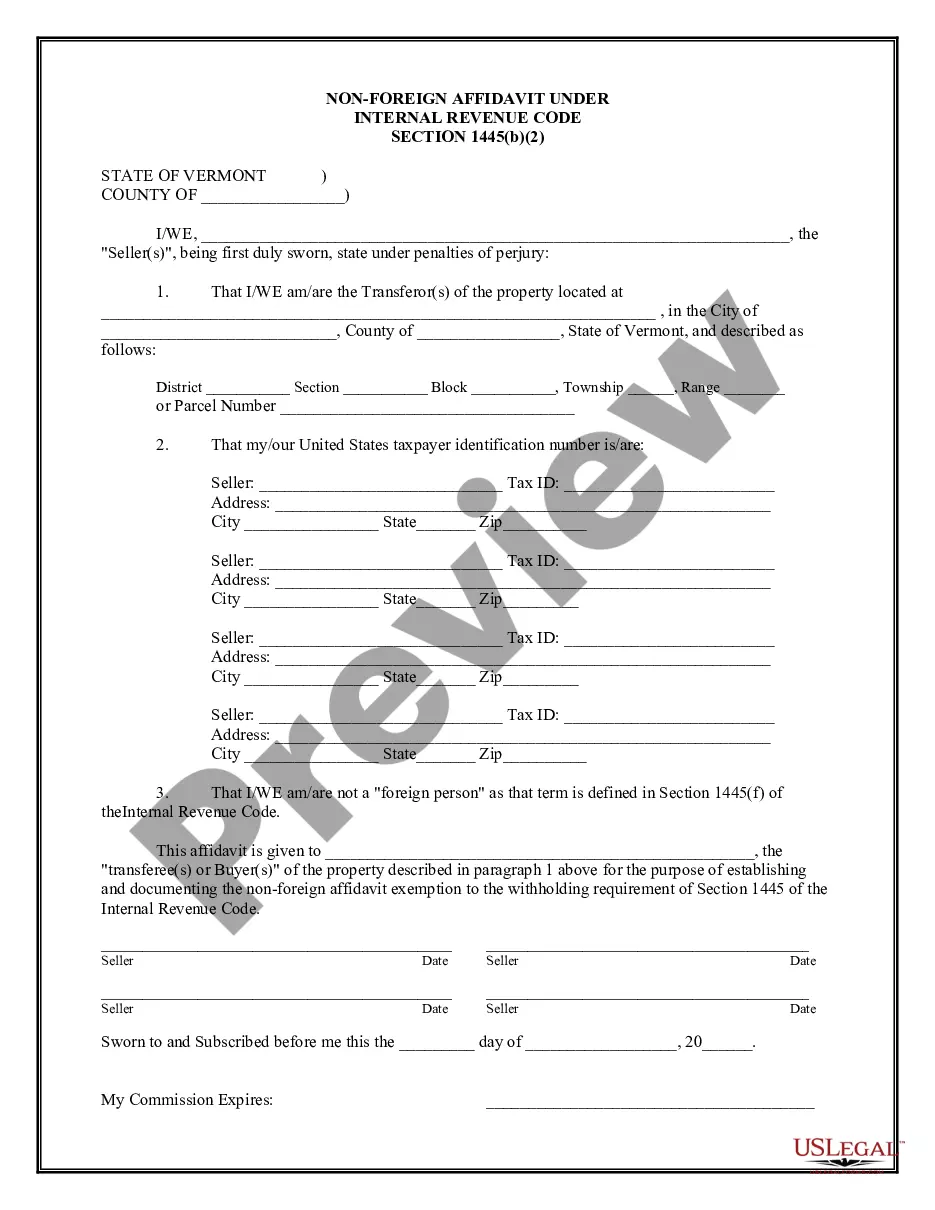

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Vermont Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Vermont Non-Foreign Affidavit Under IRC 1445?

Looking for a Vermont Non-Foreign Affidavit Under IRC 1445 on the internet can be stressful. All too often, you find documents that you think are ok to use, but find out afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Have any form you’re searching for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be included in your My Forms section. If you do not have an account, you must sign-up and pick a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Non-Foreign Affidavit Under IRC 1445 from our website:

- Read the form description and hit Preview (if available) to verify if the template meets your requirements or not.

- If the document is not what you need, get others with the help of Search engine or the listed recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the template in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted templates, users are also supported with step-by-step instructions on how to get, download, and complete templates.

Form popularity

FAQ

The Foreign Investment in Real Property Tax Act of 1980, also known as FIRPTA, may apply to your purchase. FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate.If the law applies to your purchase, then within 20 days of the sale, you are required to file Form 8288 with the IRS.

Foreign affidavit is an affidavit involving a matter of concern in one state but taken in another state or country before an officer of that state or country.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.