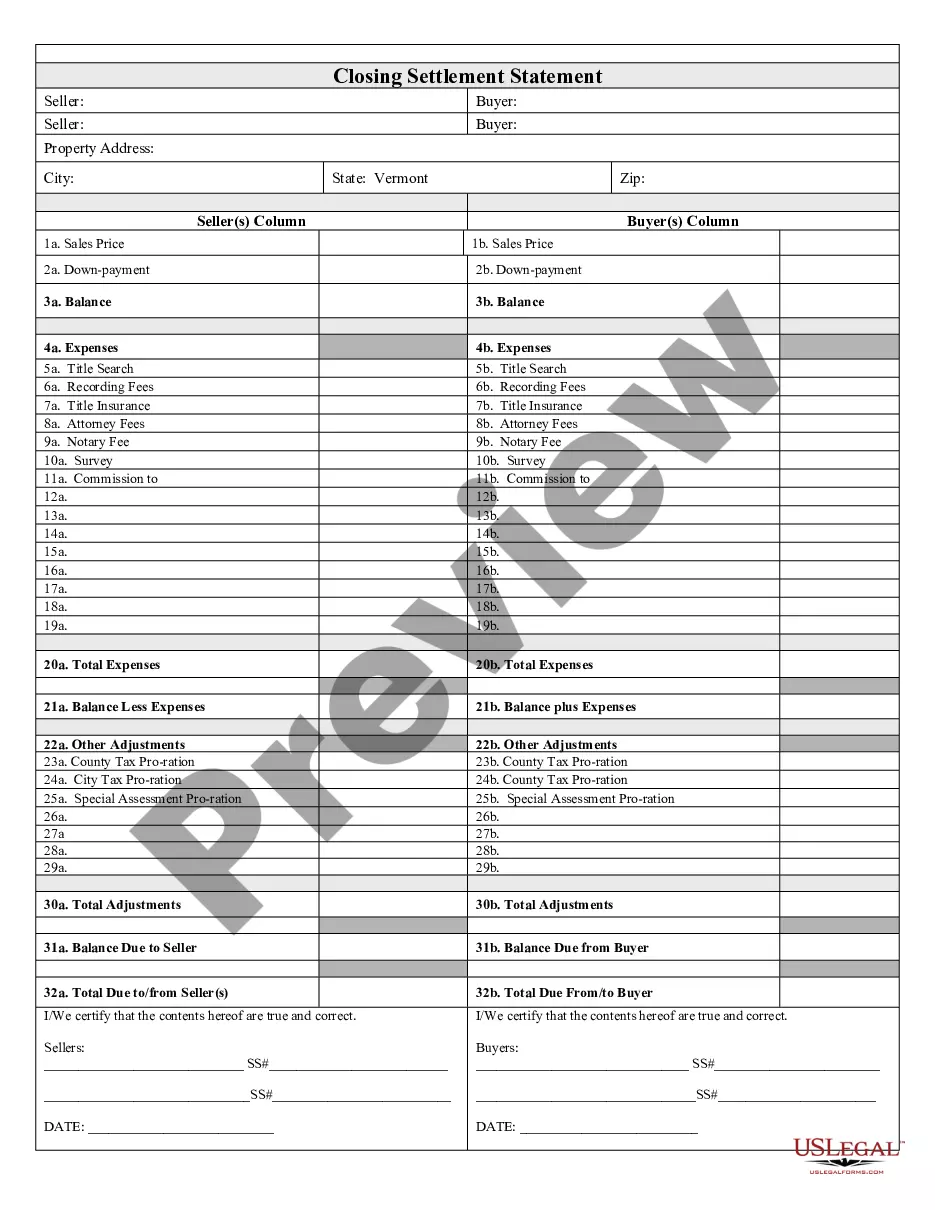

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Vermont Closing Statement

Description Average Closing Costs Vermont

How to fill out Vermont Closing Statement?

Searching for a Vermont Closing Statement online can be stressful. All too often, you find files that you believe are alright to use, but find out afterwards they’re not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Get any document you are searching for within minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll immediately be included to your My Forms section. If you do not have an account, you should sign up and choose a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Closing Statement from our website:

- Read the form description and click Preview (if available) to verify if the form meets your requirements or not.

- If the form is not what you need, get others with the help of Search field or the provided recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- After downloading it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms library. Besides professionally drafted templates, customers will also be supported with step-by-step guidelines regarding how to get, download, and fill out templates.

Vermont Closing Form popularity

FAQ

Closing Costs for Vermont Homes: What to Expect However, this does not include variable costs like title insurance, title search, taxes, other government fees, escrow fees, and discount points. In general, buyers should expect to pay between 2% and 5% of the closing price in closing costs.

The homebuyer pays the tax When a home purchase closes, the home buyer is required to pay, among other closing costs, the Vermont Property Transfer Tax. The buyer is taxed is at a rate of 0.5% of the first $100,000 of the home's value and 1.45% of the remaining portion of the value.

Who pays closing costs? Typically, both buyers and sellers pay closing costs, with buyers generally paying more than sellers. The buyer's closing costs typically run 5 to 6 percent of the sale price, according to Realtor.com.

Closing costs are expenses related to making a loan and closing the purchase, Ailion says. They include attorney fees, title fees, survey fees, transfer fees and transfer taxes.Closing costs are due when you sign your final loan documents.

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

What is the seller's closing statement, aka settlement statement? The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.

In general, average closing costs in Vermont will range from about 2% to 3% of the total loan/value of the house, although the percentage will be lower with higher priced homes since certain costs (ie, appraisals and credit reports) don't vary much in price regardless of the type of home you are buying.