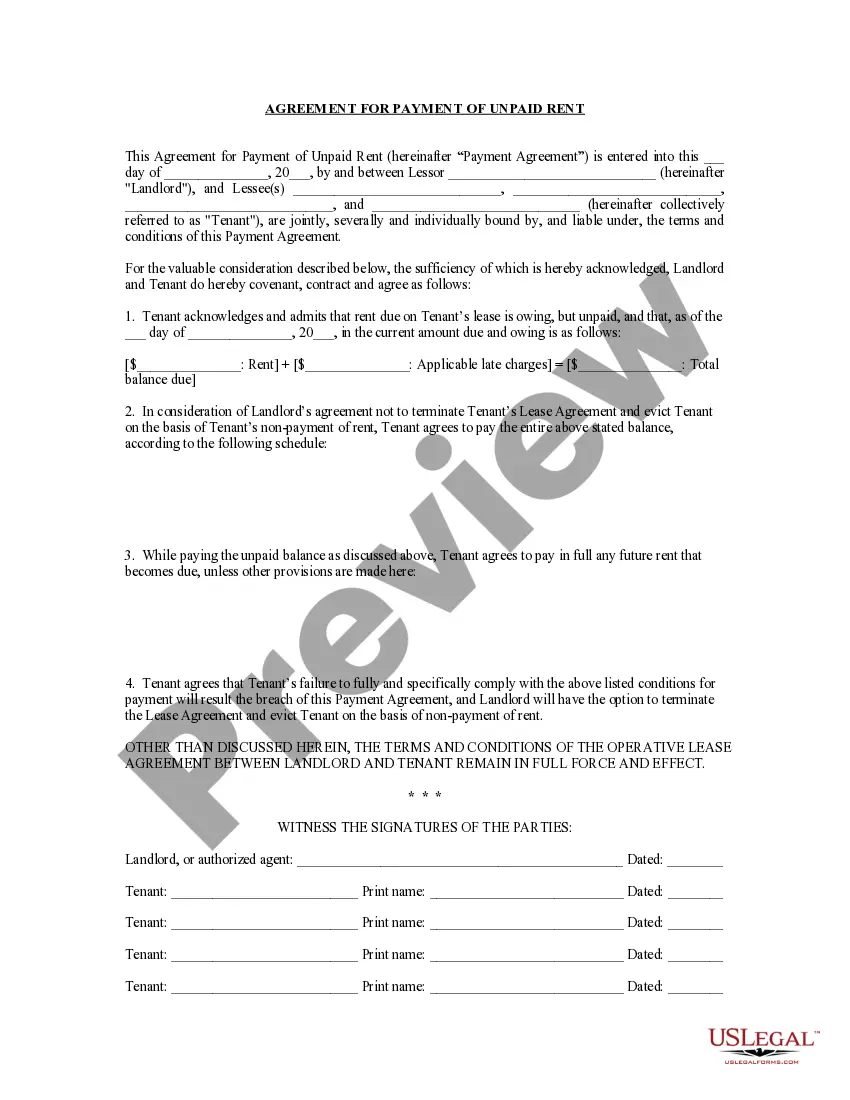

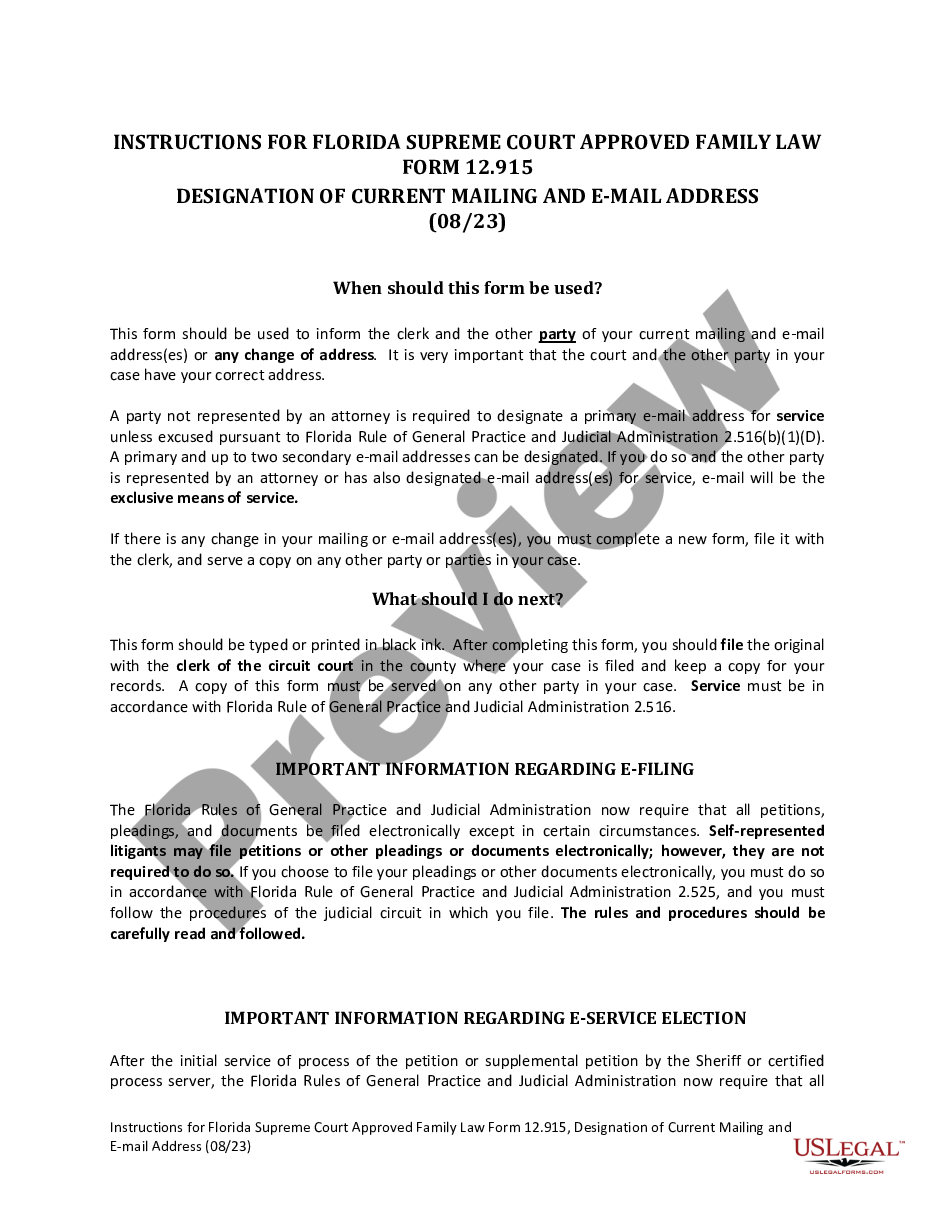

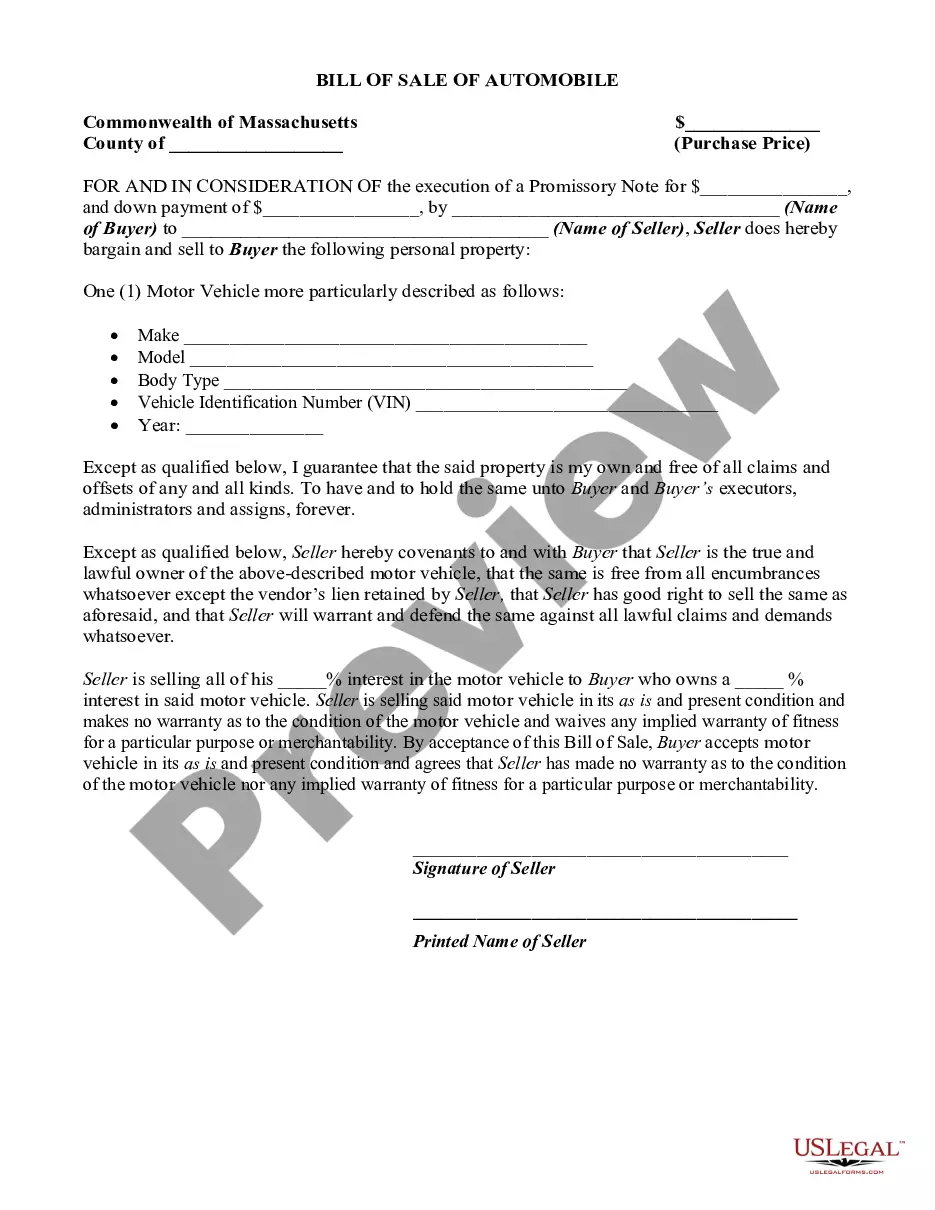

- See the document description and hit Preview (if available) to verify whether the template meets your requirements or not.

- If the form is not what you need, find others using the Search field or the provided recommendations.

- If it is right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Get access to 85,000 legal templates straight from our US Legal Forms catalogue. Besides professionally drafted templates, customers can also be supported with step-by-step instructions concerning how to get, download, and fill out templates.

Form popularity

FAQ

Debts arising out of willful and malicious damage to property. debts used to pay nondischargeable tax obligations.

Chapter 13 Is Likely to Worsen Your Finances When your Chapter 13 case is dismissed, you are often in a far worse financial position. That's because the interest on your unpaid debts has continued to mount as you've struggled to make payments. And once you're out of bankruptcy protection, you have more debt than ever.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

Chapter 13 allows you to create a 3-5-year repayment plan without liquidating any of your assets. Even if your mortgage lender has initiated foreclosure , Chapter 13 may allow you to keep your home. You may also be able to extend loan maturity and lower either the principal or the interest rate.

When you complete your Chapter 13 repayment plan, you'll receive a discharge order that will wipe out the remaining balance of qualifying debt. In fact, a Chapter 13 bankruptcy discharge is even broader than a Chapter 7 discharge because it wipes out certain debts that aren't nondischargeable in Chapter 7 bankruptcy.

A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

Debts dischargeable in a chapter 13, but not in chapter 7, include debts for willful and malicious injury to property (as opposed to a person), debts incurred to pay nondischargeable tax obligations, and debts arising from property settlements in divorce or separation proceedings.

The Section 109(e) Chapter 13 unsecured debt limit of $419,275 includes the total of all amounts owed by an individual on credit cards, medical bills, lines of credit, unsecured taxes, and other debts not secured by collateral.